Energy One Ltd (ASX: EOL) is quietly enabling the energy transition through software, with 90% recurring revenue and global ambitions.

The energy transition is well underway, and key ASX energy software stocks have exposure.

Energy One share price

Maybe you’re in denial of the changes, or afraid of Montgomery Burns executing his scheme to block out the sun.

Regardless, one entity at the forefront is Energy One, an Australian company with a market capitalisation of ~$450 million.

Who is Energy One (ASX: EOL)?

Each day, when the sun beams down on a solar panel or a gust of wind fires up a turbine, energy surges toward the grid.

Behind this silent process, a complex system of bids, trades, and asset balances is orchestrated across borders worldwide, then balanced in real-time.

This is Energy One’s domain.

While renewable infrastructure grabs the headlines, Energy One operates the digital control room, utilising software and services that allow energy producers, traders and retailers to navigate the wholesale energy market and trade physical energy.

EOL’s mission? To be a one-stop shop for wholesale energy participants.

This behind-the-scenes energy operator has evolved from an energy retailer to become a global energy software provider, delivering mission-critical services.

Energy One’s products are generally sold through subscriptions or licenses, often accompanied by managed services.

Customers access Energy One’s software through cloud platforms, generating recurring hosting and license fees.

Energy One also earns from on-premise installations for larger businesses. 90% of revenue comes from multi-year software subscriptions and managed service contracts. The company has expanded beyond Australia, where it holds an estimated 50% market share, to establish a global presence.

Energy One’s product stickiness and cross-selling ability are evident in its net revenue retention (NRR) rate (~104% in 1H’25). The NRR tells you, how much revenue is retained per customer, each year. In this case, the average customer will pay 4% more this year than last year.

By building on existing relationships, customers are expanding their spending, even if the company increases prices.

Energy One (ASX: EOL): Combining software & managed services

A typical software business generates sky-high gross profit margins of 80% or more. Energy One isn’t your typical software business.

Its blended software and managed services business dilutes group gross margins to around 63%.

Why?

Running the managed services business requires people power, which, while dilutive, adds to the appeal. Energy One’s intimate involvement in clients’ operations (sometimes literally running them) makes it more than a vendor—more like a partner, further raising switching barriers on its mission-critical software.

EOL risks, a cyberattack and board tension

2023 was a busy year.

Energy One weathered a cyberattack that breached corporate systems, but ultimately, according to the company, no customer-facing operations were impacted. It was business as usual, but it highlighted the risks of companies those with significant access to data.

When it rains, it pours.

US-based private equity firm Symphony Technology Group (STG) lobbed its bid for Energy One with a $5.85 offer, later revised down to $5.15.

The original offer sparked a storm within the boardroom, with founder and now-former director Vaughan Busby resigning in protest. With the share price now over $14, holders are undoubtedly pumped that it fell through.

Who is Energy One (ASX: EOL) up against?

Energy One’s comprehensive suite has made it the premier domestic supplier, with an estimated 50% market share.

The balance of the market is served either by in-house systems at large retailers (e.g., AGL’s proprietary trading desk tools) or smaller local vendors.

Globally, the primary direct software competitors are the large commodity and energy trading software suites offered by multinational firms. Public and Private companies, including Ion Group, SunGard, Brady PLC, Volue ASA (OSE: VOLUE) and PSI Software AG (XETR : PSAN).

Energy One First Half 2025 Presentation

Energy One management

Energy One CEO Shaun Ankers has led the business since 2010, overseeing its transformation from a domestic software provider to a global energy tech player.

Executive incentives are aligned with performance-based bonuses. Collectively, according to the 2024 financial accounts, key management holds 8.9 million shares, which account for approximately 29% of the shares outstanding. This level of insider ownership is notable and reinforces the long-term alignment with shareholders.

