A year ago, the U.S. 100 Index (tracked in Australia as ASX: U100) underwent a significant methodology upgrade to capture a wider and more accurate view of American innovation. The index now includes companies across both the NASDAQ and NYSE, applies an innovation filter based on measurable research & development (R&D) activity and intangible-asset productivity, and uses a more balanced weighting approach that rewards genuine innovation rather than inherited scale. Twelve months later, the results make a compelling case for that evolution.

Key Takeaways

- U100’s Index has outperformed major US large-cap innovation benchmarks, including the Nasdaq 100 Index, by roughly 5% since the September 2024 methodology upgrade.

- Distinct additions such as Oracle, Taiwan Semiconductor, IBM and Snowflake were key contributors, supported by rising capital investment and AI-driven demand.

- The innovation filter and refined weighting design enabled broader participation and a clearer expression of true innovation leadership.

Re-engineering a benchmark for real innovation

The 2024 methodology change stemmed from a simple reality: technology leadership had expanded well beyond traditional definitions. Innovation now spans semiconductors, data infrastructure, automation and intelligent systems — not just software. By widening its universe to include both NASDAQ and NYSE-listed companies, the U100 Index better reflects this shift and reasserts what an innovation index should represent.

At the centre of this is the innovation filter. To qualify, companies must show demonstrable reinvestment through either a positive R&D-to-sales ratio or productivity derived from intangible assets. This screen distinguishes builders from owners — shifting exposure away from legacy operators with slower product cycles and toward companies actively funding the next wave of industrial and digital transformation.

How selection translated into performance

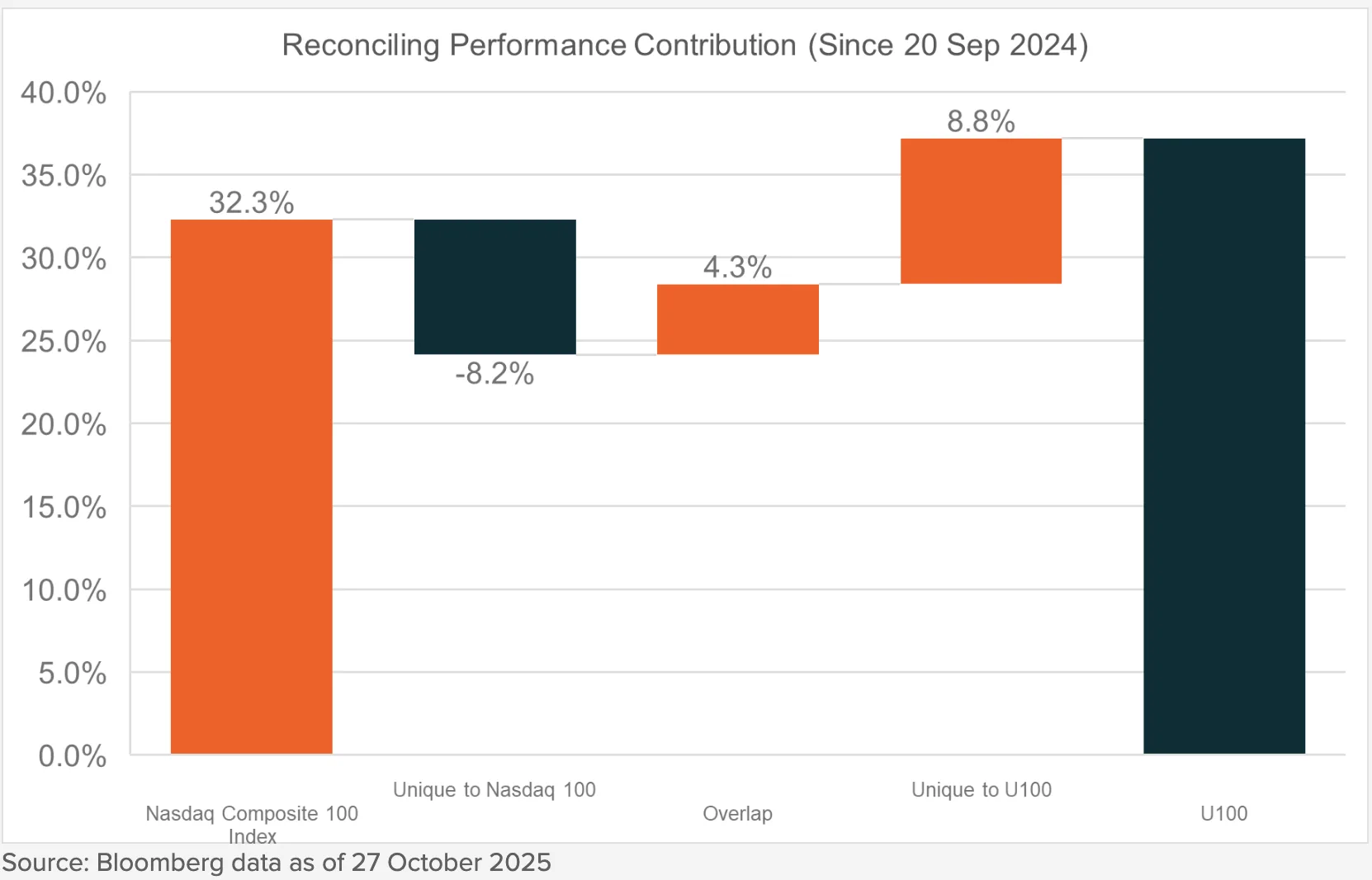

Since the upgrade, the U100 Index has returned about 37%, compared with roughly 32% for the Nasdaq 100 over the same period³. This outperformance wasn’t coincidental or cyclical — it stemmed directly from disciplined selection and measurable innovation.

