Markets overnight

Remember the good old days of the 90 day pause? 90 days of not waking up to headlines of threats on countries. It was nice wasn’t it.

The days of the pause are well behind us now and everyones being slapped with a tariff. Brazil, Canada, Mexico and this morning I wake to see the headline of a 100% tariff on Russia.

Overnight the US market has been mostly flat, with the S&- 500 up 0.15% and the Nasdaq up 0.30%.

- S&P 500 = +0.15%

- Nasdaq = +0.30%

- Aussie dollar down 0.5% to 65.46 US cents

- Iron up 0.1% to $99.40 US a tonne

What should we focus on instead of tariffs?

Where the tariff talk ends up we don’t know. What we will focus on is following the hard numbers, employment and consumer spending. So far, this has been incredibly robust. Trying to keep up with the day to day challenging, let’s leave that to those who get paid for your clicks, we get paid to invest.

G8 Education Ltd (ASX: GEM) fails the reasonable person test

Yesterday childcare operator G8 Education Ltd (ASX: GEM) responded to the ASX’s “please explain” letter.

As you’re most likely aware a couple of weeks ago now awful news broke about a childcare employee being arrested. One of the centres in the spotlight was operated by GEM. GEM operates 400 childcare centres around Australia.

Knowing the news that broke, we don’t want to even write about it here, would you say it would have an impact on the share price?

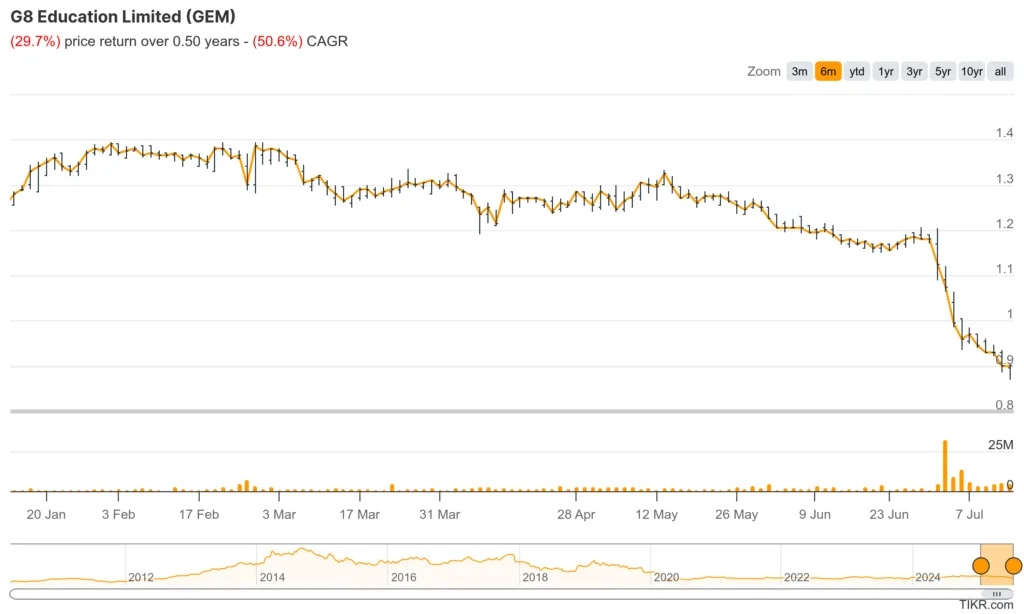

Month to date the GEM share price is down almost 30%.

When your entire business is built on trust – and let’s face it, scarcity and the prices of housing demanding most Australian parents both work full time jobs – I’d say the news that broke would most likely have an effect on the share price.

GEM however, disagreed.

In it’s response to the ASX query yesterday it advised:

“Immediately upon becoming aware of the Information, GEM considered whether the Information would be reasonably likely to have a material impact on the company’s financial position or performance. Despite being shocked and distressed by the Information, GEM concluded that it was not likely to have a material impact on GEM’s financial position or performance and in reaching this conclusion GEM took into consideration that the charges related to conduct by a former employee at one G8 Education centre (with potentially another four impacted) out of a total of 399 centres. GEM assessed any potential liability in connection with the Information as not being material and GEM did not anticipate the Information to materially affect occupancy (a key driver of earnings), regulatory approvals or other financial metrics.”

With the share price falling close to 30%, major shareholders including industry superfund’s and well known fund managers calling for a better explanation. It seems investors would disagree.

The key item in the above statement is a material impact on the company’s financial position or performance.

Will we see the handling of the situation lead to higher vacancies at GEM centres? What will the new measures to safeguard children at 400 centres cost the company? Will moral weigh on staff and there be an exit of educators?

Time will tell if it is material or not.

Anecdotally, my son goes to a GEM centre. Has done since he was 9 months old. The staff are great. There was a period of very high staff turnover at the start but that settled.

One thing that’s always got my goat though was I couldn’t help but notice every time there was an announced increase in the child care subsidy we’d soon after receive a notification of the fees increasing. May as well bang another increase through to cover the cost of cameras at 400 centres. The parents can’t argue with that surely? And, in that case, they’re probably right, it won’t have a material impact on the business.