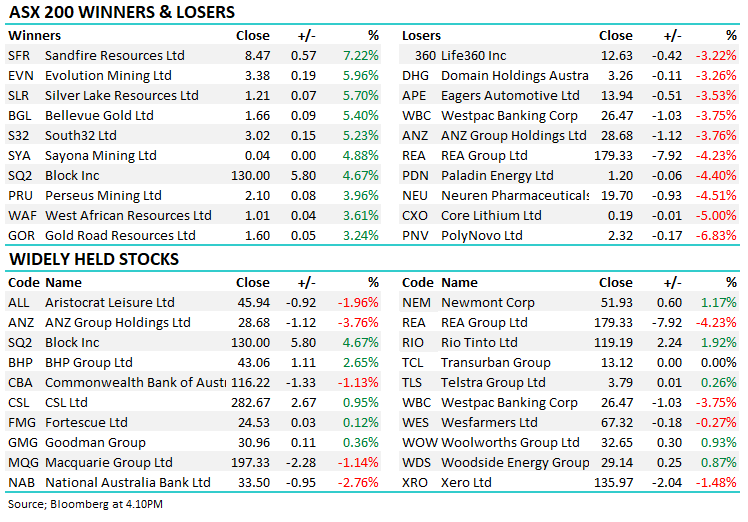

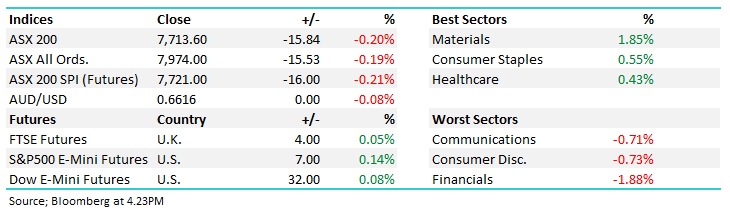

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.20% to 7,713.60.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The local market started higher however it wasn’t long before the pressure coming from the Financials sector took the market into the red for the session. Macquarie Group Ltd (ASX: MQG) moving negative on its Big 4 peers saw the space take ~35pts off the ASX200 today.

The Resources sector did a lot of heavy lifting in an effort to offset the banks, it appears money was rotating through the market today rather than outright selling of the banks.

- The ASX 200 finished down -15pts/-0.20% at 7713.

- The Materials sector was best on ground (+1.85%) while Staples (+0.55%) & Healthcare (++0.43%) also did well against the backdrop of lower equities.

- Financials (-1.88%), Discretionary (-0.73%), Telcos (-0.71%) and Tech (-0.67%) were the key laggards

- The banks copped a beating today, Macquarie cutting their ratings all of the Big 4 to Underweight, including Westpac Banking Corp (ASX: WBC), falling -3.75%, double-downgraded from Overweight. Commonwealth Bank of Australia (ASX: CBA) held up the best, -1.13%, given Macquarie Group Ltd already had it on the equivalent of a sell there, while National Australia Bank Ltd (ASX: NAB) fell -2.76% & ANZ Group Holdings Ltd (ASX: ANZ) -3.76%.

- The analyst saying the banks have re-rated without a fundamental catalyst behind it, the space now trading on expensive multiples relative to history without the stock-specific or economic reasons to back it up.

- Resources found some reprieve though, particularly any exposure to Iron ore, Copper or Gold doing well. BHP Group Ltd (ASX: BHP) +2.65% also copped an upgrade from Citigroup Inc (NYSE: C).

- Uranium was a different story though. Weakness in the space coming ahead of Kazatomprom’s production update tonight. The market is expecting a cut to FY24 guidance, though the risk now looks to the upside given the weakness heading into the update.

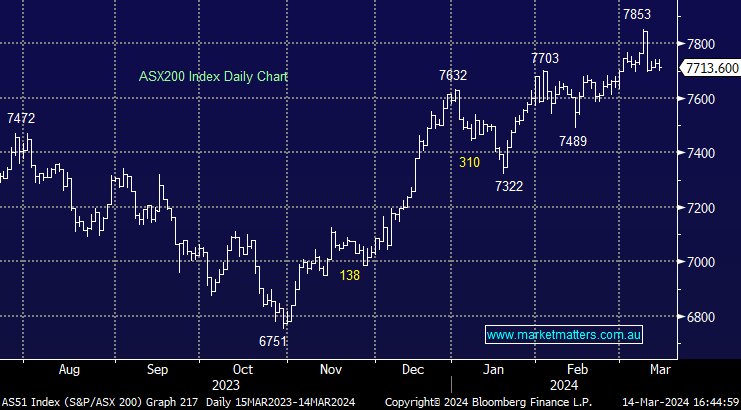

- Aussie Broadband Ltd (ASX: ABB) -18.01% fell after losing the Origin white label contract to Superloop Ltd (ASX: SLC) +24.76%. More on that below.

