The Xero Ltd (ASX: XRO) share price has been on a tear recently.

Xero share price in focus

Xero is a world-leading cloud-based accounting software platform for small-to-medium businesses. Xero allows business owners and their advisers to access real-time financial data anywhere, anytime, and on any device.

For example, Xero’s platform allows accountants and bookkeepers to collaborate with their small business clients on a single, up-to-date general ledger and manage their finances, including invoicing, payroll, tax compliance, cash flow, etc.

Before Xero’s cloud software, accountants and bookkeepers relied on desktop programs and data backup downloads to prepare financial reports and analyse business performance. This was an incredibly clunky process that often led to out-of-date data.

Imagine having to manually keep a record of every tap-and-go, Bpay, transfer, online purchase and salary payments. Then imagine that multipled by 10 – which is what business bank accounts are doing. Xero automates every single piece of this – allowing your accountant to spend their time strategising with you rather than asking for receipts from three months ago. This transformation is an incredible unlocker for the millions of business owners and their advisers using Xero.

Xero’s rising ARPU: Doing More With Every Subscriber

Xero uses a subscription-based model and offers monthly plans at varying levels depending on the client’s (business owner’s) needs.

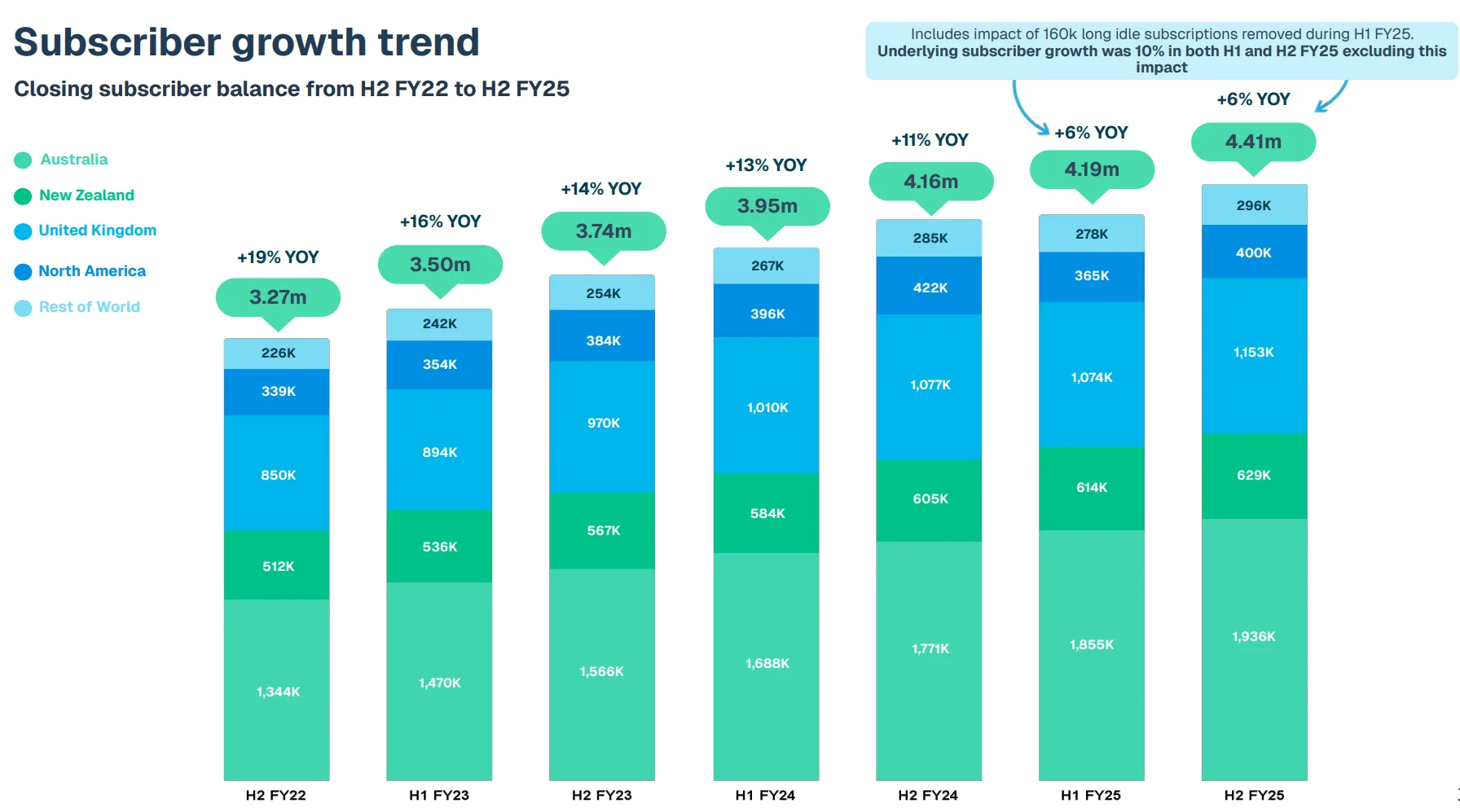

Xero has long had strong subscriber growth. Recently, Xero has shifted its focus to generating more from each subscriber – which is a sign that the rapid subscriber growth could be slowing.

