Electric vehicles (EVs), battery technology firms, and lithium miners have made significant strides in global adoption, technological innovation, and production capacity since the late 2010s and early 2020s. Despite this progress, the sectors have faced substantial headwinds in recent years, with profitability challenges weighing on investor returns.

Now, 2025 is shaping up as a potential turning point. With stronger fundamentals and more mature market dynamics than half a decade ago, the EV value chain — including many of the companies featured in the Global X Battery Tech & Lithium ETF (ASX: ACDC) — may be gearing up for a “second ride” that could reward investors who stay the course or are ready to get back on board.

Fast facts for investors

-

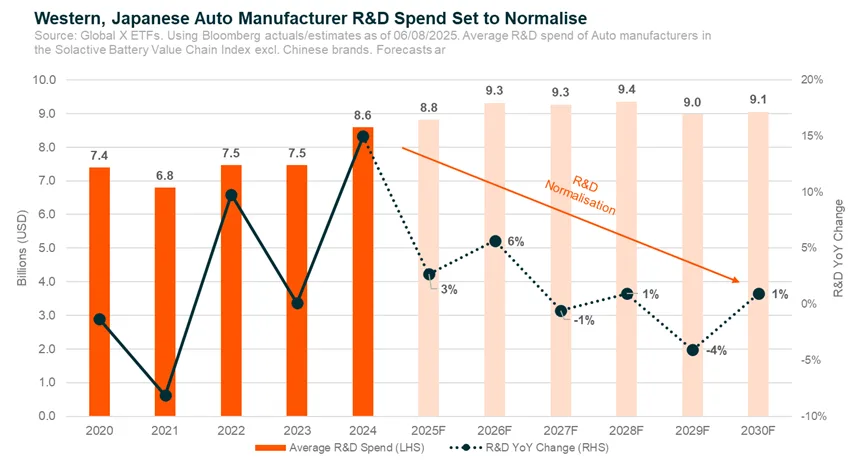

Intense research & development (R&D) efforts by Western automakers to re-orient supply chains and production processes, alongside fierce competition in the Chinese EV market, have led to margin compression, weighing on profitability and investor returns.

-

Despite the profitability crunch, the EV industry has delivered strong revenue growth. This leaves room for earnings upside if consensus analyst expectations for margin recovery materialise.

-

Lithium producers may have reached a turning point, as persistent oversupply has triggered production cuts and pauses from several Chinese miners — opening the door for a rebound in global lithium prices and sentiment.

Profit pressures and policy shifts

There comes a point in every new technology’s “hype cycle” when investors stop reaching for their wallets and start asking tougher questions. Enthusiasm gives way to scepticism, and one question rises above all else: “How much money are you actually making?”

Over the past two years, the EV industry has faced that question with increasing regularity — and the answer has often fallen short. Traditional automakers in the West have made meaningful strides in shifting production and design toward electric vehicles, but rising R&D costs have eaten into margins. Meanwhile, Chinese EV giants — despite their technological edge and battery expertise — contend with cut-throat competition at home and growing trade barriers abroad.

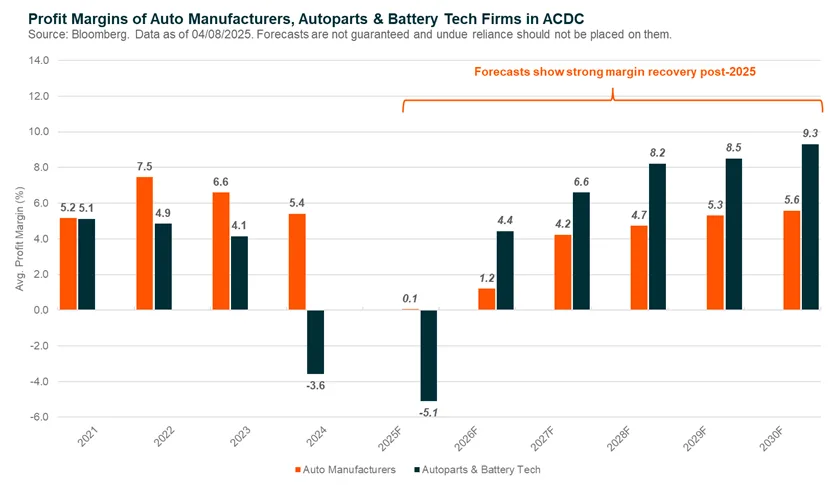

These challenges have translated into a sharp decline in profitability across the EV value chain. At the height of their momentum in 2022, global auto manufacturers and auto parts & battery tech firms boasted profit margins of 7.5% and 4.9%, respectively. But by EOY 2025, these figures are expected to fall to just 0.1% and −5.1%. This deterioration in margins has been a key driver of weak share price performance for EV-related stocks over the past two years.