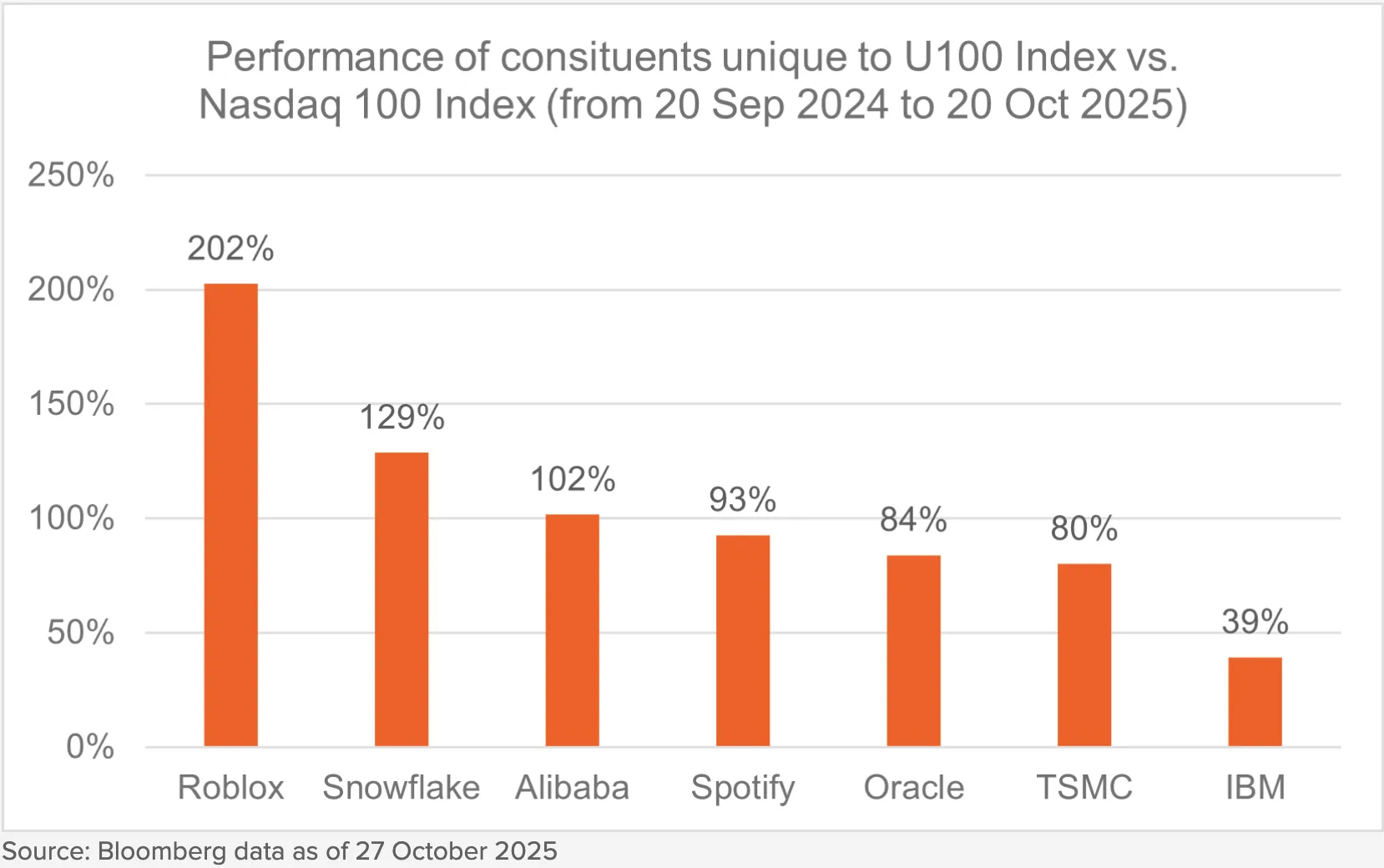

Oracle delivered standout gains, powered by ongoing cloud adoption and the rise of AI-enabled data platforms. Taiwan Semiconductor continued benefiting from its leadership in advanced chip manufacturing amid a global surge in semiconductor investment. IBM contributed through its renewed focus on hybrid cloud and enterprise automation. Names such as Snowflake and Roblox added to returns as well, illustrating the broader spectrum of innovation now captured — from data infrastructure to digital interaction.

Together, these companies highlight how the U100 Index has succeeded in identifying firms reinvesting in technology and scaling new revenue streams, rather than simply maintaining established ones. The index didn’t just outperform — it outperformed for the right reasons.

From design to demonstrated value

One year on, the U100 Index’s relative performance shows that innovation leadership can be measured — and rewarded — through thoughtful structure rather than speculation. The combination of a broader universe, objective innovation criteria and balanced weighting has produced an index that better reflects where genuine value creation is occurring in the US economy.

For Global X, the U100 Index embodies a shared philosophy of building beyond the ordinary — recognising that smart index design helps investors align with the real engines of progress. The companies leading this shift are not only writing software or producing chips; they’re powering energy systems, digitising industries and constructing the infrastructure that underpins the AI era.

As the upgraded U100 Index reaches its first anniversary, the conclusion is clear: when innovation is defined by reinvestment and real results, the outcome is stronger performance and a more accurate picture of technological leadership. To follow innovation effectively, an index must evolve alongside it — and U100 shows what that evolution can deliver.

If you want to check out the original article, access it here on Global X’s website.