The Virgin Australia Holdings Ltd (ASX: VGN) share price flipped then flopped a day after its ASX IPO – and I think that’s a sign of what’s to come for Virgin shareholders.

Hear me out…

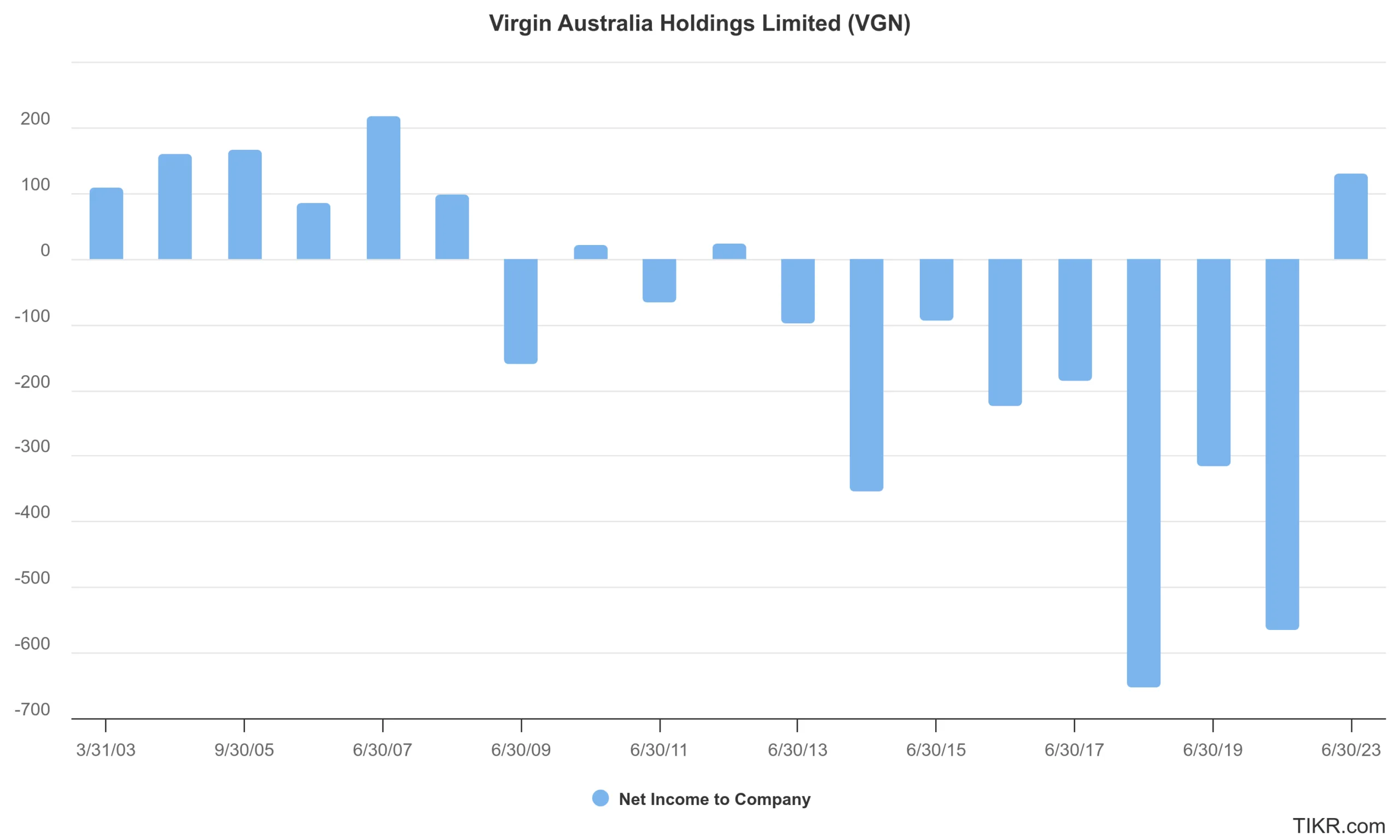

Virgin Australia in one chart

The chart above comes from the official financial data provider at Rask (the only one I trust, Tikr.com).

It should tell you everything you need to know about Virgin Australia:

Between 2003 and 2023 (a cool 20 years), Virgin generated a grand total of $1,131.69 million in profits (73% of it came before 2008) but… (wait for it) a whopping $2,718.20 million in LOSSES!

