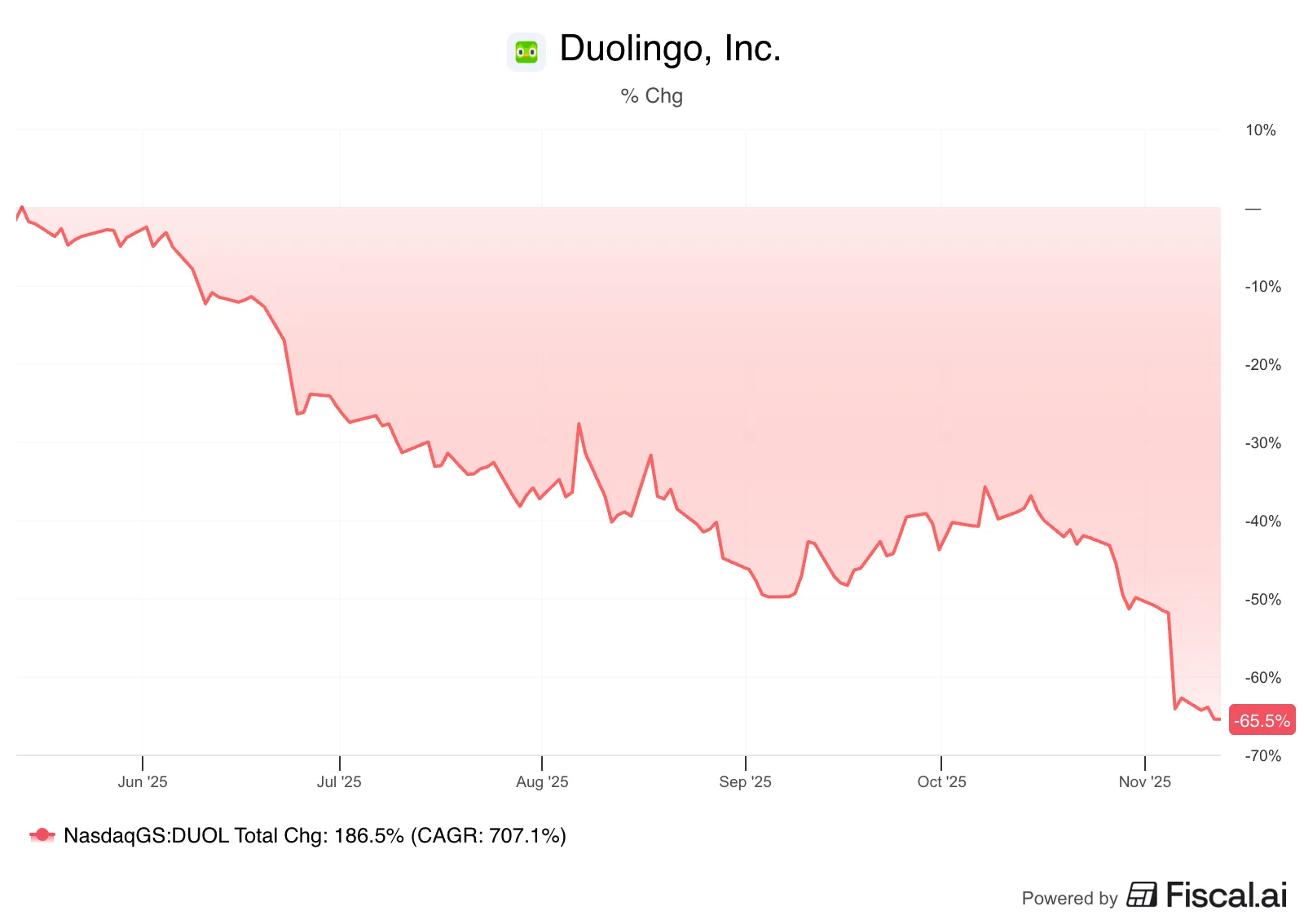

The Duolingo (NASDAQ: DUOL) share price has plunged more than 65% from its 52-week highs, leaving investors wondering whether the world’s most recognisable language-learning app has suddenly become a bargain or something far more concerning.

Let’s unpack what is actually happening behind the scenes.

What’s going on with the Duolingo share price?

Duolingo shares have been smashed in recent months, largely due to one theme: management is choosing to invest for long-term growth rather than maximise short-term profits.

In its latest quarterly update, Duolingo reported strong user growth, rising revenue, and another period of healthy margins. Yet the market reacted as though something had gone seriously wrong.

Why? Because guidance flagged slower revenue growth into Q4 and slightly lower profitability as the company ramps spending on AI-powered teaching tools and new subject categories.

What does Duolingo actually do?

Duolingo has become a global success story by making learning feel like a game. More than 50 million daily active users open the app each day, driven by streaks, quests, and social pressure — the behavioural hooks that made Duolingo a cultural phenomenon.

The business model is simple:

- A free tier that drives massive global reach

- A premium subscription with no ads and additional features

- New AI-powered tiers (Super and Max) for more personalised learning

- Expansion beyond languages into subjects like Maths, Music, and even Chess

Unlike many consumer apps, Duolingo is profitable, cash generative, and debt-free. It ended the last quarter with over US$1 billion in cash, giving it an unusually strong balance sheet for a company still growing revenue at more than 30% a year.

Operations are still strong

Despite the market reaction, Duolingo’s core metrics remain impressive. Daily active users jumped 36% over the year, with China growing quickly from a small but meaningful base. Paid subscribers lifted 34%, supported by stronger uptake of higher-tier and AI-enhanced plans.

That momentum flowed through to revenue, which climbed 41% in the quarter and continued a multi-year stretch of strong growth. Even with heavier investment into AI and new subjects, Duolingo is still generating solid free cash flow and is expected to expand FCF again next year, although decelerating from past few years.

Where the risks sit

Investors are not imagining the risks. There are real questions to weigh:

- AI competition

Can instant translation tools or AI-powered headphones reduce the need to learn a language? Possibly — but learning a language is more than translation. It involves memory, speech, context and real-world proficiency. - Margin pressure from reinvestment

Free cash flow margins will dip as Duolingo invests in AI tutors and new subjects. That is deliberate. However, short-term investors typically punish companies that reinvest during periods of high growth. - Growth naturally slows as the user base gets big

DAU growth is still strong, but it’s down from previous extraordinarily high levels. This is normal at scale, but markets rarely reward ‘normal’. - Valuation no longer a slam dunk

Even after falling sharply, the stock still trades at growth-company multiples. If revenue slows to well below expectations, there is room for further multiple compression.

So is it cheap… or a value trap?

This feels like a classic sentiment reset more than a broken business.

Duolingo is not a cash-burning, growth-at-any-cost tech story. It’s a globally recognised brand with real margins, huge engagement, and a long runway if its product roadmap lands. The company is deliberately slowing near-term monetisation to expand its future addressable market — a move that markets hate, but long-term thinkers often appreciate.

My take? At some point, a profitable global platform with rising free cash flow and tens of millions of daily users becomes too cheap to ignore. Investors just need to judge whether this reset is temporary noise… or the start of something more structural.

For now, the numbers tilt toward noise but the risks are real enough that the next few quarters matter.