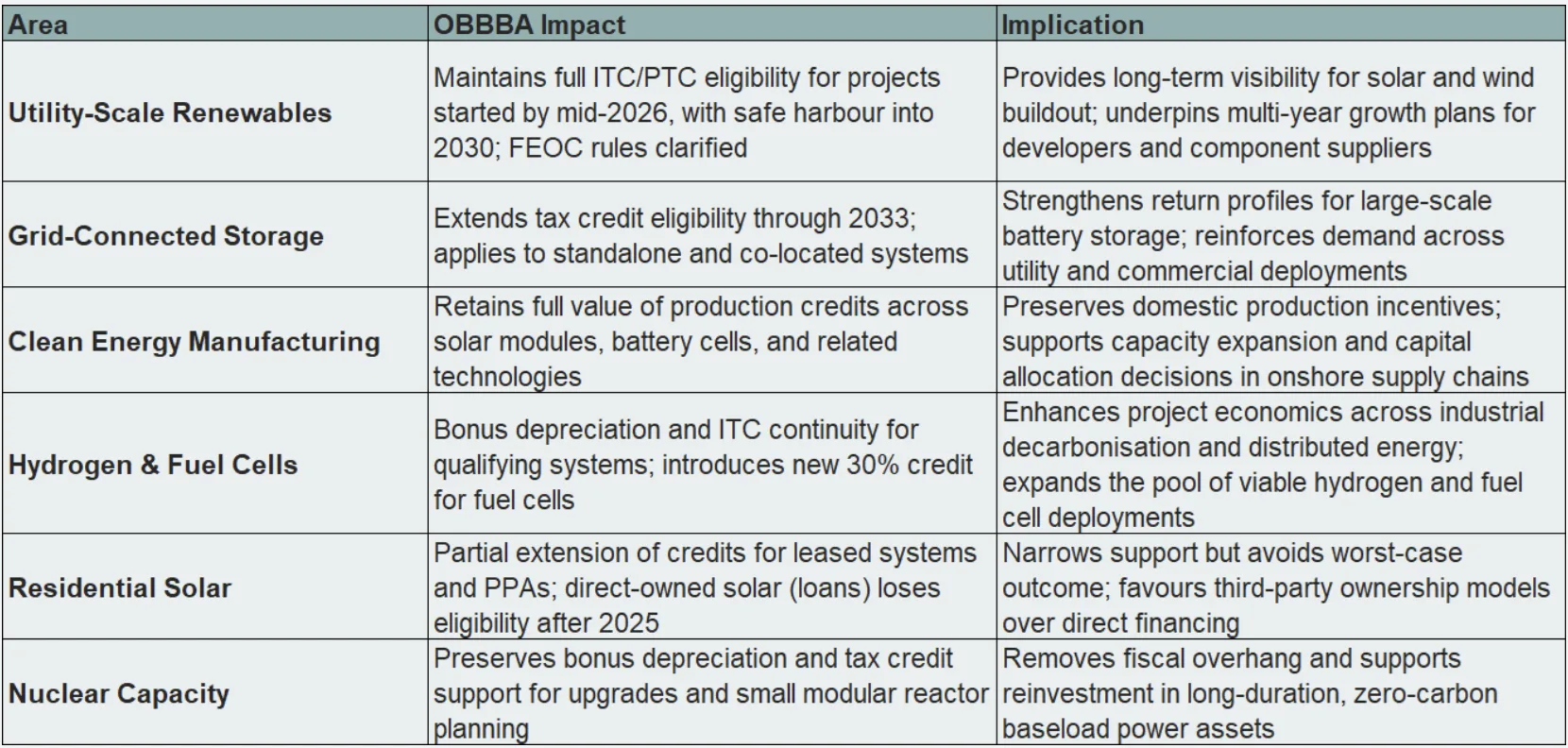

The One Big Beautiful Bill Act (OBBBA) is rewriting the playbook for US capital spending. Signed into law by President Trump on 4 July 20251, the legislation restores 100% bonus depreciation on qualifying assets—supercharging project returns and pulling investment forward. It also reshuffles clean-energy incentives, ensuring long-term funding for power networks, grid modernisation, nuclear, large-scale renewables, and continued EV support, this time with more focus on infrastructure readiness.

