Is MercadoLibre Inc (NASDAQ:MELI) still a buy in 2025? In the research below, I take a look into MELI’s growth drivers, the valuation, risks and the wild Amazon (NASDAQ: AMZN) comparisons that get thrown around…

“It’s the next Amazon”, says your mate with the stock tip, for the 17th time.

This is a familiar call for the next big thing: what if the next Amazon (NASDAQ: AMZN) is essentially just Amazon, but in another geography?

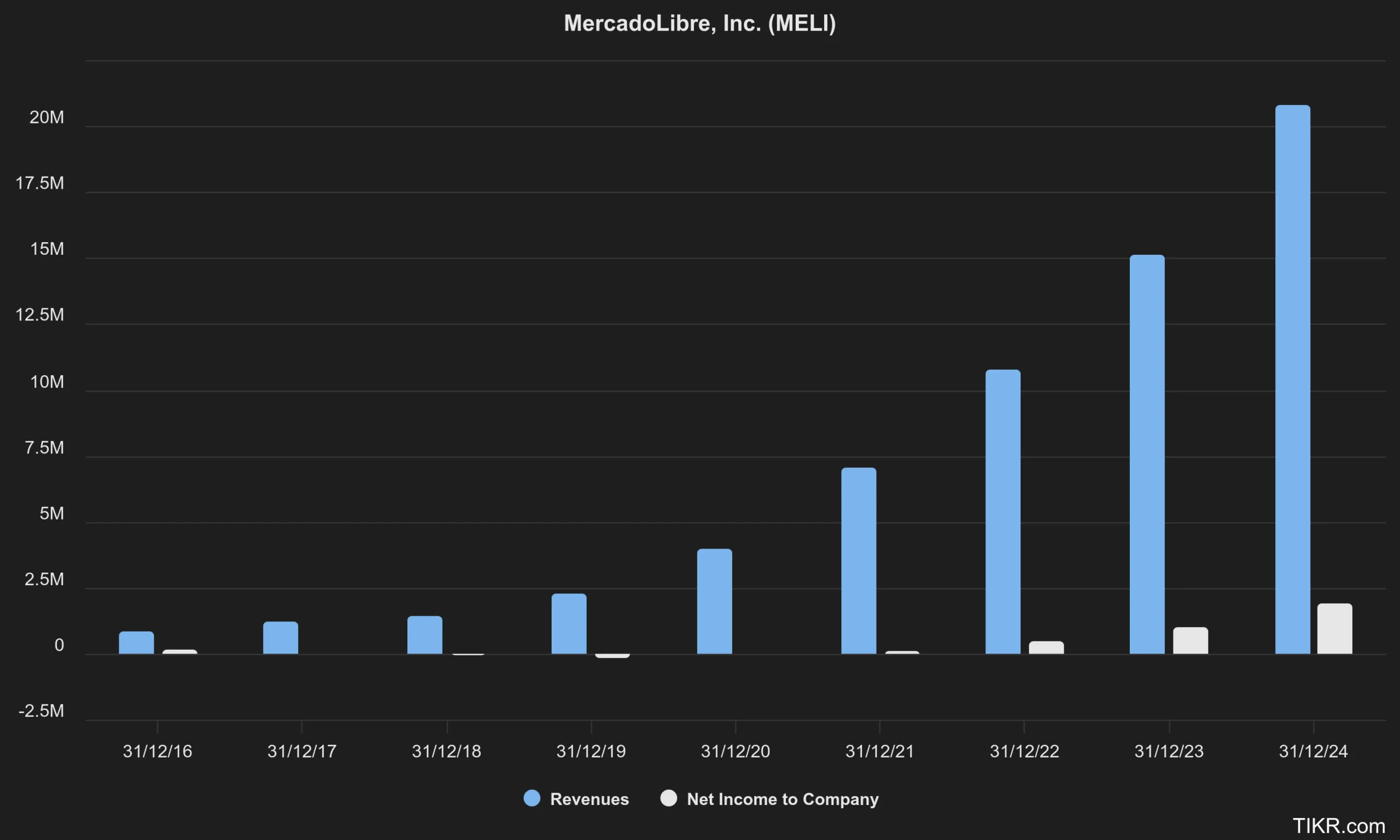

Buenos Aires-born Mercadolibre Inc is Latin America’s ‘everything store’, with an ecosystem and a multi-pillar business, generating US$5.9 billion in revenue last quarter alone, growing at a massive 37%.

The 5 keys to the Mercadolibre business model

Mercadolibre, which translates to “free market”, can be broken down into 5 key business divisions:

- Commerce: home to 66 million unique buyers last quarter, including small businesses and major brands. Over 20 years, the e-commerce platform has evolved, offering a wide range of products from millions of sellers.

