WiseTech Global Ltd (ASX: WTC) has the hallmarks of an ASX blue chip company. In this article, I’ll discuss why WiseTech could be the next blue chip on the Australian market and what to watch out for.

If the pandemic taught us anything, it’s that disruptions to supply chains cause chaos. During Covid-19, countless companies bemoaned rising prices as limited supply and disruptions caused headaches globally. A key player in this market is WiseTech Global.

WiseTech Global (ASX:WTC) share price

WiseTech Global (ASX:WTC) makes the world go round

The Sydney-based WiseTech Global sells CargoWise, a cloud platform that automates freight forwarding, customs, warehousing and e-commerce logistics.

It’s a monster and a market leader, used in 195 countries across the planet, it plugs every transport mode into one database.

Global trade depends heavily on logistics, which keeps supply chains running smoothly and ensures that items travel effectively across borders. CargoWise, a leading logistics software solution, has become a crucial tool for freight forwarders, customs brokers, and supply chain managers worldwide.

What makes an ASX blue chip?

For ASX investors, “blue chip” has generally meant the same few stocks for decades.

Think of ASX stalwarts BHP Group Ltd (ASX: BHP),Commonwealth Bank of Australia (ASX: CBA), CSL Limited (ASX: CSL). It’s challenging for new entrants to break in.

The typical characteristics of blue chips include market dominance, a strong balance sheet, durable earnings/profit and a strong management team.

So, does WiseTech Global share these features?

The $36 billion behemoth has compounded revenue at ~30% per annum for a decade, while maintaining gross profit margins of 80%! Commonwealth Bank of Australia has a $300 billion market capitalisation, but is growing nowhere near as fast as WiseTech – nor does it have the sheer market size available in front of it.

As of 31 December 2024, the company had net cash (cash balance minus debt) to the tune of ~$70 million USD. In other words, WiseTech Global is flush with cash. And it is generating close to $28 million USD in the first half alone. It’s a cash box and a cash machine.

WiseTech has risen up the boards in market capitalisation on the ASX, and there are definitely hallmarks of a blue chip in the making.

It’s not all rosy, though…

WiseTech Global headaches

I won’t delve into the details, but founder Richard White recently found himself in the headlines. You can watch our interview with Richard White.

The recent news has caused severe headaches, as well as a dip in the share price in recent months. Between board changes and director movements, you could be forgiven for rephrasing the meme to ‘1 Richard White vs. 100 board members’.

