Here are 5 questions to ask your financial adviser – part 3!

Hello again my advice seeking Raskles 👋

Today, we’re covering off the third and final part of my blog series on “questions to ask your financial adviser”.

In this instalment, we’re going to talk about the 5 most critical questions to ask your adviser when you are 6 months into your partnership.

If you haven’t already read my other blog updates, I highly recommend starting there (the links open in a new tab):

- 5 questions to ask the adviser before signing up for financial advice

- 5 questions to ask when you receive your financial plan / statement of advice

(Otherwise, this might have you feeling like a barista without the coffee beans – ready to go, but with nowhere to start.)

5 questions to ask your adviser, 6 months in

I’m assuming you have read my other articles, so let’s move on…

You’ve now met with an adviser, received your “Statement of Advice” (financial plan) and have implemented, or at least started to implement the plan. At this stage, the right questions can help you extract maximum value out of your adviser.

Now, I’ll let you in on a secret here. Part 1 and 2 of this series were a breeze to write. Part 3? Not so much.

I spent a while thinking about the best lens to frame these questions – something that would offer real, lasting value.

Where I started was this: what do I believe is the single greatest value that an adviser brings to their client?

Education and behavioural coaching.

These two things create lasting value. Powerful habits and knowledge for decades to come.

So, these next five questions have been crafted with that focus in mind.

Questions one to three focus on extracting information that’s hyper-relevant to you: insights that are clear, actionable and actually makes sense (because eventually the goal is to be able to navigate things, adviser-free).

Questions four and five shift the focus to mindset and behaviour: helping you refine your decision making process for long-term success

Question 1: What adjustments, if any, do you recommend based on our progress and market conditions and why or why not?

This question allows you to dig a little deeper with your adviser, and understand the logic behind their previous recommendations. Now, generally speaking, unless there’s been major changes to your personal circumstances, there really shouldn’t be a need to overhaul your strategy just six months in.

So why ask this question?

Gauge the adviser’s conviction: it’s an opportunity to sense how confident your adviser is in the strategy they’ve put in place. A solid plan should be built to endure, not just react.

Understand your own biases: it also serves as a subtle opportunity for your adviser to coach you, the client, on your own behavioural biases that may impact decision making.

Wait – behavioural biases in money? What on earth am I rambling on about here? This is finance, not psychology…

I’ve found that our decisions around money are often influenced more by psychology than logic. These biases can heavily impact our long-term success (or otherwise) with investing. To quote the Psychology of Money guru himself, Mr Morgan Housel:

“Doing well with money has little to do with how smart you are and a lot to do with how you behave.”

Asking your adviser about the strategy is not just about understanding their perspective – it’s about understanding your own.

Question 2: What’s the one thing I should be paying more attention to right now to make sure my financial plan stays solid long-term?

This one also serves a dual purpose.

Firstly, and more obviously, it probes your adviser to be a little more proactive in their focus, and inform you of the key indicators of your performance, so you can keep tabs after you step out of their office. Or after you close your laptop, because, let’s face it, you’d rather eat burnt toast than commute into the city for a meeting in an office full of navy suits.

