Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.1% to 7695.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The best of it was seen early on today with a bullish start tapering off throughout the session ahead of the US Federal Reserve’s decision on Interest rates tomorrow morning our time.

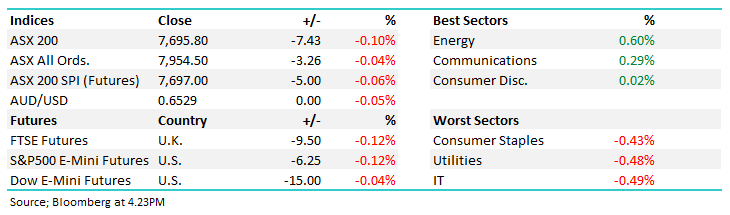

The index fell 45pts from high to low, largely tracking US Futures which were sold off throughout the session.

Energy was one of the few highlights, alongside Telcos which have been choppy of late. Tech was the main drag.

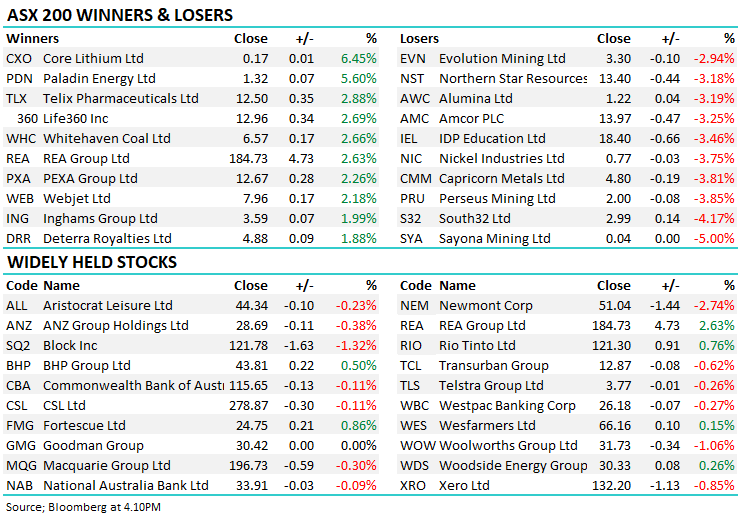

- The ASX 200 finished down -7pts/-0.1% at 7695.

- The Energy sector was best on ground (+0.60%) while Communication Services (+0.29%) and Consumer Discretionary (+0.02%) were the only sectors in the black today.

- Tech (-0.46%), Utilities (-0.48%) and Staples (-0.43%) were the notable detractors.

- Not a lot of conviction either way today with no sector moving up or down by more than ~0.6%.

- Sonic Healthcare Ltd (ASX: SHL) -0.22%little changed on plans to acquire Dr Risch laboratory group for $202m. Not a game changer and SHL are still struggling with cost issues.

- South32 Ltd (ASX: S32) -4.17% fell after withdrawing its manganese output guidance due to bad weather, a cyclone damaging operations at their NT facility.

- Amcor CDI (ASX: AMC) -3.25% was soft after their CEO stepped down for Health reasons, the Chief Commercial Officer taking on the CEO role in the interim.

- Uranium stocks rallied, now that both Cameco Corp (NYSE: CCJ) and Kazatomprom have reported, the sector is getting some clearer air – Paladin Energy Ltd (ASX: PDN) +5.6% & Deep Yellow Limited (ASX: DYL) +6.94%

- Iron Ore was higher in Asia, up another 1.4% building on yesterday’s gains, Iron Ore stocks ticked higher.

- Gold was flat trading at US$2157 at our close.

- Asian stocks were mostly solid, with Hong Kong up +0.2%, Japan +0.66% while Chinese stocks added 0.50%.

- US Futures are down a touch, but nothing significant.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Broker Moves

- Iperionx Ltd (ASX: IPX) Rated New Speculative Buy at Bell Potter; PT A$3.70

- Arafura Rare Earths Ltd (ASX: ARU) Cut to Speculative Hold at Bell Potter

Major Movers Today