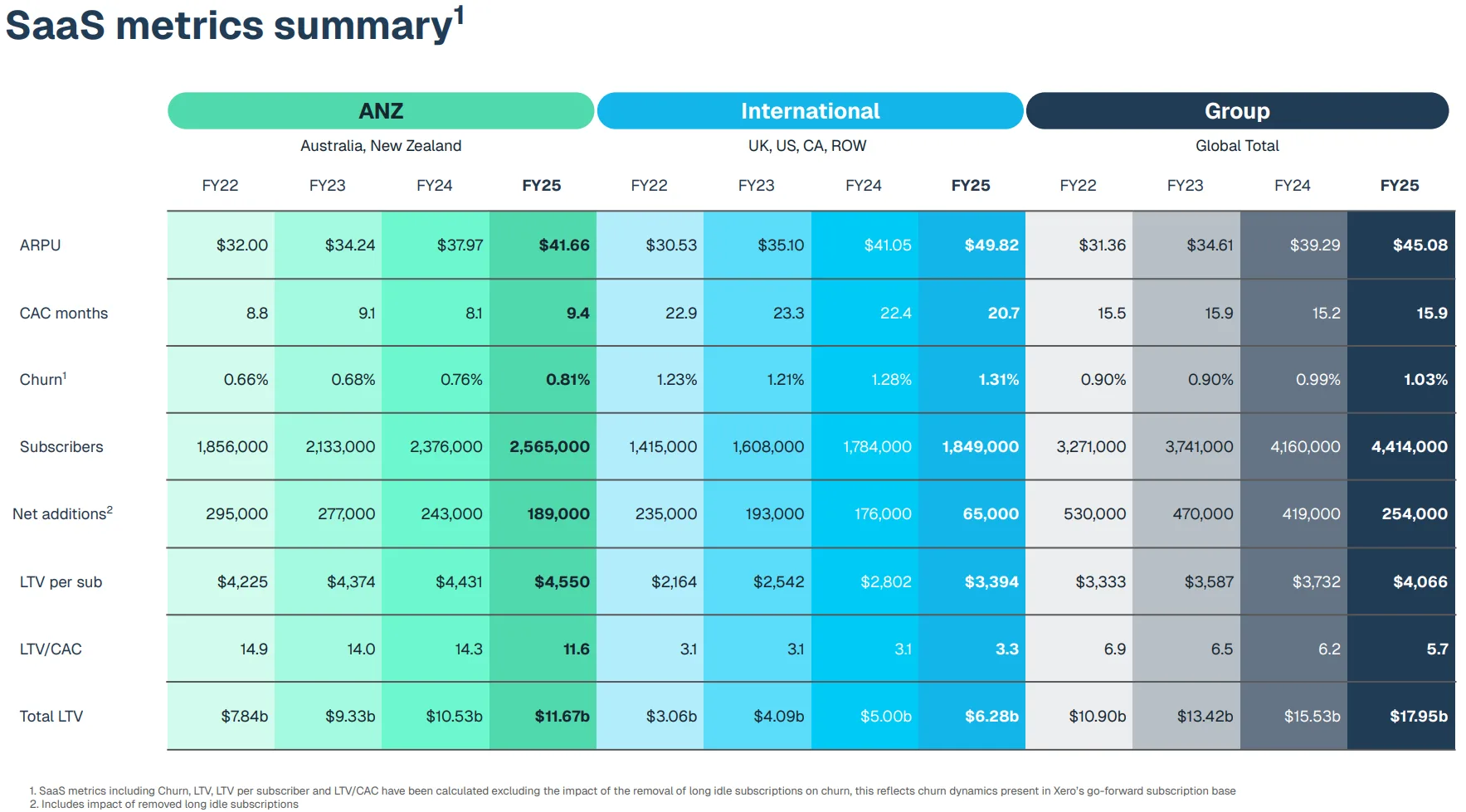

Indeed, this has resulted in slowing subscriber growth of late, but in turn a much higher growth in Average Revenue Per User (ARPU) – ARPU tells you how much money a customer pays Xero per year, on average.

