US markets were closed overnight for a public holiday, meanwhile the world continues to wait on Trump’s decision to launch strikes on Iran.

As tensions have escalated the biggest movement has been in an increasing oil price. Overnight Brent oil was up 2.5% to $US78.63 a barrel. In the last month this has risen from approximately $67 a barrel.

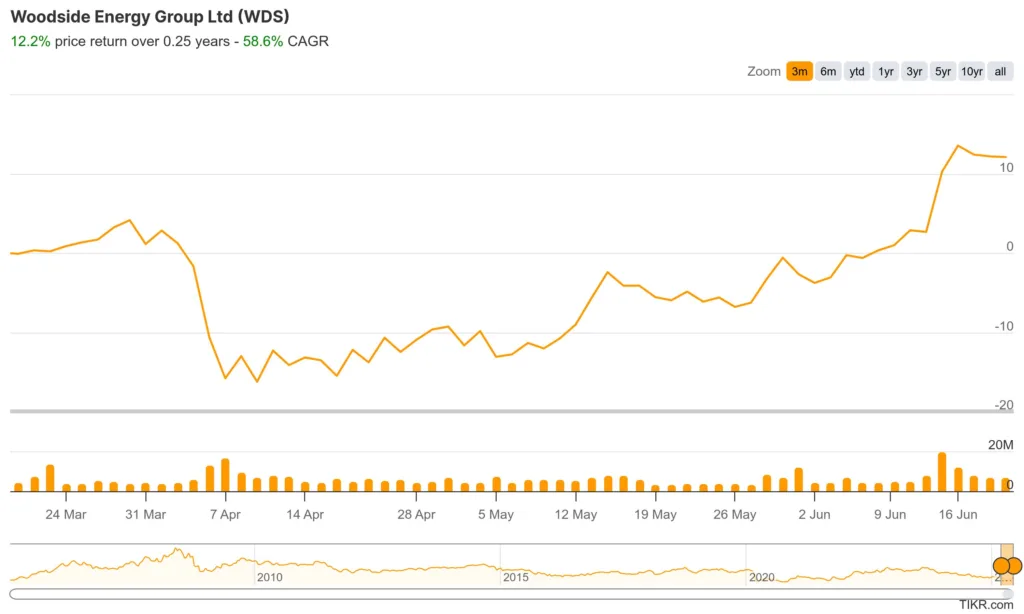

In the last month oil and gas company, Woodside Energy Group Limited (ASX: WDS) has increased just over 19% and Karoon Energy Ltd (ASX: KAR) is up over 26%. Horizon Oil Limited (ASX: HZN) and Beach Energy Ltd (ASX: BPT) are up modestly. We’ll keep an eye on this as the situation unfolds. Woodside is the twelfth largest position in the Vanguard Australian Shares ETF (ASX: VAS) which is our chosen ETF for passive Australian shares exposure.

- S&P 500 = Closed

- Nasdaq = Closed

- Aussie dollar down 0.8% to 64.56 US cents

- Iron up 0.5% to $92.90 US a tonne

Great podcast and competitive advantages

I have listened to this podcast with British hedge fund manager Chris Hohn twice now. I’m also not ashamed to say I have used the opening question, “what makes a good investment” in my recordings as well.

What a fantastically simple, open ended question to ask the right guest.

I recall listening to Andrew Denton talk about preparing for guests on his show, Enough Rope. Him and his team of researches would prepare around 200 questions for each guest and Andrew said he’d hope to only need one. In what we do, the above is a good one.

Hohn’s answer? Competitive advantage and price.

Yesterday I had the privilege of interviewing Tim Carleton from Auscap Asset Management. It was a great episode and I’ll get the producers to put it on the fast track. I put the above question to him and his answer was very similar to Hohn’s. In the podcast we talked a lot about competitive advantage, moats and whether or not they were increasing or decreasing.

Tim used a lot of company examples and there were a number of highlights but two towards the end of our chat really stood out.

Knowing your circle of competence

Tim guest lectures at Sydney Uni on portfolio management. One of the first exercises he gets the students to do is to rank different business types by how familiar they are with them to least familiar. Inevitably discretionary retail, supermarkets, social media platforms and businesses close family are involved in rank at the top.

The next part of the exercise is to get your current portfolio and see where your investments rank on this familiarity scale. Inevitably the students portfolios will clump towards the complex.

This is a great exercise to do, and if you have time on the weekend, give it a go. What I appreciated about the way Tim put it, is we have all heard and used the Buffett quote about investing in your circle of competence, but how many of us abide by it or have taken the time to actually draw it?

Unknown unknowns

The second thing I took away from Tim was why people often didn’t invest in the things they were most familiar with. It was because they could articulate the risks.

“Hey, why don’t you invest in JB Hifi? You go there all the time.”

“Well, you see I can get most of it online, Amazon will most likely crush them, people work from home 50% of the time now so foot traffic in the city is lower so fewer people will walk past and in the stores….”

“So tell me, how does that gold mine you own work?”

“…¯_(ツ)_/¯…”

I had never thought of it this way before. Because we are close to something we can articulate all of the risks, what a lot of people fail to do is then take it a step further and assess and analyse those risks. If they did, they may become a lot more comfortable with them and invest.