Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.51% to 7,819.60.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

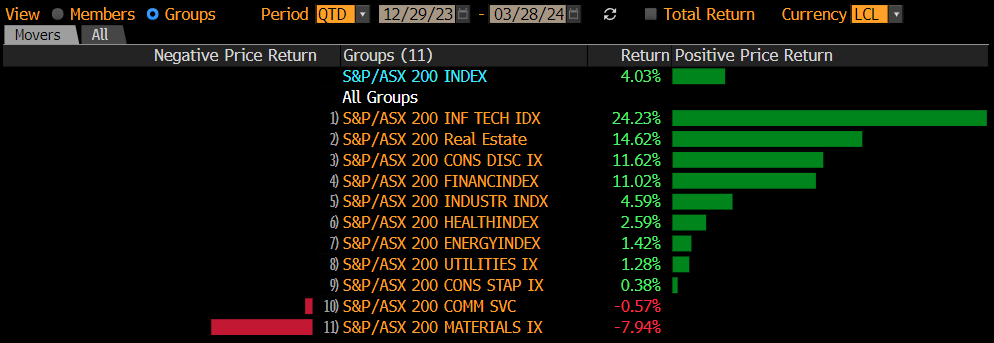

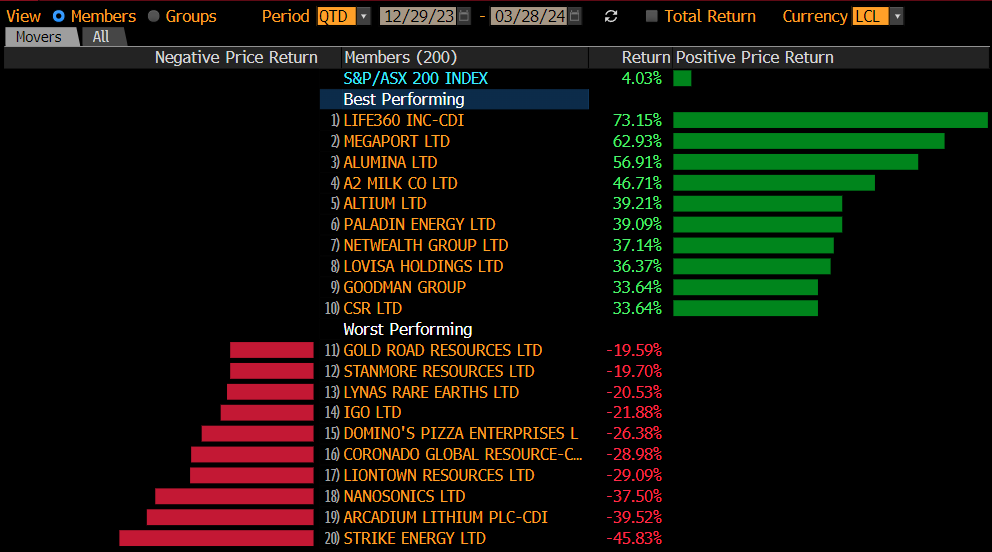

A bullish session to end a positive quarter for equities with the market rallying ~3% in the last month, propelling the ASX200 to fresh all-time highs. Have a wonderful Easter break with family and friends.

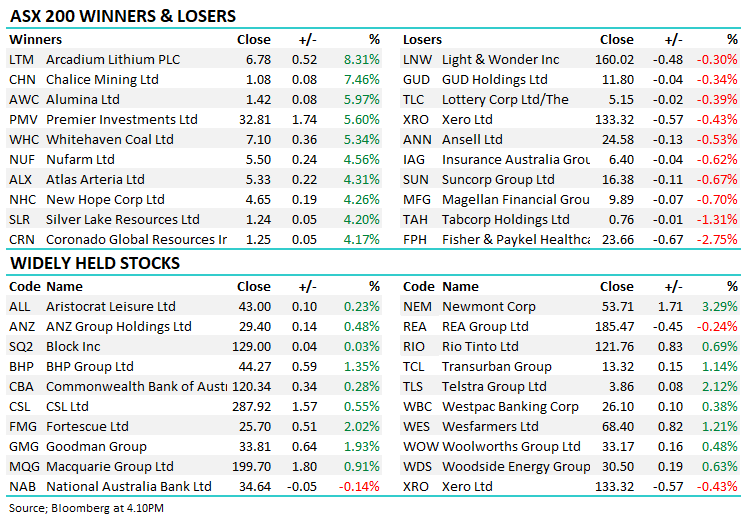

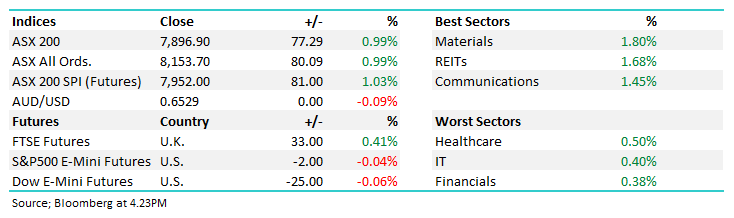

- The ASX 200 added +77pts/ +0.99% to 7896.

- Materials (+1.8%), Property (+1.68%) and Communications (+1.45%) the shining lights.

- Financials (+0.38%), IT (+0.4%) & Healthcare (+0.50%) were up, but lagged the broader rally.

- Lithium stocks rallied after Albemarle Corporation (NYSE: ALB) in the US said they sold spodumene for $1298/dmt in an auction, about two weeks earlier, Pilbara Minerals Ltd (ASX: PLS) received $1200/dmt implying the market for Lithium is becoming more constructive for the producers.

- Fisher & Paykel Healthcare Corporatn Ltd (ASX: FPH) -2.75% slipped on a recall of their breathing support system. The issue only impacts devices made before 2017 and will result in a ~$12 m impact for FY24, less than 5% of recent guidance.

- Audinate Group Ltd (ASX: AD8) -2.15% Chairman sold a few shares, taking some off the table after a strong run. We don’t see this as a huge negative, shares have softened after the stock entered the ASX200 index.

- Hotel Property Investments Ltd (ASX: HPI) +3.36% saw Charter Hall Group (ASX: CHC) take a ~15% stake in the business, ought of 360 Capital Group Ltd (ASX: TGP). First glance this looks a positive for all parties.

- Beach Energy Ltd (ASX: BPT) +3.67% rallied on plans to axe 30% of staff as part of a restructuring. BPT is looking interesting again.

- Iron Ore was flat lower today, however the miners enjoyed the markets bullish vibe, Fortescue Ltd (ASX: FMG) +2.02%, BHP Group Ltd (ASX: BHP) +1.35% and Rio Tinto Ltd (ASX: RIO) +0.69%

- Stocks in Asia were mixed, Hong Kong down -3%, Chinese equities dipped -1.4%, while Japan added +0.25%.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Sectors this quarter – Source Bloomberg

Stocks this quarter – Source Blomberg

Broker Moves

- IGO Ltd (ASX: IGO) Cut to Underweight at Morgan Stanley (NYSE: MS); PT A$5.95

- Alumina Ltd (ASX: AWC) Cut to Equal-Weight at Morgan Stanley; PT A$1.30

- 29Metals Ltd (ASX: 29M) Cut to Underweight at Jarden Securities

- Platinum Asset Management Ltd (ASX: PTM) Raised to Buy at Bell Potter; PT A$1.20

- Infomedia Limited (ASX: IFM) Cut to Hold at Bell Potter; PT A$1.80

Movers & Losers