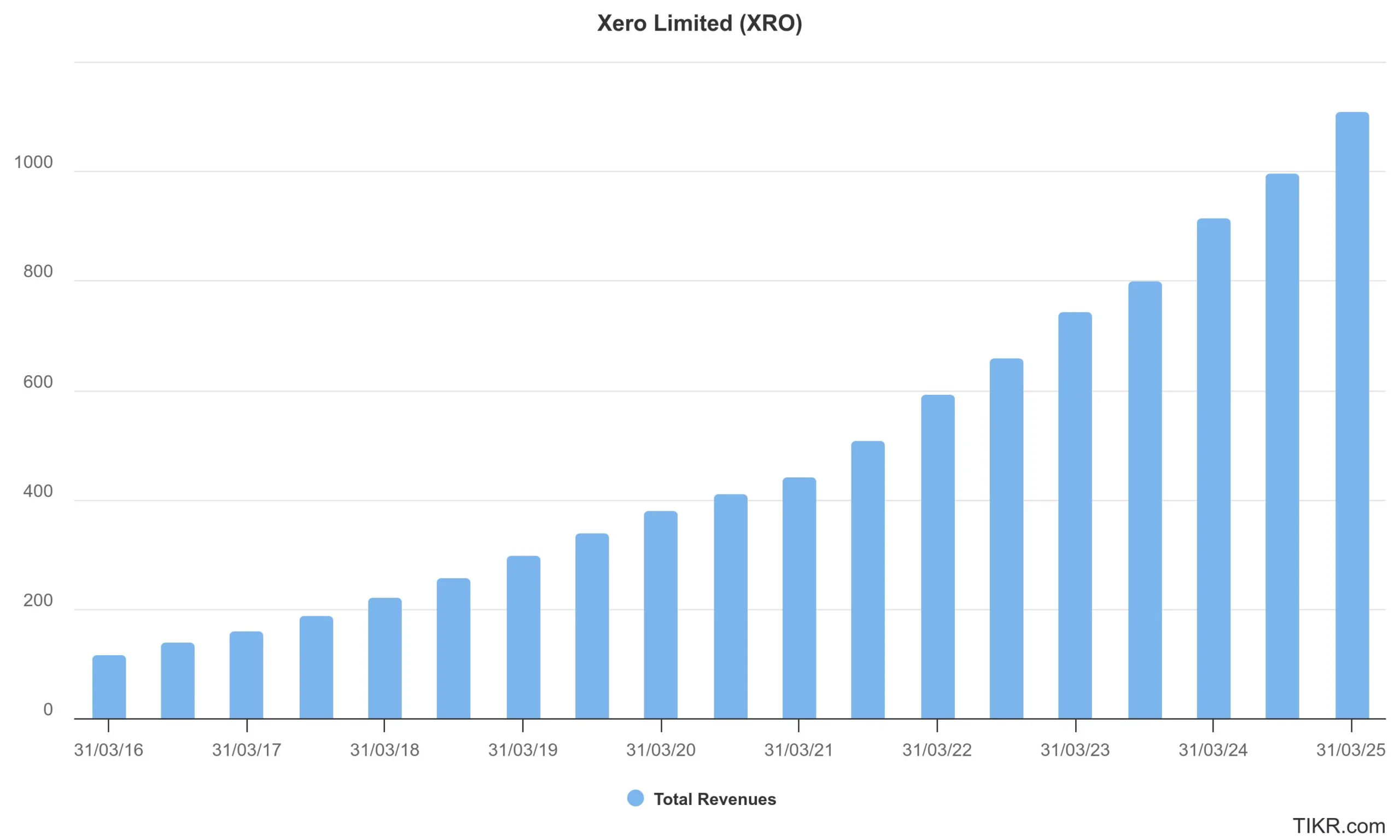

A higher ARPU, albeit with lower subscriber growth, and a stable churn rate, have powered higher revenues, as shown below (I’ve used half yearly revenue to illustrate consistency).

Under new management, the Company’s focus is maximising its current user base while looking to grow APRU, cut costs, and even flirt with the idea of paying dividends in the future.

Mission‑Critical Software With Near‑Zero Churn

The growing ARPU and stable churn support the stickiness of Xero’s software.

Xero becomes so ingrained within small businesses that it’s difficult for owners to see life without it. This was exemplified during the pandemic. With COVID-19 stimulus packages linked to performance, businesses needed live, up-to-date information, which Xero provided. It’s also a helluva pain to switch, both in cost and time spent.

It has also become a part of how accounting firms operate, dialling up advisors’ efficiency by integrating the data into end product financials and tax returns, streamlining tax time reporting and compliance. Having clients on Xero can create a network effect, with greater scale and reduced costs.

If you’re going to track anything, below is an excellent table the company provides to follow its key numbers, you can also brush up on our guide to SaaS valuations:

Xero’s sticky economics: 89 % gross margins & pricing power

If growing ARPU wasn’t enough, Xero’s ability to maintain a gross margin of 89% plus proves how sticky the software is.

Producing such a high margin suggests that the company has been able to defend its market position while maintaining pricing power. The recent jump in subscription prices has had little impact on the low level of churn. Even as operating your accounting software costs inches up, changing software and learning a new program would have business owners tearing their hair out.

Why the Xero (ASX: XRO) share price could pull back (in the short term)