And the timing couldn’t be sharper. With AI infrastructure, data centres, and US manufacturing already driving record levels of capital expenditure, OBBBA arrives as both a financing tool and a demand catalyst. Projects can start sooner, scale faster, and secure supply chains more effectively. The big winners aren’t just the companies claiming tax benefits directly, but also those supplying the equipment, technology, and materials feeding into this accelerated investment cycle.

Why OBBBA matters for investors

The reinstatement of 100% bonus depreciation by the OBBBA is accelerating investment across AI, infrastructure, and semiconductors in the US, while helping preserve investment continuity in hydrogen and nuclear by maintaining key tax incentives.

While direct tax benefits of OBBBA favour asset-heavy sectors, second-order beneficiaries include equipment suppliers, industrials, and component makers.

Investors positioned in strategies aligned to capex-intensive themes, especially in the US, may see upside from both fiscal tailwinds and improved free cash flow dynamics.

Mega tech wins from tax boosts

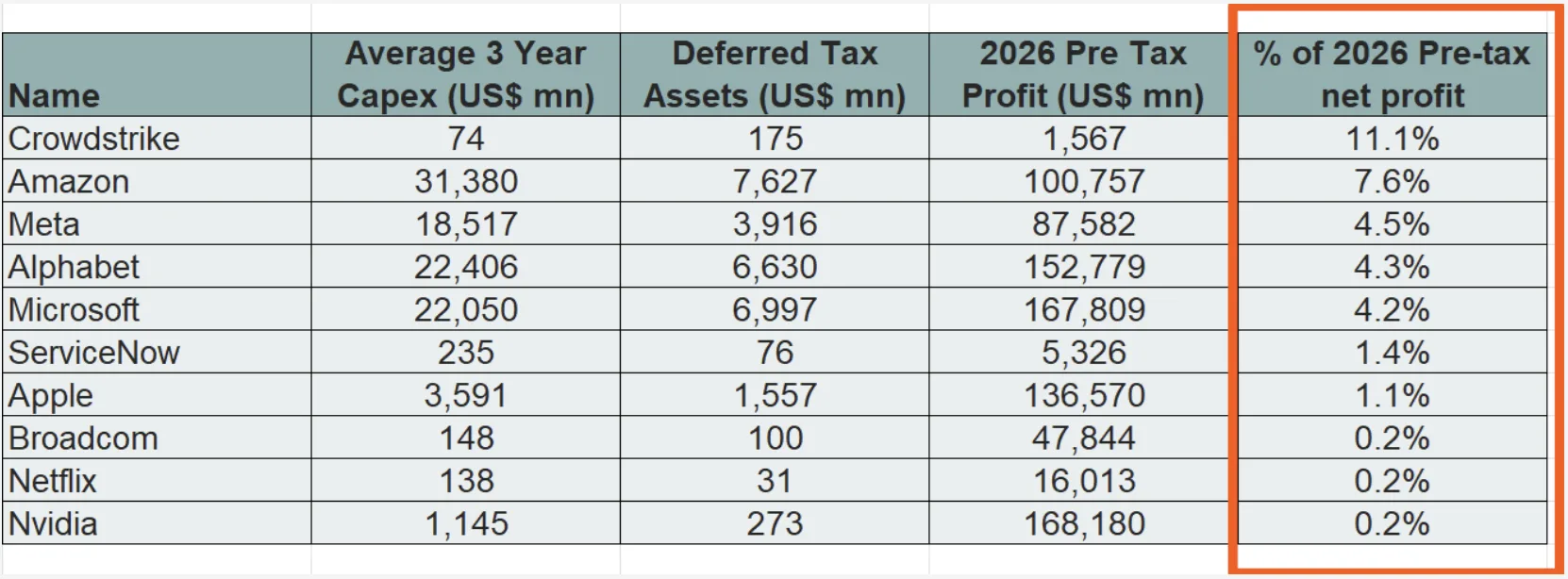

The reinstatement of 100% bonus depreciation by the OBBBA has introduced a powerful financial lever for large US-listed tech platforms. Under the revised tax treatment, capital expenditures on qualifying tangible assets can now be immediately deducted, pulling forward substantial tax benefits. For companies already committing billions to AI infrastructure, this change enhances near-term cash flow, profits, and increases flexibility around capital deployment.