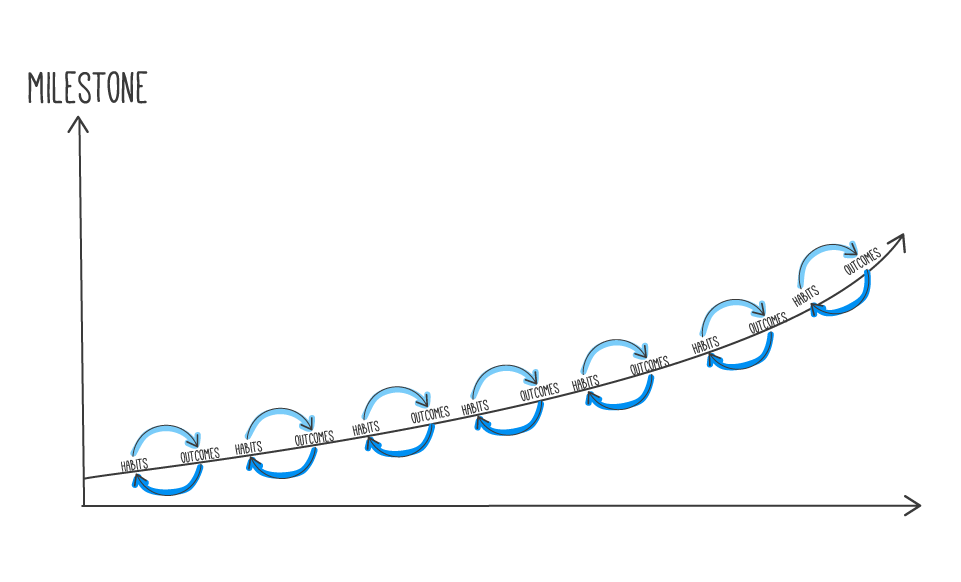

The second, and more subtle intention, is to reinforce the stability/resilience of your financial plan. If you’re working with a sound adviser, your entire future financial position shouldn’t be derailed by a small blip in the road. Really, a strong long term plan is reliant on consistent habits and behavioural choices, we apply day in day out, to ensure our own adherence, despite what happens on the market.

Question 3: What steps can I take to enhance my financial literacy, and how can you help me become more self-sufficient in making informed financial decisions in the future?

When it comes to money, and our broader sense of financial security, knowledge really is the most powerful factor. The more you understand the “why” behind each decision, the more confident you’ll be when it comes time to make them yourself. Your adviser isn’t just there to manage your money – they should be helping you understand it.

Ask your adviser what resources they recommend (or provide) for building financial literacy. This might include the top money books, online finance courses, or even webinars they run themselves. The idea is to chip away at the mystery that is 🔮f i n a n c e🔮 so you’re not just nodding along in meetings. You’re actually understanding the strategy, and could explain it back if someone asked you.

The ultimate goal? You become more self-sufficient and capable of making informed decisions with or without an adviser by your side!

Question 4: How can I improve my approach to managing financial stress or emotions when the market fluctuates, so I can stick to my plan with confidence?

Ever heard of Vanguard’s “Adviser Alpha” study?

(It’s okay – most people haven’t.)

Essentially, it was a study conducted by Vanguard that suggests the most valuable thing an adviser can do for you isn’t picking the right stocks – it’s coaching you through the emotional rollercoaster of investing.

(For the number’s people: Vanguard found that the more complex the tax and financial system, and the more experience of the adviser in that market, the more value that gets added – it adds up to 3% or more per year!)

When markets take a nosedive, it’s human nature to want to pull out, to ‘cut our losses’ and run for the hills.

But that’s the kind of behaviour that hurts big time in the long run. During the recent market pull-back, over 40,000 people tuned in to our live investor update on audio and video. One retiree said ‘I was about to change my Super to all cash, but after watching this I feel much more confident to stay the course.’

This question encourages your adviser to help build your resilience and understand the long-term view, so the next time the market inevitably gets wobbly, you’re not scrambling for the ‘sell’ button.

If your adviser is good, they’ll not only talk you through it, but help you recognise those emotional triggers before they even happen.

Question 5: What are the little habits I can start today that will set me up for a more financially confident tomorrow?

Big financial wins are often the result of tiny habits repeated over time. This question is about drilling into those habits and finding out where you can improve.

Maybe it’s automating your savings, setting aside 10 minutes a week to review your budget, or learning to read a company balance sheet so you can feel more confident in the resilience of the companies your portfolio holds.

Your adviser should be able to give you practical, bite-sized steps to build better money habits. Because let’s be real, financial confidence isn’t just about having a plan – it’s about knowing you’ve got the personal toolkit and habits to back it up.

Wrapping up

These five questions aim to optimise your adviser relationship. I’d bet, your adviser will enjoy the conversations more when you ask these questions.

So don’t be afraid to use them to deepen your understanding of your financial plan, strengthen your financial literacy, and build resilience against market fluctuations—all while tuning out the noise from media, friends, and colleagues.

Go forth and conquer!

Ready for advice? Book a call with our team now to get your finances sorted and let’s build a plan 💥