Tariffs are back in the headlines…but did they ever leave? This is why I am watching the Telstra Group Ltd (ASX: TLS) share price, but what does Trump have to do with the mobile phone in your pocket?

Why I’m keeping an eye on the Telstra share price

When the initial tariff news struck it significantly spooked markets.

But in all the uncertainty, domestic stalwarts stood strong. Dominant domestic telecommunications business Telstra not only withstood the negative sentiment but increased in share price significantly. Better known as a stable dividend payer, for a short period of time it was the only growth story on the market.

So, why did this typically unexciting share price increase? Investors were moving funds from US exposed businesses and expensive growth businesses to defensive, Australian revenue focused businesses. Regardless what Trump does, we still need to text, talk, email, stream, work and TikTok. This is the type of consistent revenue investors value in times of uncertainty.

Look across the major components of the Vanguard ASX Shares Index (ASX: VAS) – the major Australian shares exposure for all Rask Invest portfolios – and you’ll see a good number of mature, dividend paying, domestic, essential businesses. Woolworths Group Ltd (ASX: WOW), Coles Group Ltd (ASX: COL) and Origin Energy Ltd (ASX: ORG).

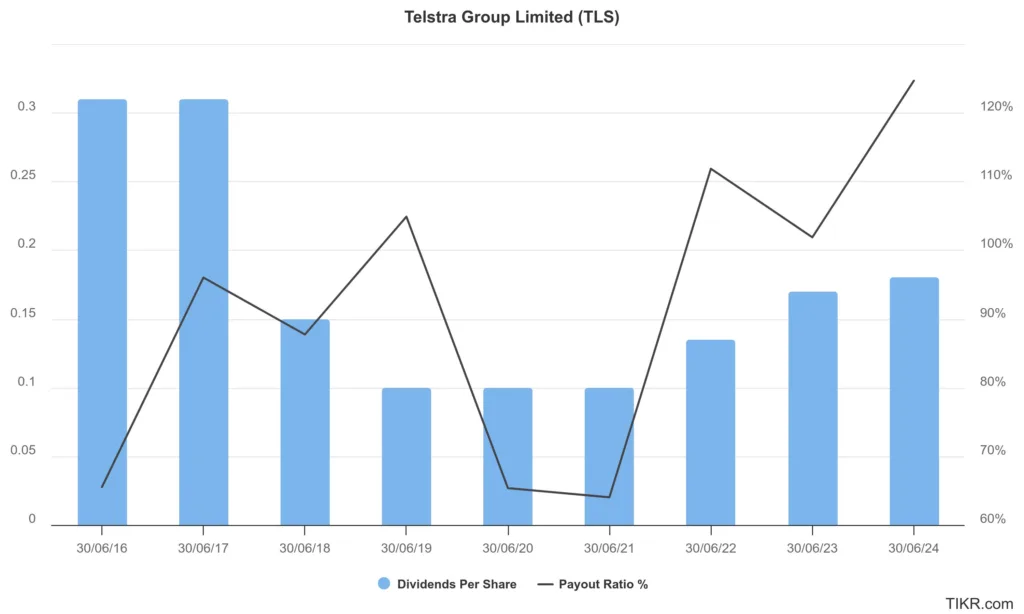

Keep an eye on the Telstra dividends

For a true reflection of the performance of these businesses, let’s keep an eye on the dividends paid by them over the next six months instead of focusing on short term gyrations of the share price.

Interest rates are tipped to fall

Interest rates are in my eye for a number of reasons. Firstly, with Rask Invest we have a number of investors using a debt recycling strategy, funding of these strategies will become cheaper. Additionally, I take a lot of calls from prospective investors looking to sell out of investment properties. Often they’re just fed up with the management that comes with the property. Finally, down-sizers selling properties, purchasing smaller ones and looking to generate an income with the left over cash.

Where does Telstra fit into this? When investors are no longer receiving adequate income from their term deposits they look towards names they know and trust to provide income. Or, ETFs such as the Vanguard Australian Shares High Yield ETF (ASX: VHY). We use VHY in our income producing portfolios like Martian, Terra and Mercury. We like the diversified nature of the ETF and it’s simplicity. Telstra makes up over 6% of the ETF. That is triple the weight of Telstra in VAS.

If diversifying your income sources is becoming more important to you, you can reach me for a chat here.