REA Group’s new CEO doesn’t have far to travel

The real estate behemoth, REA Group Ltd (ASX: REA) finally has a new CEO and he doesn’t have far to travel. Outgoing CAR Group Ltd (ASX: CAR) CEO, and friend of the Australian Investors Podcast, Cameron McIntyre will be swapping his Punt Road office for the corner office at REA Group on Church Street.

He might even be able to keep his same parking spot. He’s literally only swapping one letter between company names, ticker included!

International experience

Cam is a fanstatic get for REA Group. He knows what it takes to become a dominant online classified business and he has had fantastic success when it comes to expanding CAR Group’s operations internationally.

The one country though where CAR Group didn’t have a foot print was India which is becoming a more important piece of the REA Group story.

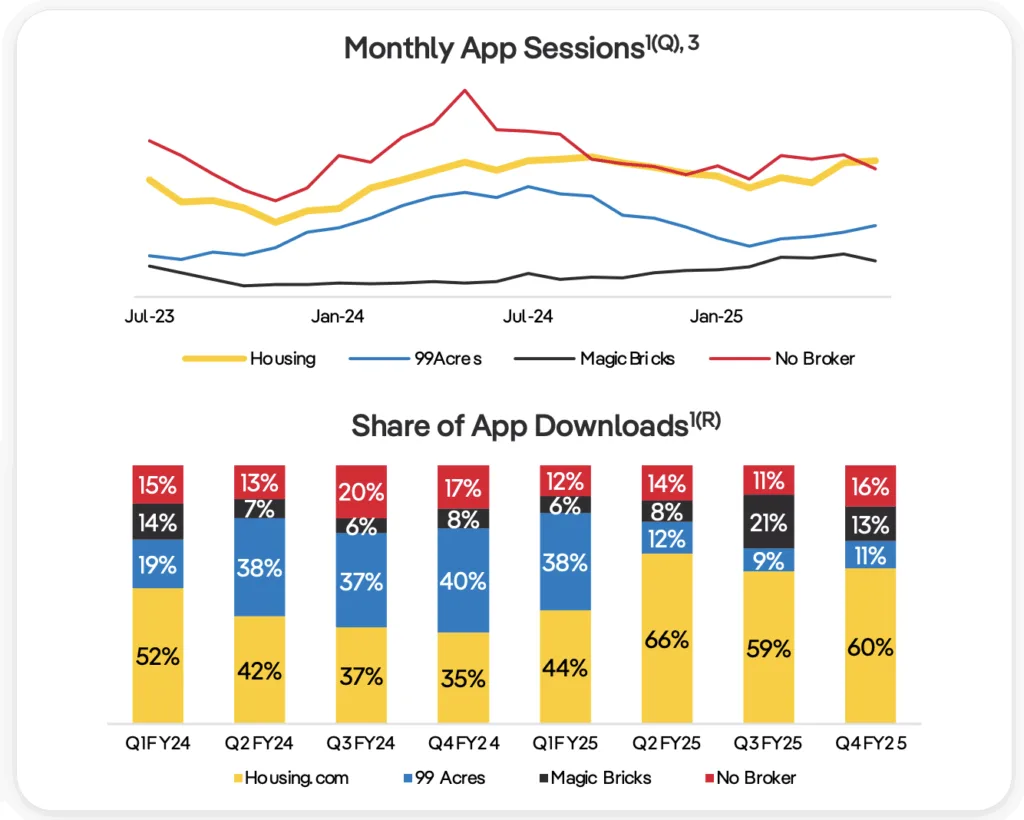

From the outside the Indian market’s appeal is quite obvious. The population is enormous, wealth is increasing, digitisation is rapid but there’s no clear number one property portal yet. REA Group is hoping Housing.com emerges as that number one. And with the digitisation of India, it is all about the app.

Online classifieds businesses are notoriously winner take all. CAR Group grew to dominate the domestic landscape here, I challenge you to think of who is even the second best vehicle classified business in the country. The Indian market may be large enough for two players, but as an REA Group investor you’re eyes are thoroughly on the above charts. You’re wanting to see that yellow line move further and further away from the rest.

Culture of innovation

Cam was known at CAR Group for fostering a culture of innovation that solved genuine customer headaches. He wanted the team to try and to have a project failure rate of 50%. If you’re not failing you’re thinking big enough.

He was not a CEO to sit back and rest on the dominant market position CAR Group enjoyed.

Interestingly enough, CAR Group had tried and failed at finance a number of times during Cam’s tenure. It will be interesting to see the approach taken with REA Group’s own finance divisions, namely Mortgage Choice.

One thing we remain weary of will be Cam’s time. This is no small job and with the board seat at Brambles Ltd (ASX: BXB) we hope he’s not stretching himself too thin. So far, this was not an issue over at CAR Group.

All in all, we think it is an excellent appointment and once Cam has his feet thoroughly under the desk I look forward to welcoming him back to the Australian Investors Podcast.

Markets overnight

US markets overnight were flat as talks between Trump and warring Russia and Ukraine continue. The US market is eagerly awaiting Jerome Powell’s speach later this week.

- S&P 500 = -0.009%

- Nasdaq = +0.03%

- Aussie dollar down 0.2% to 64.95 US cents

- Iron down 0.2% to $101.70 US a tonne

If you would like more insight from myself and the Rask team jump across to Rask Core. Rask Core is where you will find more of my write ups and our ETF model portfolios. Rask Core is our “do it with me” service. You can control your own investments but do so with confidence as you see the exact holdings and percentages. Check it out here.