With the Global X Uranium ETF (ASX: ATOM) offering diversified access across the full nuclear value chain, it’s worth stepping back to understand why nuclear power remains essential in the global shift toward cleaner energy. While some may feel the theme peaked with the uranium rally and subsequent pullback between 2023 and late 2024, the broader trend tells a different story.

So, is the nuclear energy boom really over? Has the urgency for nuclear diminished? If the steady stream of policy support and innovation is anything to go by, the answer is a firm no.

If anything, the volatility seen in spot uranium prices has served as a lesson: investing in the nuclear resurgence isn’t as simple as backing one commodity. Demand for uranium doesn’t materialise overnight, and many of the firms making nuclear safer and more modular are not tied to uranium at all.

This is why a broader, more holistic investment view is essential.

Commodities Alone Don’t Tell the Whole Story

Investing in raw commodities like uranium can be a bumpy ride. Since 2020, uranium prices surged from near historic lows to 15-year highs—before tumbling by around 40% between mid-2024 and early 2025.

This type of volatility is to be expected. As the old saying goes, “the cure for high prices is high prices.” That is, rising prices encourage more supply, which cools demand and ends the rally. It’s a natural boom-and-bust cycle.

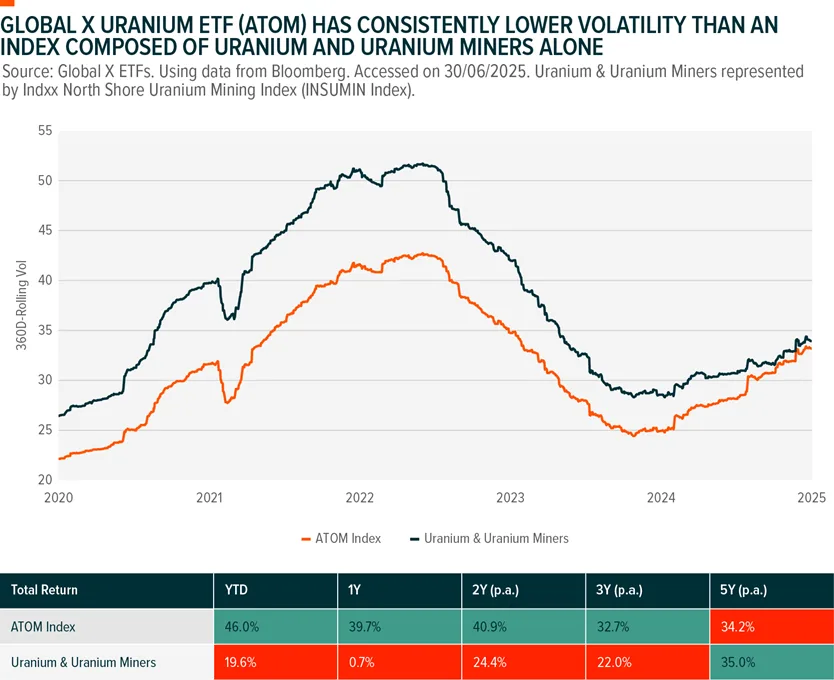

However, for long-term investors—especially those looking to ride big structural trends—less volatile, more diversified exposures tend to be more appealing.

ATOM: Full-Cycle Exposure to Nuclear Growth

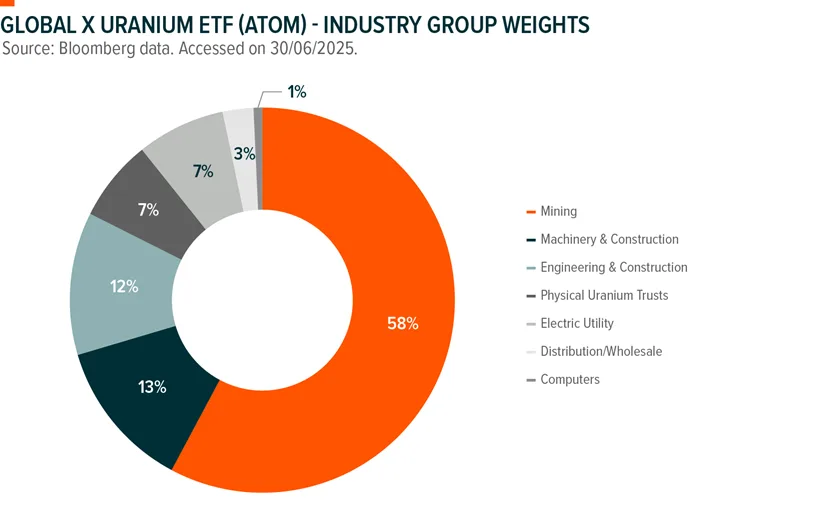

That’s where ATOM comes in. Rather than focusing solely on physical uranium or miners, ATOM provides broad exposure to the entire nuclear energy ecosystem. This includes not only uranium trusts and miners, but also engineering, construction, and technology firms helping build next-generation nuclear infrastructure.

This approach makes ATOM both more diversified and more reflective of the broader nuclear theme. And the benefits aren’t just theoretical: data shows that ATOM consistently delivers lower volatility compared to indices made up only of uranium miners and trusts. In many timeframes, it has also outperformed.

