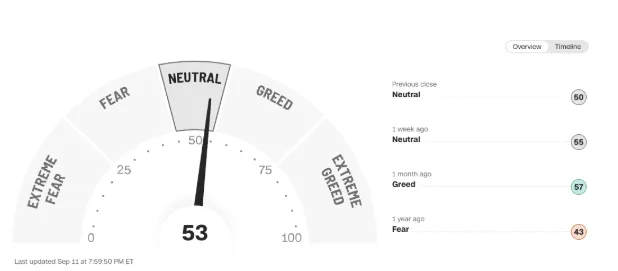

When the Fear and Greed Index shifts, so do investors’ emotions; but the real opportunity lies in how you respond, not react. People are asking, is the stock market about to crash?

Markets today sit close to record highs. Some companies have gone on extraordinary runs, yet if you look at the classic Fear and Greed Index, it isn’t screaming “extreme greed.” At the same time, volatility gauges like the VIX are sitting at very low levels. That’s often when complacency sneaks in.

Fear & Greed Index

Investors are caught between two uncomfortable emotions: envy when they see others posting wins, and hesitation when they think about deploying fresh capital. This is where FOMO (fear of missing out) and what I like to call FOL (fear of loss) creep in. Both can be destructive if they dictate your decisions.

What the fear & greed index really tells us

The Fear and Greed Index was created to measure overall investor sentiment. It gives a score from 0 (extreme fear) to 100 (extreme greed), based on things like volatility, safe haven demand, and trading volumes.

It’s a neat shortcut to gauge the market mood.

However, like any shortcut, it has limitations. It can tell you the weather, but not what you should wear. It reflects the crowd, not you. The real danger comes when one uses it as the sole signal to act, rather than as a reminder to step back and think.

The modern reality: FOMO and FOL

FOMO tends to dominate in rising markets. It starts when friends, influencers, or fund managers post about their winners. You might have passed on the stock, or sold too early, and suddenly you feel left behind.

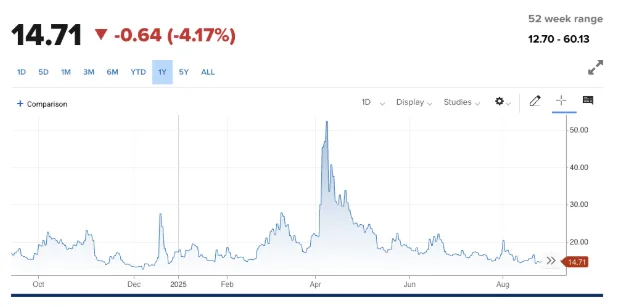

Even the best aren’t immune. Stanley Druckenmiller, one of the most respected investors of his generation, famously shorted tech stocks in 1999. The bubble looked obvious to him.

He was early, lost hundreds of millions, then capitulated and went long near the peak. His timing error cost billions. If someone of his calibre can be pulled into FOMO, none of us are immune.

On the other side sits FOL: the fear of loss. This dominates during downturns. Prices fall, the headlines grow darker, and the thought creeps in:

“What if I buy now and it drops another 20%?”

Fear of loss is tied to what psychologists call “loss aversion”; we feel the pain of a loss more than the pleasure of an equivalent gain. In markets, that often means panic selling near the bottom, or sitting frozen while opportunities pass by.

Both FOMO and FOL kill compounding. One drags you into poor decisions, the other keeps you out of the game altogether.

Bull and bear markets flip our behaviour. In bull markets, growth stories are all that matter. Everyone shares their year-to-date returns. Every sale feels like a mistake because prices keep climbing. In bear markets, balance sheets suddenly matter. Nobody posts their returns. Every buy feels like a mistake as prices keep falling.

The truth is that both environments tempt us to act in ways that harm long-term results. Following the crowd’s emotions — whether it’s euphoria or despair — is usually the surest path to regret.

The super-investor lens

Warren Buffett’s advice is as timeless as ever: “Be fearful when others are greedy, and greedy when others are fearful.”

Charlie Munger put it even more bluntly: long-term advantage often comes not from brilliance, but from simply avoiding stupidity.

Terry Smith built Fundsmith on a deceptively simple mantra: buy good companies, don’t overpay, do nothing. It’s a framework designed to resist FOMO and FOL.

François Rochon, another long-term compounder, actually keeps a “podium of errors” each year. His philosophy: learn from mistakes so they aren’t repeated.

The common thread? Each of them has a system to step back from emotion and go back to basics.

For an everyday investor, that doesn’t require billions in capital or a Wall Street pedigree. It means:

- Recognise the feeling.

- Notice when you’re tempted by FOMO because others are winning, or paralysed by FOL when headlines scream panic.

- Detach, then reset. Take a breath. Instead of asking “what’s the market doing?” ask “does this fit my plan?”

- Return to your framework. That might mean dollar-cost averaging into broad ETFs, or actively building positions in a handful of quality companies you know well.

You don’t need to react to every twitch in the Fear and Greed Index. You need to create your own index — your personal plan — and measure yourself against that.

From fear & greed to patience & discipline

The Fear and Greed Index is useful, but it’s just a mirror of crowd psychology. Your real challenge is spotting when FOMO or FOL are tugging at you personally.

When greed dominates, the temptation is to chase. When fear dominates, the temptation is to hide. Long-term investors need to resist both. Rational investing isn’t about eliminating emotion; it’s about recognising it, detaching, and sticking with a disciplined plan.

Patience, discipline, and the humility to follow your own framework may not sound sexy. But over time, that’s how compounding builds wealth.