With the mature ANZ market, global growth has always been a target for Xero.

While not without its challenges, it has seen improvement in the UK and Rest Of World markets. The problem child for Xero has been the US. The States is dominated by rival QuickBooks-owner, Intuit Inc (NASDAQ: INTU), and is fragmented from a tax compliance point of view, with each state under differing law.

Xero announced a change in strategy in its half-year report for 2024 with a more streamlined approach. If it can tap this market, there’s a tremendous growth opportunity, with the region lagging in cloud accounting. It could also be a cash oven, so keep a close eye on it.

Valuation can be a knock on Xero, which is difficult to deny.

Xero delivered a net profit of NZ$227 million, an increase of 30% on the prior year. Equating to a diluted earnings per share of $1.47, increasing 29% on the preceding period. With an ever increasing share price threatening record highs at ~$190, it implies a price-to-earnings ratio of 129 times!

While applying a price-to-earnings ratio to Xero hasn’t always been possible, given the growth still available to the Company, it may be better to consider a price-to-sales metric as a comparative, particularly to prior years. Total operating revenue for 2025 landed at $2.1 billion, on a market capitalisation of $29 billion, which implies a 14x sales multiple. Its 5-year average has been around 18x. It is never cheap, but high-quality software companies on the ASX rarely are!

Xero is constantly pressured to execute at these lofty valuations. As a business, Xero ticks plenty of boxes that make most SaaS companies envious.

As an investor in the BetaShares Australian Technology ETF (ASX: ATEC) via Rask Invest (see full Saturn portfolio), we get around 10% exposure to one of the world-leading technology companies – without the fuss of individual stock picking. I think you’ll agree – that sounds pretty good.