Policy Wins Don’t Always Lift Uranium

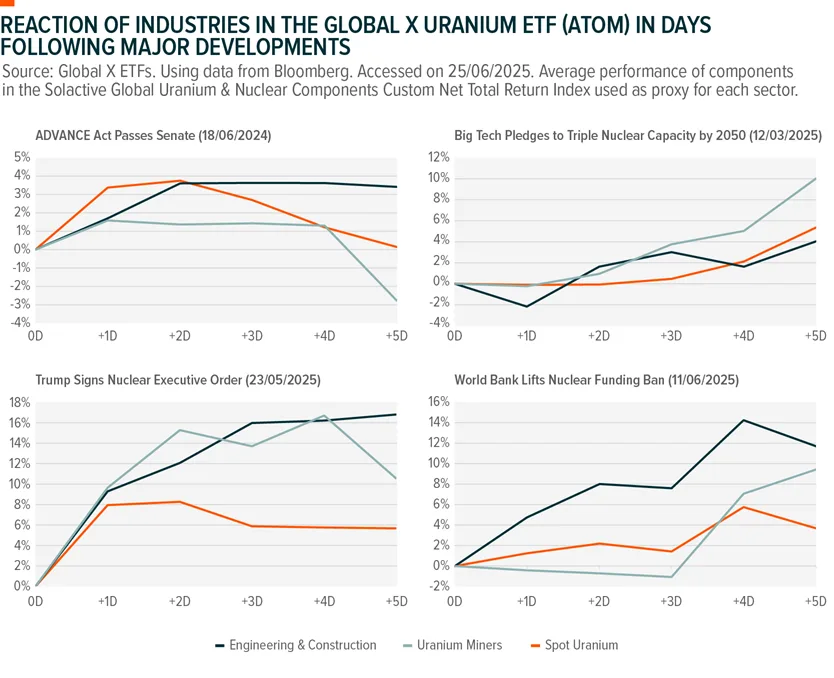

A key challenge in using commodities to capture thematic trends is that major positive developments don’t always impact commodity prices directly. In the nuclear space, much of the good news relates to infrastructure and policy—not uranium supply or demand.

Here are some major nuclear-related headlines from the past 12 months:

-

July 2024: The Biden Administration passes the ADVANCE Act to support licensing of advanced nuclear tech and domestic fuel chains

-

March 2025: Tech giants like Amazon, Google, and Meta commit to tripling global nuclear capacity by 2050

-

May 2025: Trump signs orders to quadruple U.S. nuclear power and launch construction of 10 large-scale reactors by 2030

-

June 2025: The World Bank lifts its decade-long ban on nuclear financing, with the Asian Development Bank following suit

While all of these are major wins for the nuclear narrative, they don’t necessarily drive uranium prices higher. Investors focused purely on uranium may miss out on the momentum these developments generate for companies involved in construction, licensing, and deployment of advanced nuclear tech.

Analysis of market responses to these announcements shows that in three out of four cases, companies within the broader nuclear value chain—like those in ATOM—outperformed physical uranium and mining stocks in the days following.

Thematic Strength in a Volatile Market

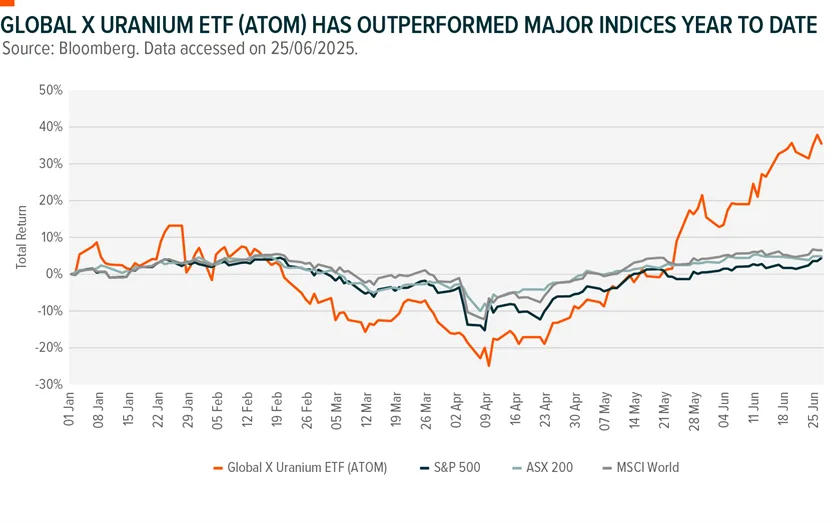

ATOM’s recent outperformance is especially notable given the broader market conditions. Investors today face high volatility, geopolitical uncertainty, and a fragile economic outlook.

Yet despite these headwinds, nuclear-related equities have continued to perform strongly—supported by policy momentum and structural demand for energy security. ATOM, in fact, is the top-performing ETF on the ASX (excluding defensive sectors like gold and defence tech).

Its success highlights how diversified, thematic exposures like ATOM can shine even when broader markets struggle.

Positioning for the Nuclear Future

Thematic investing is about more than simply identifying trends—it’s about capturing their full potential. And in many cases, that means looking beyond the obvious.

For investors wanting to participate in the global nuclear renaissance and the broader clean energy transition, the Global X Uranium ETF (ATOM) offers a well-rounded solution. By including uranium producers, infrastructure enablers, and technology leaders, ATOM captures the full spectrum of opportunity in nuclear’s next chapter.