However, consensus now points to 2025 as the likely trough for industry margins. Analysts broadly expect a recovery phase to begin from 2026 onward, supported by two structural shifts:

-

R&D normalisation: Market estimates suggest that R&D spending for Western and Japanese automakers will largely peak around 2026, with little to no growth through 2030. The EV transition for traditional automakers is finally approaching maturity. R&D intensity is beginning to ease, and production processes are becoming more standardised and cost-efficient, enabling profitable scaling rather than continued heavy investment in transitional infrastructure.

-

Policy stabilisation in China: In China, where EV makers have been locked in a brutal price war, state policy is expected to play a major role in stabilising margins. As part of its broader effort to combat deflation, Beijing has launched an “anti-involution” campaign aimed at curbing excessive competition and promoting more rational, sustainable market behaviour.

Recent headlines underscore the Chinese government’s increasing urgency and resolve to rein in destructive competition in the EV sector:

-

31 May 2025 — The Ministry of Industry & Information Technology called for an end to destructive price competition, warning of threats to long-term industry health and pledging joint enforcement with regulators to tackle below-cost sales and oversupply.

-

16 July 2025 — Premier Li chaired a national meeting targeting “irrational competition” in the NEV sector, calling for regulation to restore order and stabilise margins across auto and solar stocks.

-

30 July 2025 — The Politburo reaffirmed efforts to manage disorderly competition and excess capacity in key growth sectors — including autos and EVs — as part of a broader anti-deflation strategy.

-

5 August 2025 — President Xi and the Politburo flagged EV price wars as a threat to growth and introduced draft legislation targeting anti-competitive pricing practices.

If these catalysts help drive material margin recovery in both Western and Asian markets, it could mark the beginning of a major earnings expansion for the EV industry.

Furthermore, while margin recovery alone can be a powerful driver of earnings growth, the effect can be exponential when paired with strong underlying revenue momentum. From 2020 to 2025, the aggregate revenue per share of constituents in the Global X Battery Tech & Lithium ETF (ASX: ACDC) grew at a compound annual rate of 15% — roughly double that of the S&P 500.

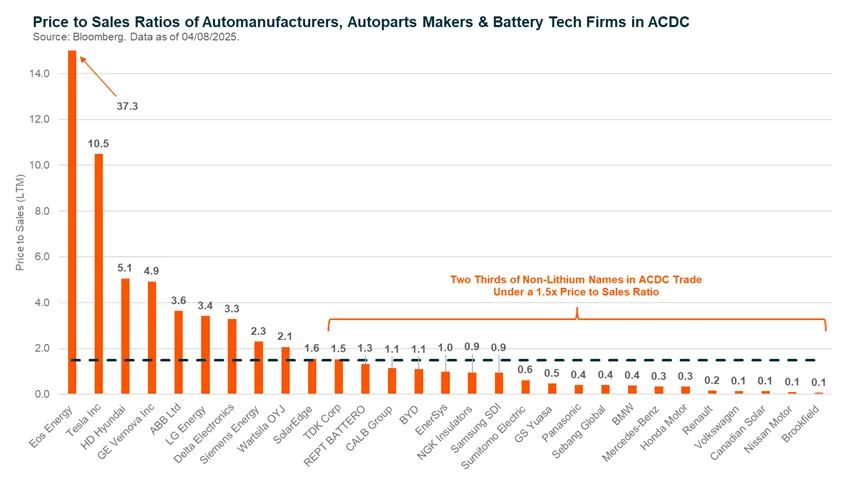

Investors’ focus on near-term earnings has also left large portions of the EV value chain trading at depressed revenue multiples. As of August 2025, roughly two-thirds of ACDC’s constituents trade below a price-to-sales ratio of 1.5×. With a leaner cost base and margin recovery underway, this low starting point could set the stage for significant upward revisions and positive earnings surprises in the years ahead.