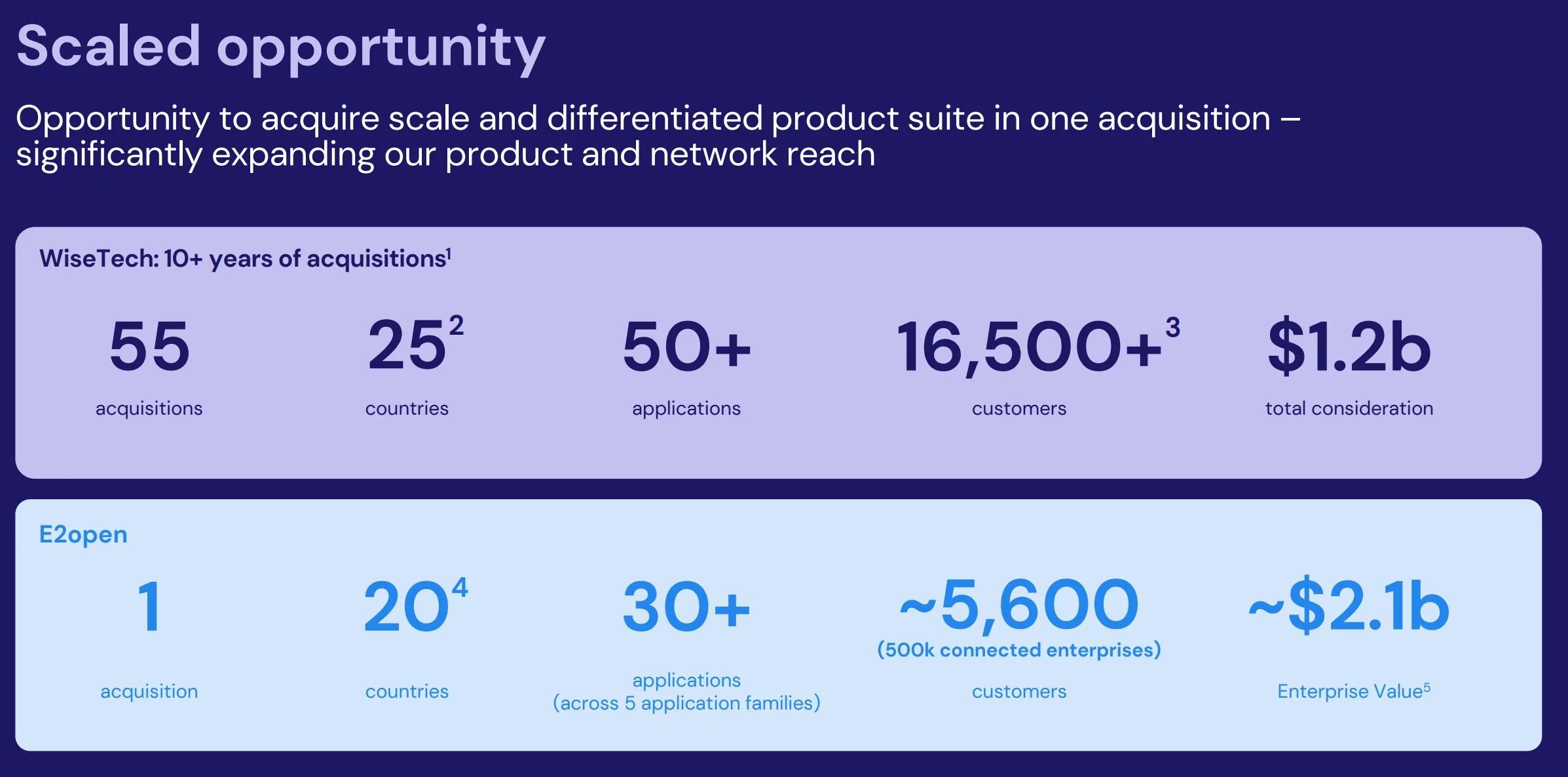

Beyond the boardroom battles and controversies, WiseTech Global recently entered into a significant acquisition of E2open (NYSE: ETWO), a U.S. based provider of SaaS-based solutions in the global logistics value chain, for US$2.1 billion. While the company has successfully integrated many purchases, E2open is a different beast.

As with any acquisition, there is integration risk, particularly at this size. Given WiseTech Global’s history of success, I do feel you need to back the team in. The opportunity is enormous, Richard White believes, as adding E2open helps further connect the burgeoning logistics market, specifically the freight company clients of WiseTech Global, with E2open’s large manufacturers, retailers, and distributors. E2open’s EBITDA margins are around 35%, much lower than the 50% of WiseTech, so be prepared for some profit dilution.

WiseTech Global catalysts to watch from here

WiseTech Global is slated to report its results in August; current guidance is for FY25 revenue to be between $792 million and $858 million, with growth of between 16% and 26%, with FY25 EBITDA to be between $396 million and $436 million an increase of between 22% and 34% on the prior period. This excludes a one-off ~$40 million in transaction costs as a part of the acquisition, which is due to be completed in the first half of 2026. Anything noteworthy around integrations or logistics issues is worth keeping an eye on, not to mention continued management drama.

With a dividend yield of 0.18% and a significant acquisition in the works, we may not see a substantial increase in dividend yield for a while, which would fuel blue chip claims, especially from those franking-hungry Australian investors.

For now, keep your due diligence checklist within reach as this is a fast moving business.

Buy, Hold or Sell: WiseTech Global

I should say that during the recent Trump Tariffs I bought some WiseTech shares at $85 and I loaded up on an ETF which includes a big stake in WiseTech.

At $112.50 per share today, WiseTech Global has a market capitalisation of $37 billion.

Meaning, WiseTech currently trades at a staggering 46x yearly profit multiple – at the lower end of its guided revenue for 2025.

Rich in valuation and business quality, with governance issues and noise, as well as slightly lower forecast growth, you could mount an argument for sitting on the sidelines at these prices.

Alternatively, industry growth, price rises and a successful integration of E2open could be the boost WiseTech needs to keep the party going.

I’d still consider holding WiseTech as a position within a satellite portfolio (alongside your core), but only if I had a willingness to hold it for 5 years at least (ie. 2031).

If that feels too much, you should know that WiseTech is already part of two Rask Invest positions: ATEC (ASX: ATEC), the Betashares technology-focused ETF, holds 11% in WiseTech; and our position in the Vanguard ETF, VAS (ASX: VAS), has a weighting of just under 1%.