- Myer Holdings Ltd (ASX: MYR) +7.55% hit 10-month highs on a decent 1H and a strong start to 2H. Ex-Qantas executive will also take the reigns at the retailer. More below.

- Appen Ltd (ASX: APX) -17.1% has seen the bid from Innodata pulled following a breach of confidentiality. Hard to argue with that one.

- Gold was softened marginally, just -US$3/oz, trading at US$2171 at our close.

- Asian stocks were again mixed, though reversing some of the recent moves. The Nikkei 225 (INDEXNIKKEI: NI225) rallied 0.3% today, China is flat & Hong Kong is down -0.75%.

- US Futures are stronger, S&P 500 (INDEXSP: .INX) futures +0.14%, Nasdaq Composite (INDEXNASDAQ: .IXIC) better at +0.30%.

- US retail sales data tonight, expecting a bounce back, alongside Producer Price inflation (PPI) expected to come in at +0.3% for Feb.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Aussie Broadband (ABB) $3.55 / Superloop (SLC) $1.31

ABB -18.01% / SLC +24.76%: opposing outcomes today for the smaller telco companies, Aussie Broadband losing their white label deal with Origin Energy Ltd (ASX: ORG) to Superloop Ltd (ASX: SLC), oddly enough ABB had looked to takeover SLC not too long ago.

130k users will migrate over to Superloop over the next few months, a deal that is expected to earn ABB ~$14m EBITDA over FY24, though new terms offered to Aussie Broadband would have seems margins decline with an estimated $10m EBITDA in the first year once the updated deal was in place.

Superloop look to have given up a lot to get this deal – approx. 19.5m shares issued to Origin over the course of the migration, a further $30m of shares contingent on future milestones as well as an option to buy 55.7m shares at the prevailing market price, Origin could end up with ~25% of SLC if the full outcome is achieved and taken up.

They did upgrade EBITDA expectations for FY24 to the top end of previous guidance while now expecting EBITDA growth of 60-70% in FY25.

ABB was hit hard on the news despite maintaining near-term guidance. SLC look to have given a lot away to land the deal, though this is an opportunity to substantially grow longer term.

Aussie Broadband (ABB)

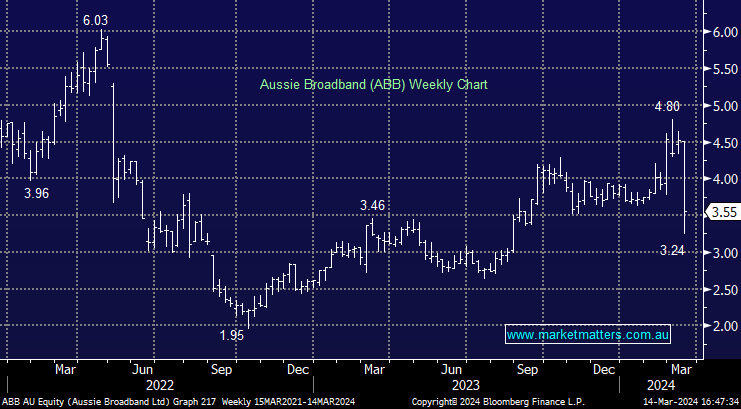

Myer (MYR) 85.5c

MYR +7.55%: the retailer hit 10 month highs today on a strong 1H and growth returning, while some changes at the top were also announced.

First-half sales were up marginally while NPAT dropped to $52m, though this was at the top end of recently provided guidance. Net cashflow improved by $10.7m, however, this was mostly as a result of an inventory reduction.

Myer have also fielded external interest for their investments in apparel brands, Marcs, David Lawrence and sass & bide, appointing advisors to undertake a strategic review. Trading into the 2H has been strong with comparable sales up +4.9%, on track to beat full-year expectations at that run rate.

Ex-Qantas Loyalty business boss Olivia Wirth will take over the Chief Executive & Chairwoman roles at Myer, the dual position a rarity on the ASX, particularly from non-founder-led companies.

Myer (MYR)

Broker Moves

- McMillan Shakespeare Ltd (ASX: MMS) Rated New Buy at Bell Potter; PT A$22.52

- BHP Raised to Buy at Citi; PT A$46

- Fortescue Ltd (ASX: FMG) Raised to Neutral at Citi; PT A$24

- Somnomed Ltd (ASX: SOM) Cut to Market-Weight at Wilsons; PT 45 Australian cents

- Liontown Resources Ltd (ASX: LTR) Raised to Overweight at Wilsons; PT A$1.85

- Lynas Rare Earths Ltd (ASX: LYC) Rated New Underweight at Morgan Stanley (NYSE: MS); PT A$5

- ANZ Group Holdings Ltd Cut to Underperform at Macquarie; PT A$27

- Westpac Cut to Underperform at Macquarie; PT A$26

- NAB Cut to Underperform at Macquarie; PT A$32.50

- Liontown Resources Raised to Neutral at Barrenjoey; PT A$1.35

- Sims Ltd (ASX: SGM) Raised to Buy at Citi; PT A$13.50

Major Movers Today