When lithium producers reach their limits

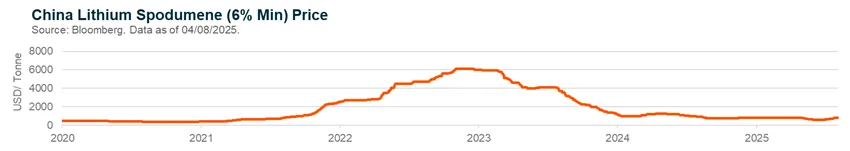

Lithium spot prices — and, by extension, lithium miners — have struggled over the past few years in a chronically oversupplied market, largely driven by a surge in Chinese production capacity. Typically, sustained low commodity prices would trigger a reduction in supply, setting the stage for a gradual price recovery. But Chinese lithium producers have disrupted this traditional supply-cycle dynamic.

While most mining companies recognise lithium’s strategic role in the future electric economy, none have been as aggressive in pursuit of global dominance as Chinese firms. In a bid to outlast and outcompete international rivals, China’s large-scale lithium producers have embraced a “short-term pain for long-term gain” strategy. Despite weak prices, they’ve continued to overproduce, aiming to squeeze out less profitable or capital-constrained competitors and consolidate global market share — a pattern reminiscent of OPEC’s historic approach to defending influence through price pressure.

However, in recent weeks, we appear to have crossed the threshold of maximum pain for many of China’s over-producing lithium miners. Cracks are beginning to emerge among the country’s largest players, suggesting a potential turning point for global supply:

-

Jiangxi Special Electric Motor, a vertically integrated EV parts manufacturer, suspended all lithium production for a month, citing cost cutting measures and system maintenance.

-

Sinomine Resources said in June it would pause new mine developments in Jiangxi as it “adjusted technology requirements”.

Even among producers still capable of operating at current price levels, pressure is mounting. Much like in the EV sector, the Chinese government is increasing scrutiny of lithium miners under its broader “anti-involution” campaign.

Notable examples include:

-

Zangge Mining Co. was ordered by the Haixi local government to immediately halt all “illegal mining activities”.

-

In Yifun, a major lithium district, eight separate miners were asked to submit reserve reports after audits found false numbers had been registered to expedite licensing in 2021–22.

-

CATL, the world’s largest EV battery producer, recently failed to receive renewed permits for lithium production at its Jiangxi mine — a facility representing roughly 3% of global lithium supply.

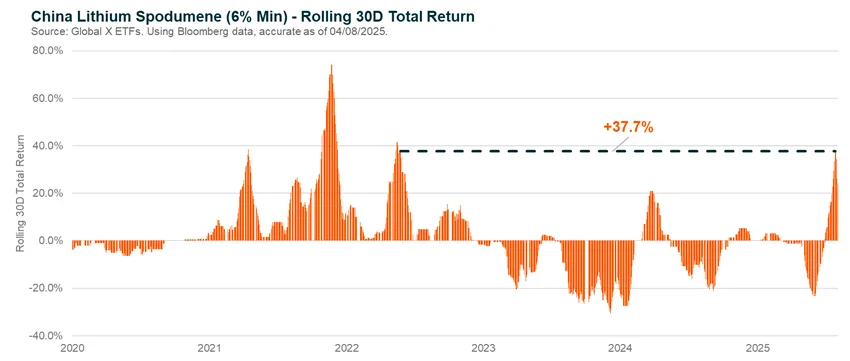

These announcements have sent ripples through China’s lithium spot market, signalling a potential new mechanism through which the government may control supply. All these signs of emerging supply restraint have culminated in a 38% surge in Chinese lithium spodumene prices over the past month — the strongest rally since 2022, when lithium prices were still rising.

Past performance is not a reliable indicator of future performance.

Why the outlook could be changing

After years of heavy investment, margin erosion, and investor scepticism, the EV ecosystem may finally be approaching a turning point. Across the value chain — from automakers to battery tech and lithium miners — the worst of the transition pains now appear to be behind us.

Western and Japanese automakers are beginning to benefit from years of R&D investment, with spending now stabilising and production processes becoming more efficient. Meanwhile, in China, regulators are stepping in to end the EV price war and restore discipline across the supply chain through the government’s broader anti-involution campaign.

If these forces hold — and margins begin to recover atop a still-growing revenue base — the EV value chain could be on the verge of a powerful earnings resurgence.

About the fund

The Global X Battery Tech & Lithium ETF (ASX: ACDC) invests in global companies developing electro-chemical storage technology and electric vehicles, as well as mining companies producing battery-grade lithium. With Western automakers nearing peak R&D spend, China moving to end its EV price war, and lithium miners showing signs of supply discipline, ACDC offers an easy way to get back on board for the EV sector’s “second ride.” Read more about ACDC here.