Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.36% to 7,703.20.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

While they’re still saying otherwise, the RBA is looking increasingly poised to cut rates in the coming months as inflation comes back into range and labour market pressures ease.

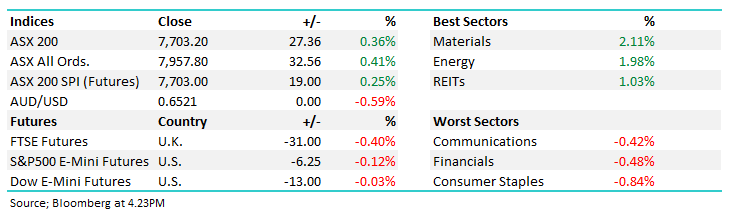

Markets are pre-empting the move, the Aussie Dollar down (65.31c), bond yields down, and equities up as we edge closer to D-Day for Michelle Bullock et al.

However, at a sector level today, Materials & Energy stocks bounced nicely and Iron Ore rallied ~5% in Asia, implying some improving confidence around the outlook for the Middle Kingdom, we’re certainly positioned for it!

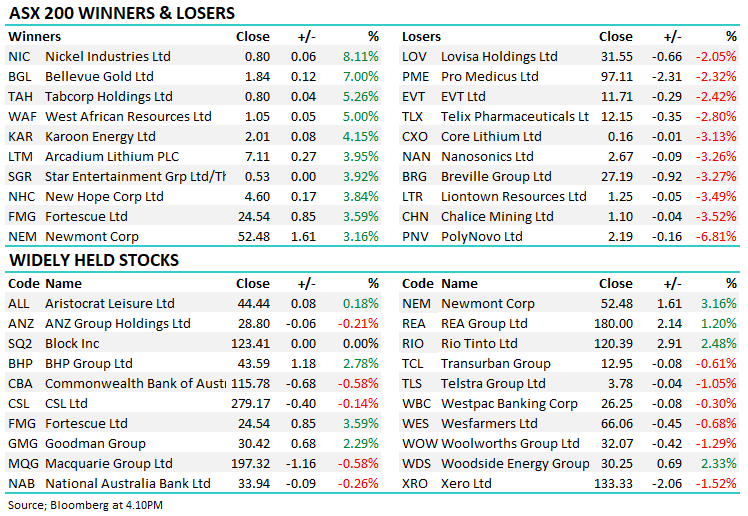

- The ASX 200 added +27pts/ +0.36% to 7703

- Materials (+2.27%) and Energy (+1.91%) the standouts while Property (+1.29%) bounced back from yesterday’s weakness.

- Staples (-0.77%), Healthcare (-0.47%) and Financials (-0.44%) underwhelmed.

- The RBA left rates unchanged as expected at 4.35% – Not a lot of new news, cuts on the way with bond markets pricing as much, Aussie 3’s down 6.5bps to 3.67%.

- The Bank of Japan (TYO: 8301) hiked rates for the first time since 2007 in a momentous shift for one of the world’s largest economies.

- The central bank led by Governor Kazuo Ueda, increased the overnight call rate to a target range between 0.0% to 0.1% from a targeted -0.1%, where it stood for eight years. While the move is subtle, it’s important in terms of the signal it sends.

- New Hope Corporation Ltd (ASX: NHC) +3.84% rallied after it booked 1H24 EBITDA of $424.8m and net profit of $251.7m, while declaring an interim dividend of 17cps fully franked, equating to 5% yield for the half inclusive of franking. We’ll cover the result in more depth tomorrow morning as part of the portfolio positioning report.

- Superloop Ltd (ASX: SLC) +9.36% shares rose after issuing Aussie Broadband Ltd (ASX: ABB) 0.00% with a notice to sell stock (~37.6m shares) to take their stake to below 12% given they had not received approval from the Singaporean regulator when they bought 19.9% of the company, before launching a bid.

- Aussie Broadband is subsequently taking court action to try to stop Superloop forcing it to lower its stake. This is an interesting tussle, particularly given Origin Energy Ltd (ASX: ORG) +0.66% just dumped ABB and appointed SLC as their white-label provider.

- UBS upgraded Iluka Resources Limited (ASX: ILU) +2.39% this morning from sell to hold, calling out a more constructive mineral sands market – we’ve pre-empted this trend, having bought ILU recently.

- Dental clinic operator Pacific Smiles Group Ltd (ASX: PSQ) +11.4% rallied after receiving a revised non-binding proposal from Genesis Capital at $1.75 cash, shares closed $1.66

- KMD Brands Ltd (ASX: KMD) +2.08% rose despite a soft 1H result today for the owner of Kathmandu, though largely pre-released. Sales fell -15%, EBITDA -67% and the company swung into NPAT loss, missing expectations on financing costs. Feb sales were tracking -3.5% on pcp though, an improvement on the 1H run rate.

- Boral Ltd (ASX: BLD) +2.43% rejected the takeover from Seven Group Holdings Ltd (ASX: SVW) at $6.05/sh. An independent expert report suggests fair value is around $6.50-7.13/sh, though SVW already own ~72% of the building products company.

- Gold was flat in Asia, trading at $US2159/oz at our close, Gold stocks rallied.

- Iron Ore was up 5% at $US109.70

- Stocks in Asia were down, Hong Kong -1%, Chinese equities dipped -0.40%, while Japan was flat.

- US Futures are down a touch

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Broker Moves

- Felix Group Holdings Ltd (ASX: FLX) Rated New Speculative Buy at Taylor Collison

- Iluka Raised to Neutral at UBS; PT A$7.50

- Lifestyle Communities Ltd (ASX: LIC) Rated New Buy at Moelis & Co (NYSE: MC); PT A$20

- Baby Bunting Group Ltd (ASX: BBN) Raised to Overweight at Morgan Stanley (NYSE: MS); PT A$2.20

Movers & Losers