Energy One (ASX: EOL) financial performance

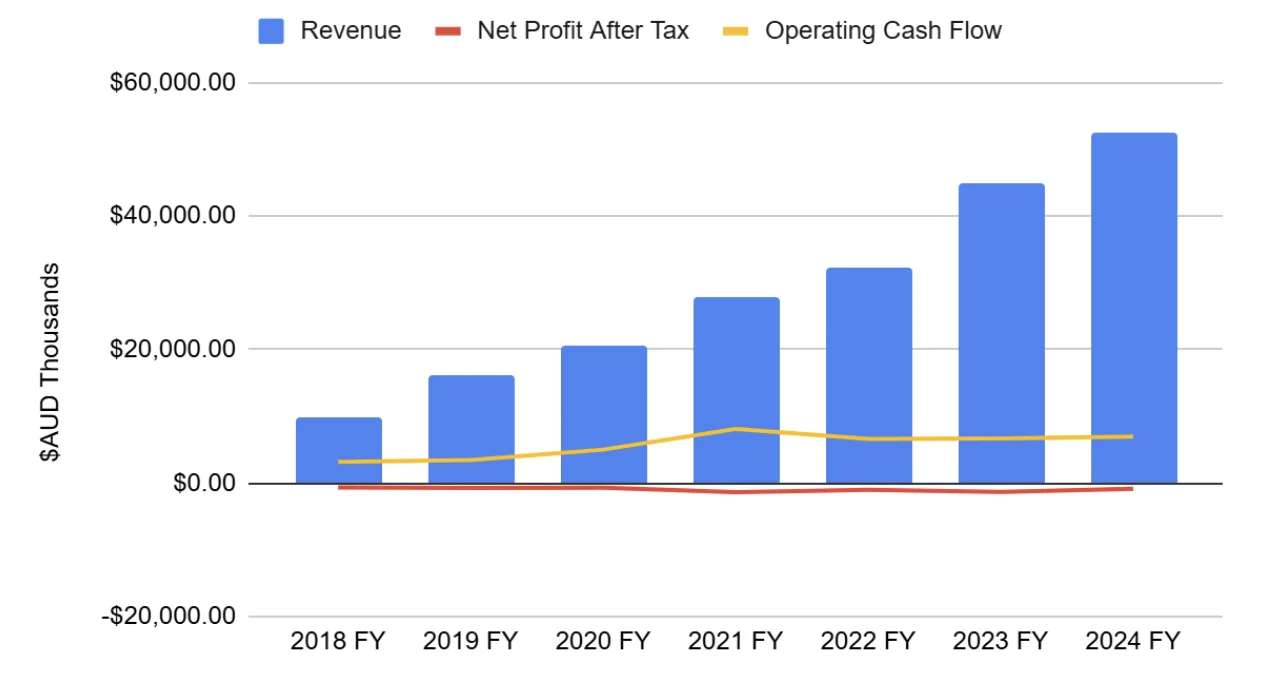

Historically, Energy One achieved an impressive 20% compound annual revenue growth from FY2020 to FY2024, driven by a combination of organic growth and acquisitions.

Management has stated that it is focused on organic growth, targeting 15%-20% annual recurring revenue (ARR) growth over the medium term.

Operating leverage is a thing of beauty.

Energy One exemplified this in the first half of 2025. Revenue grew by $3 million (14%), but operating costs remained the same, with the $3 million making its way down the P&L, resulting in an 800% increase in profit before tax.

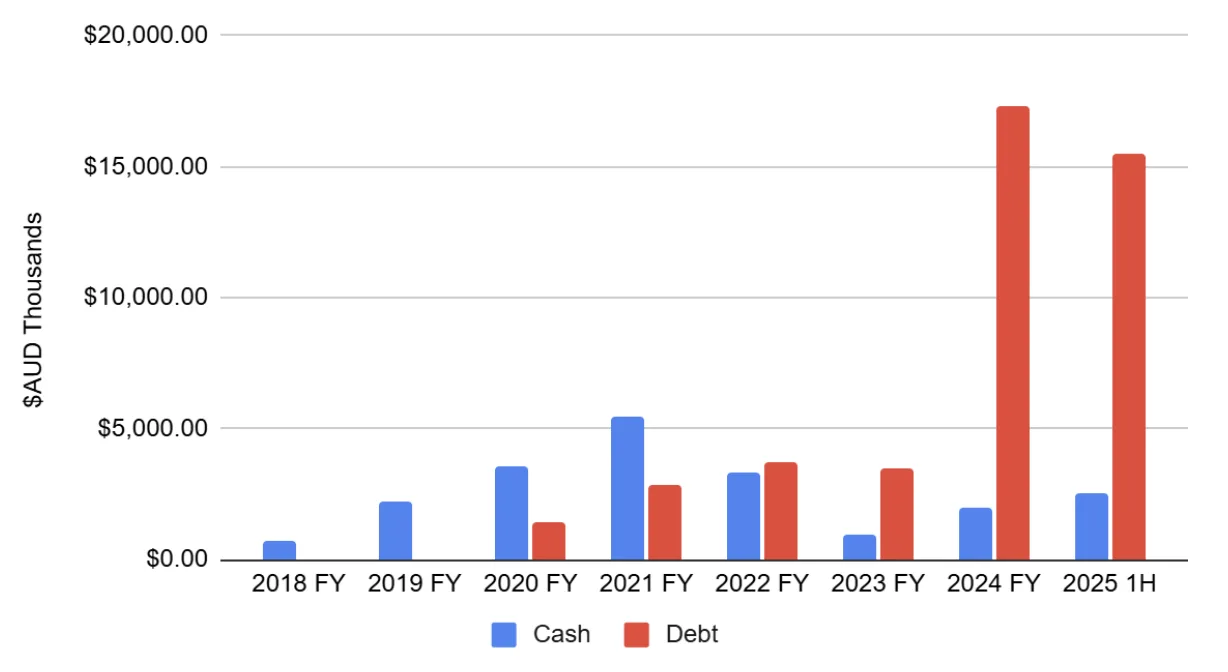

The balance sheet is a little more precarious.

As of 31 December 2024, the Company had $15.5 million in debt, compared to a cash position of $2.5 million. The concern was reflected in the share price a few years back, organic revenue was growing slowly, and debt was even higher.

Energy One has since achieved improved organic growth and successfully integrated acquisitions. The increased operating cash flow is being used to pay down debt, and shareholders have been rewarded, with the share price of $14.50 today compared to $2.80 just two years ago.

Continuous research and development (R&D) is vital to remaining competitive. Energy One prioritises R&D, investing about 10% of its revenue.

Raskals should monitor this. Capitalised R&D can inflate reported earnings, such as EBITDA (or bullsh*t earnings, as Charlie Munger famously said). But it may not reflect actual cash performance.

Is Energy One (ASX: EOL) overvalued?

There’s a lot of optimism (and lack of liquidity) baked into the current Energy One price.

Doubling first-half earnings to assume a $5m profit (which is a little crude) with a market cap of $450 million results in a PE multiple of ~90x.

While PE isn’t an ideal valuation tool for growing companies like EOL, with high operating leverage, it highlights the pressure to execute the growth story. You may need to forecast further into the future to get an estimate of what profit could look like and the kind of multiple it may be priced at if achieved.

To conclude, I think Energy One is absolutely an ASX company worth adding to your watch-list and initiating your own research. It ticks more of the boxes for a future multi-bagger being high recurring revenue, operating leverage, global expansion and high insider ownership.

What do you think? Ask me questions in the free Rask investor community.