Large-scale investments in compute, data centres and energy systems, which are central to deploying foundation models, now come with material tax offsets that lift free cash flow conversion. This dynamic is especially visible in firms with significant and recurring capex programs, where accelerated deductions are influencing both internal budgeting and forward profit guidance.

Beyond accounting effects, the change strengthens the investment case for continued infrastructure buildout. Management teams are more willing to bring spending forward, knowing it can be offset in year one. This is particularly relevant for companies with dominant AI positions, as it lowers the effective after-tax cost of scaling. The result is greater visibility on margins and return profiles, and potentially positive surprises in earnings quality over coming quarters. The potential tax uplift impact on the profit level is not evenly distributed, but the impact is high in absolute dollar terms, supporting stronger free cash flow conversion in names with scale, pricing power and a multi-year AI investment roadmap.

Industrials: the quiet winners

While the OBBBA does not directly subsidise US industrials or construction companies, it reinforces a favourable backdrop for firms supplying capital equipment, engineered systems, and services into investment-heavy sectors. Even before the Bill was signed, policy-driven industries such as freight, utilities, and airlines had begun ramping up capital expenditure, lifting demand for the machinery, materials, and logistics providers that enable them.

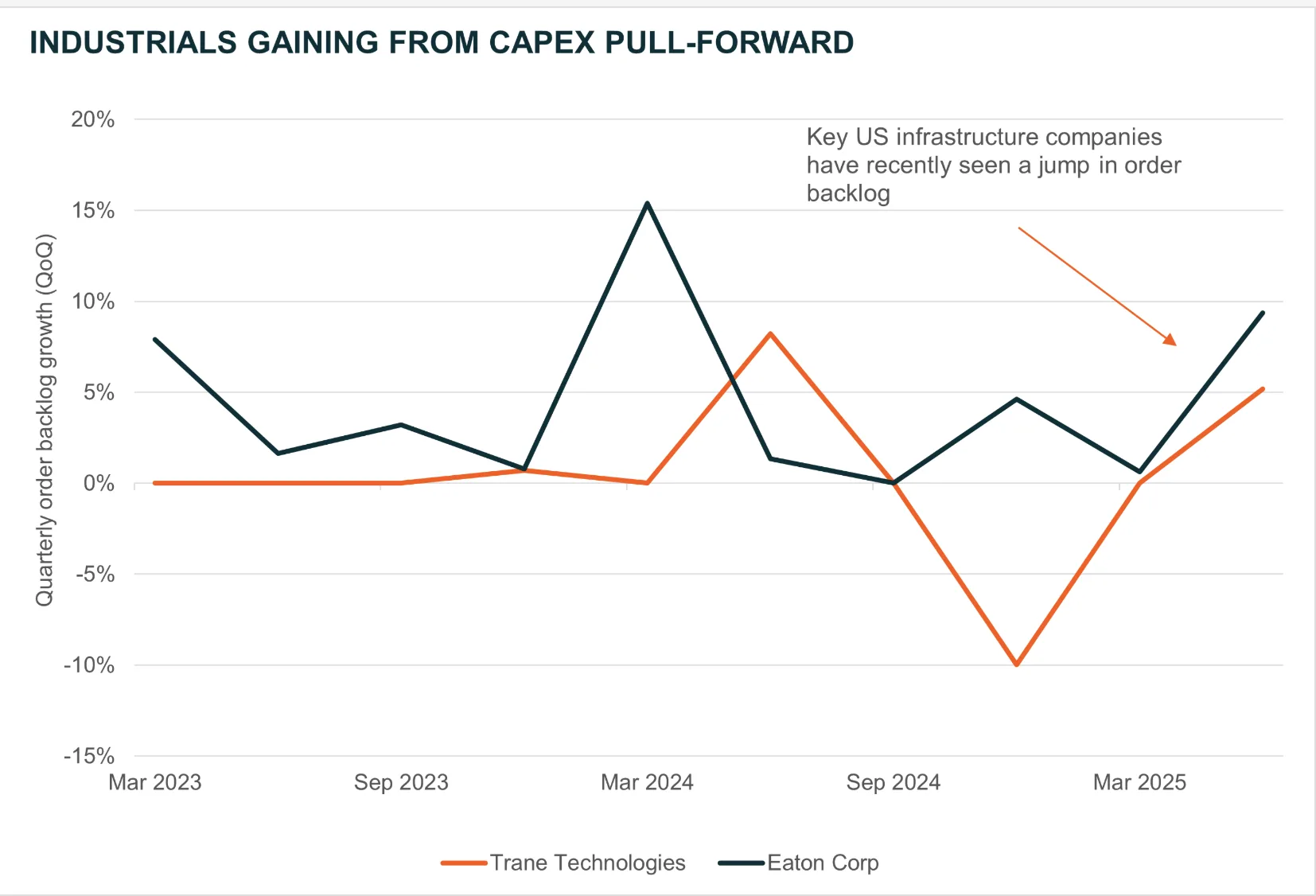

Recent company results and narrative show early indications of this shift. Trane Technologies (NYSE: TT) reported strong commercial HVAC bookings linked to data centre construction and institutional retrofitting—a sign of growing investment tied to power and thermal infrastructure. While residential demand remains soft, management cited steady activity in non-residential markets and a rise in large-scale project orders.

Eaton (NYSE: ETN), a leading supplier of electrical systems and power management solutions, is also emerging as a second-order beneficiary of OBBBA.5 While not directly subsidised, the company is seeing strong momentum across utilities, industrials, and data centre clients—all areas aligned with policy-driven capex. Management has recently raised its earnings outlook, pointing to resilient demand and structural tailwinds tied to electrification and grid modernisation.

