Kiwi tech invading the ASX is nothing new.

Like Phar Lap, Pavlova, and Russell Crowe (maybe?), we could claim another one as our own. Given that they’re now native to our exchange, is that a stretch? Probably. But success stories like Xero (ASX: XRO), Fisher & Paykel Healthcare (ASX: FPH) & The a2 Milk Company (ASX: A2M) provide a precedent for strong performance from our NZ neighbours.

The three above have achieved market darling status at varying stages, which can be a poisoned chalice.

When investors price a company for excellence because they believe the story, the share price can outpace fundamentals. Often, when a company misses or changes course, it’s a quick pile-on followed by a sea of ‘I told you so’ by those who chose not to participate or simply missed the run. This can lead to an overreaction in the opposite direction. Investors sell off the shares and throw the baby out with the bathwater.

Gentrack (ASX: GTK), the New Zealand billing/CRM software provider for energy and water utilities and airports, could be a good fit.

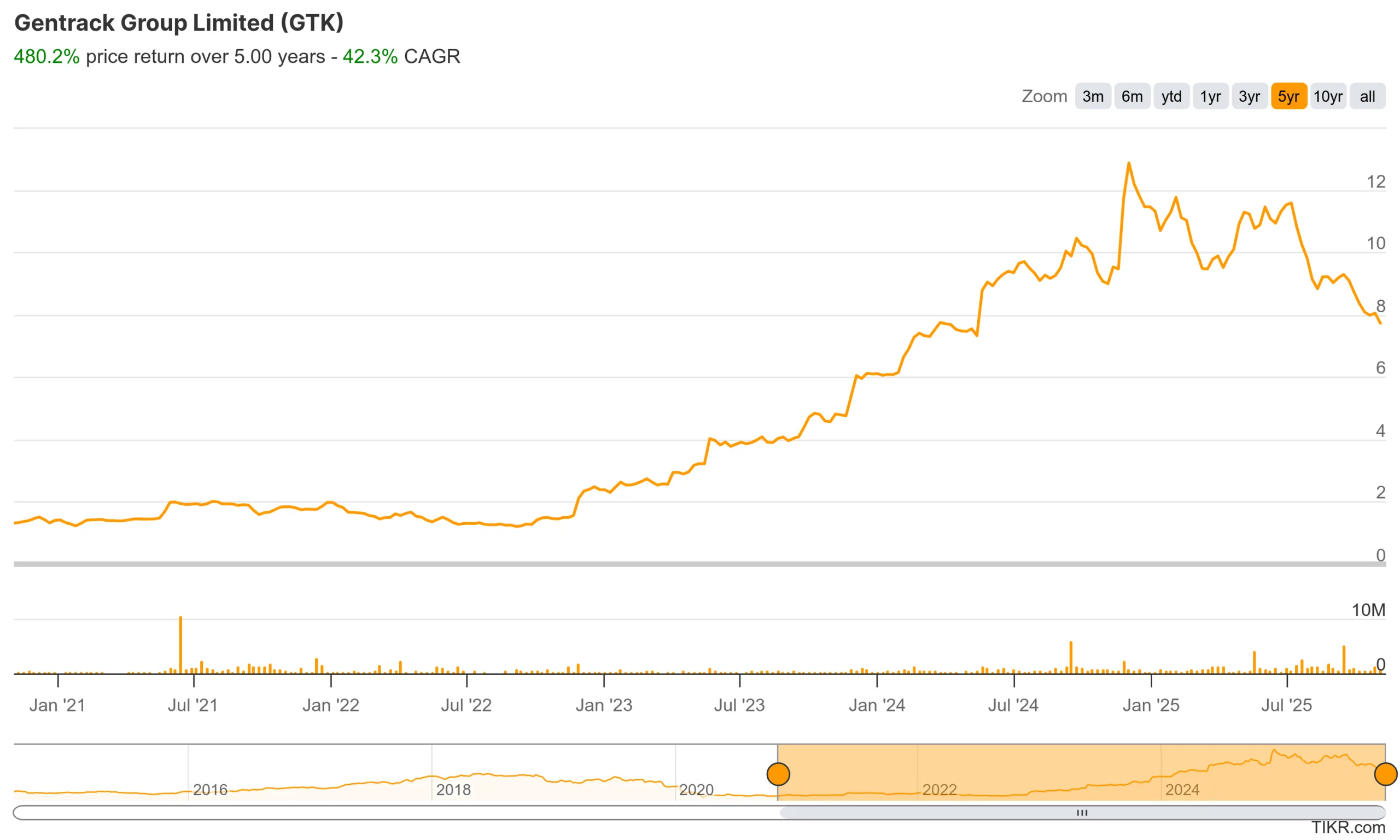

A post-pandemic darling, Gentrack has seen its share price fall on hard times recently. The company peaked at $13 per share with a valuation of over $1 billion at the end of November 2024, to now sinking below $8.

Is there an opportunity in Gentrack?

Why the Gentrack sell-off?

The share price slide began in July 2025, but there were some signs of weakness before this.