- Fintech Services: Mercado Pago, from digital accounts to insurance, the division serves both sides of financial transactions. The company offers credit to its consumers and to its merchants (sellers). Monthly active users reached 64 million in Q1 of 2025, a 31% increase on the prior year. Think: technology like PayPal (NASDAQ: PYPL), but with the staying power of a bank like Commonwealth Bank of Australia (ASX: CBA).

- Acquiring: via Mercado Pago, this unit serves merchants (i.e. businesses selling stuff) with a wide range of payment solutions tailored to different needs, such as Point of Sale, QR payments and Merchant Services. Think: Square/Block (ASX: SQ2).

- Logistics: Mercadolibre prides itself on delivering a world-class shopping experience to buyers, driving greater traffic and sales conversion. Services include next day delivery, Meli Delivery Day (consolidated delivery on one specified day) and Meli Places (partner shops, kiosks, parcel lockers, etc). This is kind of like Amazon’s Third Party Logistics business (where brands, or a country’s entire postal service, use Amazon’s warehouses and delivery network).

- Advertising: Mercadolibre says it’s essentially what Amazon offers ad-wise, but on their platform. These advertising solutions enable sellers and brands to reach buyers throughout their shop. It’s like paying for a premium ad spot on Carsales.com.au (ASX: CAR) – but when you’ve got millions of sellers competing for limited advertising space, this service is extremely powerful.

Mercadolibre’s opportunity ahead

As an investor, you’re naturally drawn to MELI’s marketplace, as an Amazon comparison. After all, how many companies are up 251,400% like Amazon?

One of the most exciting prospects for me is that over 80% of Latin America retail remains offline, leaving a huge pie for Mercadolibre to slice off and eat. Not only is it a giant pie, but it’s still cooking.

E-commerce volume is projected to reach US$769 billion in 2025 and grow to US$1 trillion by 2027, increasing at an impressive compound annual growth rate of 20%. Not only do you have excellent network effects by introducing buyers and sellers within the marketplace, but you also begin raising switching costs as users expand into payments and credit as they become accustomed to the platform. Logistics and advertising naturally grow with all of it. It’s a win some, then win lots more, type business model.

Have we missed the opportunity to buy Mercadolibre in 2025?

Naturally, with a business growing at these incredible rates, it grabs investors attention.