Paint me Virgin red and call me Shirley, that’s a lotta losses!

Virgin: catch this falling knife if you can

In other words, Virgin spent 20 years creating a grand total of $1,587 million in net losses for its loyal shareholders. Meanwhile, the All Ordinaries (ASX: XAO) went up more than 3x.

Maybe this is why Warren Buffett said in his 2007 letter:

“The airline industry’s demand for capital ever since that first flight has been insatiable. Investors have poured money into a bottomless pit, attracted by growth when they should have been repelled by it.”

Or perhaps it’s why Virgin’s founder, Sir Richard Branson, famously said:

“If you want to be a Millionaire, start with a billion dollars and launch a new airline.”

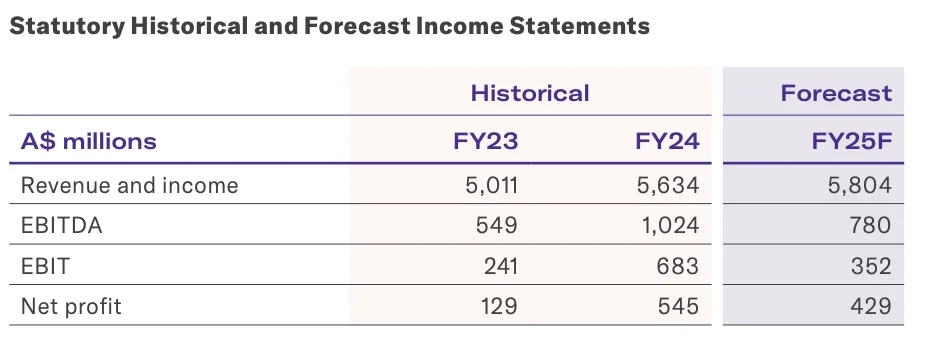

“But… but… but… my good sir,” I hear you say. “Our good friends at private equity heavyweight Bain Capital say Virgin Australia will produce a profit of $430 million this year.”

Hmm… okay.

Maybe I’m wrong about all of this?

Maybe buying shares in a second-tier airline that has more debt instruments than cash, doesn’t own most of its planes once the debt is accounted for (but incurs $900m a year in maintenance and related costs), competes against state-sponsored international airlines as well as Qantas Airways Ltd (ASX: QAN), hasn’t created value for shareholders over 20+ years, can’t control its fuel costs, pays airports a brutal toll just for landing and parking the planes… and operates in a competitively priced industry… is a good idea.

At least we don’t have to compete with the prime minister for tasty snacks in the Virgin Australia lounge – he’s got the Chairman’s Lounge for that.

And maybe one of the most highly regarded, highest paid private equity funds with all of the key financial information was able to stage the ASX’s most dramatic turnaround in years and now wants us to share in the marvel that is Virgin?

And maybe IPO-ing the company with a limited supply of shares available isn’t just a play to get Vanguard, SDPR, iShares and the other index fund hippies to pump the stock price?

Maybe I’ve got this all wrong.

Paint the town Virgin red

I mean, sure.

You could buy any one of the other 2,000+ shares on the ASX.

Or the 400+ ETFs.

Or the 10,000 stocks & ETFs overseas.

Or a fast-growing technology share, with a little spice and a tailwind, like Energy One Ltd (ASX: EOL).

Or a company like Macquarie Group Ltd (ASX: MQG), Wesfarmers Ltd (ASX: WES) or Washington H. Soul Pattinson & Co. Ltd (ASX: SOL) which have been pushing higher profits and dividends since before I was born.

Or even an amazing index fund like Vanguard Australia Shares Index ETF (ASX: VAS)…

But c’mon. This is Virgin we’re talking about!

After all, who wants to make a good investment decision when you can just buy Virgin shares, right?

Virgin: buy, hold, sell?

When I was starting out in my career as an analyst my mentor said to me, “I’m convinced the best returns come from the investments we don’t make rather than those that we do.”

To quote Buffett one more time, ‘Rule #1 is don’t lose money. Rule #2 is don’t forget rule #1‘.

I’m a very happy Virgin flyer. I like the airline, especially Velocity – its best business unit. But I doubt the company’s share price and profits will be able to defy gravity as often as its prospectus forecast might suggest.

I would avoid Virgin shares and instead focus on much more reliable and predictable opportunities in ASX small caps, mid-cap compounders, ETFs and stable blue chips.