Taken together, these developments suggest industrials are positioned as second-order beneficiaries of OBBBA. While not directly incentivised, they stand to benefit from the broader uplift in capital formation, particularly as the lower after-tax cost of investment flows through to orders for power infrastructure, climate systems, engineered components, and construction inputs.

Hydrogen and nuclear: policy continuity powers on

While OBBBA did not introduce new subsidies for hydrogen or nuclear, it helped preserve the policy footing many projects rely on. The reinstatement of 100% bonus depreciation lowers upfront capital costs, while continued access to the Section 48 Investment Tax Credit (ITC), contingent on Foreign Entity of Concern (FEOC) compliance, provides ongoing support for eligible infrastructure.

For hydrogen, this clarity allows projects involving electrolysers, storage, and distribution systems to proceed with greater confidence. Deployment is being driven not by new incentives, but by the avoidance of policy disruption, with tax offsets and ITC eligibility supporting return profiles across industrial decarbonisation, heavy transport, and grid-support applications.

In nuclear, the ability to expense qualifying upgrades and maintain ITC access is encouraging utilities to move forward with life extensions, capacity uprates, and early-stage small modular reactors (SMR) development. Rising baseload needs from data centres and electrification have shifted focus back to reliable, zero-emissions power and OBBBA has removed some of the fiscal uncertainty that previously constrained planning.

For both hydrogen and nuclear, OBBBA reduces policy uncertainty and supports continued investment by preserving eligibility for existing incentives and lowering upfront capital costs.

Turning OBBBA into Portfolios

The One Big Beautiful Bill Act is accelerating investment across multiple corners of the US economy, but not all sectors benefit equally. For those looking to position around this structural capex wave, targeted exposures may offer more precise access.

These ETFs are well positioned to benefit from the OBBBA policy;

- The Global X FANG+ (ASX: FANG) is well placed to benefit from increased free cash flow among megacap tech platforms deploying billions into AI infrastructure.

- The Global X US Infrastructure Development ETF (ASX: PAVE) stands to gain from rising demand in industrials and construction linked to physical infrastructure upgrades.

- The Global X Hydrogen ETF (ASX: HGEN) is exposed to hydrogen infrastructure, including compression and storage systems now made more cost competitive.

- The Global X Uranium ETF (ASX: ATOM) may benefit from increased nuclear investment and rising demand for uranium fuel as utilities bring forward generation plans

Find the original article on Global X’s website here.