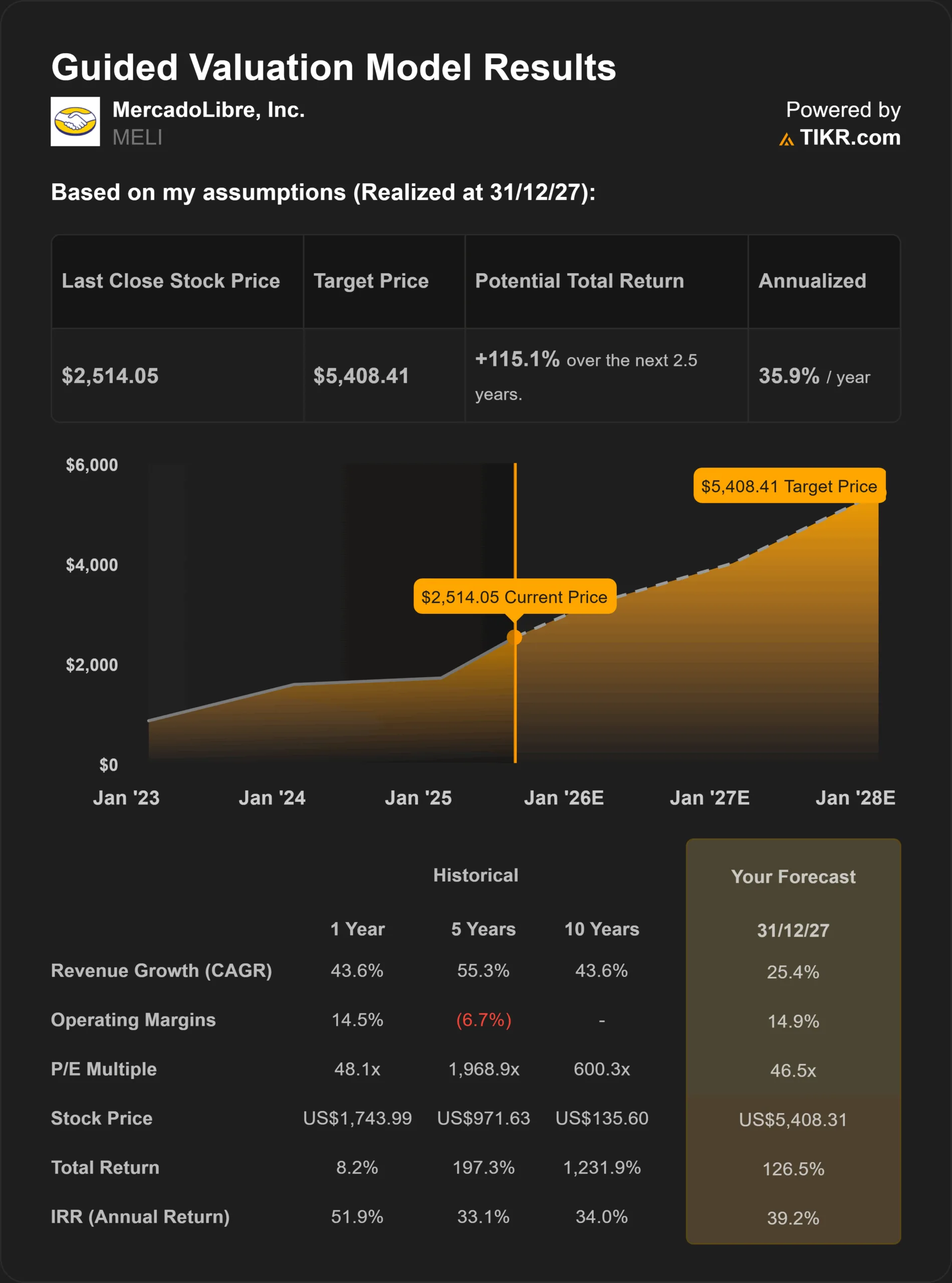

At the time of writing, Mercadolibre trades on 58 times its 2024 full-year profits (P/E of 58x). It’s hardly on the “cheap” side of investing. But considering the opportunity within its markets (+20% per year tailwind) and its potential for continued growth within the markets and push into adjacent services, it may reach that valuation over time.

So, is it too late? Are we now just picking out the metaphorical collection card from the letterbox?

Mercadolibre doesn’t put out formal profit guidance. If you’re looking for some numbers to compare to your own estimates, or simply to get a rough idea, you can jump on the TIKR website and use the “estimates tab” within the company profile. This will display what analysts expect from Mercadolibre in the near future. While not perfect, it can give you an idea before you run your own estimate.

Within the estimates breakdown tab, you can view a summarised version of analysts’ expectations and the average multiple over those years.

Amongst the analysts following MELI stock closely, the consensus is they expect it to grow revenue by 31% in 2025, which would imply a 47% revenue compound growth rate since 2020. That’s ultra impressive growth.

Those same analysts expect that growth to flow to the bottom line, with Earnings Per Share (EPS) estimated to grow by the equivalent amount. That puts Mercadolibre on a multiple of 51 times profit. Again, not cheap. But with a view to longer-term growth (e.g. to 2028, as shown above), there’s a strong case to be made that the company is looking like good value.

What could go wrong for Mercadolibre?

Analyst forecasts look great. But it’s never that simple.

Given the profit multiples Mercadolibre stock is trading on, there’s plenty of management execution and implied growth that has to take place for this to be a winning investment.

Mercadolibre has a large exposure to markets such as Brazil, Argentina and Mexico. Any weakness in those economies or political systems could see demand hit and the business suffer (if only temporarily). The natural Amazon comparison is great… until you realise it’s also playing in the same league as one of the best companies in the world (Amazon itself!). The continued threat of the Amazon juggernaut will always act as a spectre over Mercadolibre.

Core, satellite, or… wait?

It can often feel a little foreign (pardon the pun) owning shares in a company that is solely focused overseas. Especially one that you have little exposure to (MELI is not Apple).

If you can get past that, there’s potentially a mammoth opportunity awaiting, especially if you have a long enough time horizon. Mercadolibre is no longer the scrappy auction site of 1999, but nor is it a fully mature blue chip. It finds itself in a sweet spot, large enough to enjoy network effect defensibility, early enough to compound profits at 25-30 % for years.

That said, the high profit multiples demand execution, with little room for error. And there are also plenty of examples of businesses with large addressable markets that haven’t worked out. So if you’re searching for more conviction, perhaps it’s worth biding your time until you are comfortable.

As we’ve recently discussed, timing the market is next to impossible. So it really comes down to understanding the business, the market and being prepared for volatility.

A great way to dip your toe in the water with MELI would be to own the stock within Rask Invest. Our Saturn, Jupiter, Martian & Terra strategies all have a partial holding in the Lakehouse Global Growth Fund Active ETF (ASX: LHGG) which in turn has a large position in Mercadolibre. That’s a much more diversified and considered way to gain exposure to fantastic overseas compounders, without a single stock in your portfolio keeping you up at night.