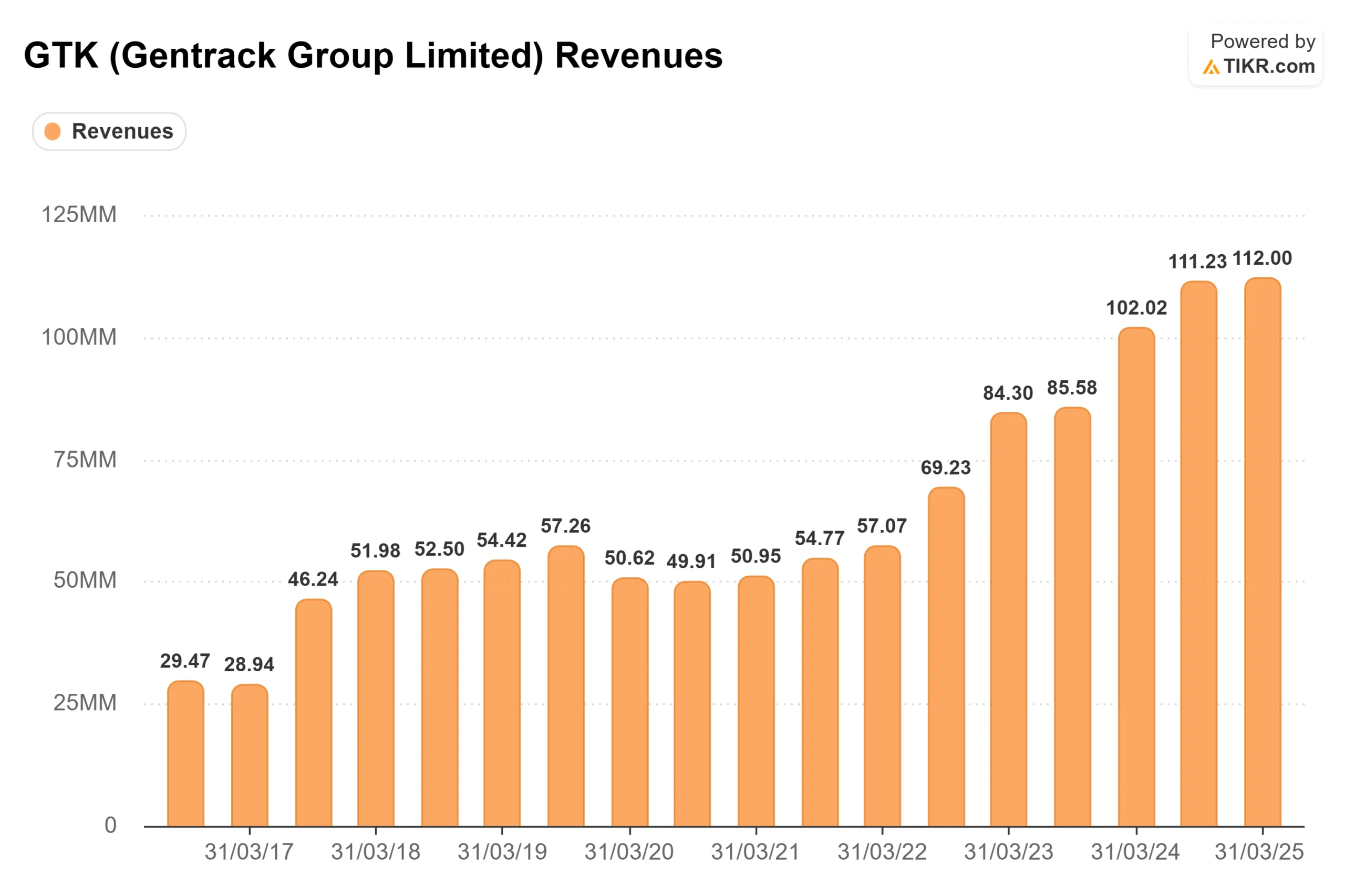

After such a strong run, investors set high expectations. In November, at the conclusion of FY2024, Gentrack management guided growth in revenue at a rate exceeding 15% CAGR and an EBITDA margin of 15-20% after expensing all development costs.

Gentrack announced its half-year results in May with revenue growth of 10% to NZ$112 million and EBITDA growth of 5% to NZ$13 million. Hardly shooting the lights out. Management then updated their guidance expectations for the full year, forecasting revenue of NZ$230 million and an EBITDA margin expectation of 12%+ (NZ$27.6 million), slightly lower than the original guide and leaving some work to do in H2.

History would suggest (excluding 2023) that second halves tend to be stronger for Gentrack:

We’ll find out soon, Gentrack will report full-year results on 24 November.

Adding salt to the wound, later in July 2025, the company disclosed that an Australian customer removed it from a platform-replacement process. Management said the financial impact wasn’t material, but the update still knocked sentiment, coupled with a broker downgrade, the share price fell.

Why might Gentrack be interesting?

The theme remains, utilities worldwide are digitising.

Billing, pricing, and customer operations are all requiring greater transparency and regulation as decarbonisation and reporting reshape the sector. Gentrack has positioned itself to enable the transition, and with the recent pullback in price. If management can deliver, Gentrack could look like a markedly better investment.

What Raskals should look for and how to hold Gentrack

Keep a close eye on management’s guidance.

Will the company hit what they say they will? How does the revenue mix look? Is there a greater shift toward one-off project work, or is recurring revenue growing? Like all investments, investors need to do plenty of due diligence here.

If you’re interested, but not convinced to go all in, you can invest in Gentrack through the Rask Invest portfolios. Gentrack is a 0.5% holding in ATEC and a tiny 0.03% holding in VAS.