Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +1.47% to 7,699.40.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The ASX has now put on ~950pts/14% over the course of the last 4 months to hit a new all-time high today at 7703.

This week, more benign inflation, relief on interest rates and an economy that looks and feels like it will navigate a goldilocks-style economic (soft) landing has underpinned a resurgent ASX + other global equity markets, and in the process, rewarding equity investors for staying the course & burying all the negative rhetoric that percolates through the media.

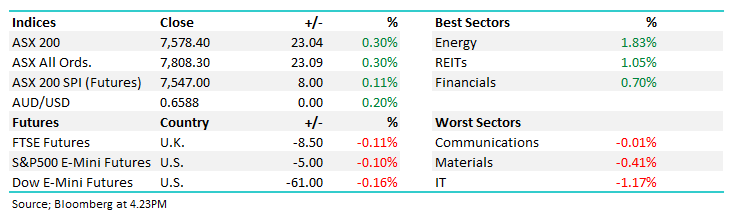

- The ASX 200 finished up an impressive +111pts/ +1.47% to 7699

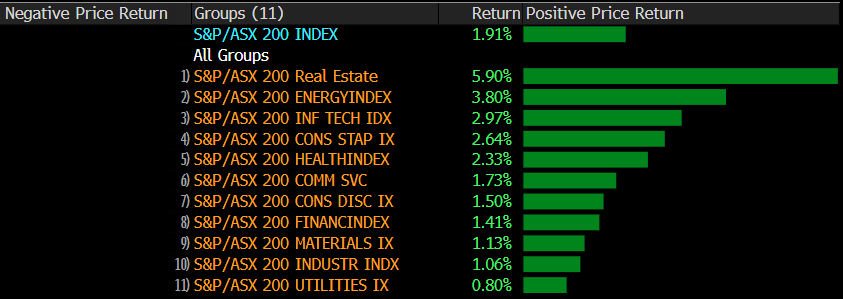

- The Property sector (+3.27%) was the standout as was Tech (+3.13%).

- 10 of the 11 Sectors closed up by more than 1% today in a session that saw 182 of the top 200 companies make gains.

- Only the Utilities sector finished lower (-0.43%), although that was largely to do with one stock.

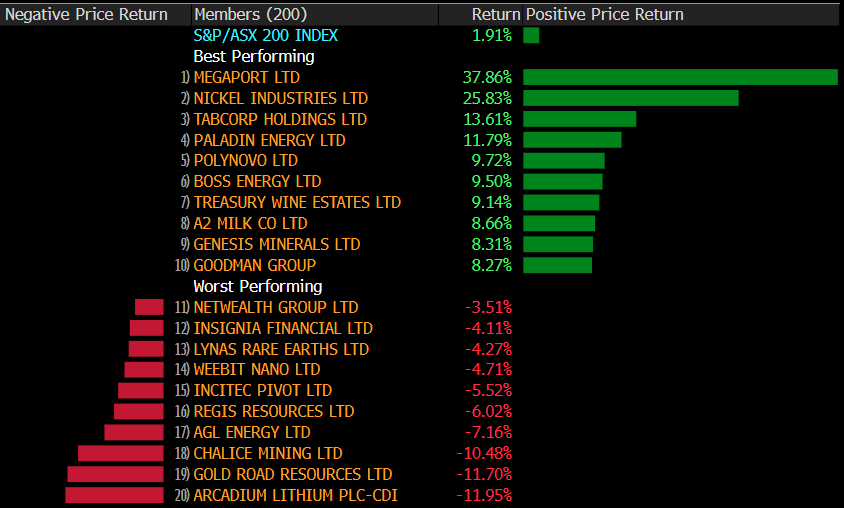

- Pinnacle Investment Management Group Ltd (ASX: PNI) +8.62% released 1H24 numbers last night, profit was a miss ($30.2m vs $32m expected) but the div was good and FUM climbed to over $100b while costs are expected to ease in the 2H.

- Chalice Mining Ltd (ASX: CHN) -7.84% tumbled on concerns around their balance sheet despite having more than $100m in cash.

- Bank of Queensland Ltd (ASX: BOQ) +1.18% has sold their NZ assets for 91% of book value. The book had a limited contribution to earnings, so it seems fair to cut the exposure as they look to simplify the business.

- AGL Energy Limited (ASX: AGL) -4.33% fell on a broker downgrade. MQG moves to neutral and $9.30 PT, worth taking note & we discuss why below.

- Uranium stocks ripped, Paladin Energy Ltd (ASX: PDN) +6.59% & Boss Energy Ltd (ASX: BOE) +7.95% the front runners in the ASX 200 after Joint Stock Company National Atomic GDR (OTCMKTS: NATKY), the world’s largest supplier of uranium which accounts for about 25-30% of global production, flagged cuts of about 14% of production.

- Goodman Group (ASX: GMG) +6.18% hit a new all-time high today – the property/data centre operative has blue sky ahead….We continue to own in the Active Growth Portfolio.

- Altium Ltd (ASX: ALU) +4.54% was also very strong, a stock we sold this week that has continued to run

- Iron ore was down 0.93% in Asia

- Asian stocks were mixed, Hong Kong added 0.23%, Japan was up +0.81% though China dipped -1%.

- US Futures are firm, the Nasdaq Composite (INDEXNASDAQ: .IXIC) the best of them after Meta Platforms Inc (NASDAQ: META) surged 14% higher in after hours trading, partially offset by Apple Inc (NASDAQ: AAPL) which was trading down 1.7% as their China sales missed expectations.

Market Matters Australian Reporting Calendar – Click to download a spreadsheet HERE and PDF document HERE

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

AGL Energy (AGL) $8.17

AGL -4.33%: Hit today after Macquarie downgraded them to hold, but with a big amendment to their price target. There have been a few questions this week on broker moves, and today AGL provides a good case in point. For subscribers. Ian Myles, the analyst at MQG that has pushed through the downgrade is the No 1 rated analyst on the stock, so his calls hold more weight than others.

Incidentally, there are analysts in the market that we just don’t take notice of, but we’re reticent to highlight this publicly. In our experience, not all analysts add value via analytical/deep research, some simply look at rudimentary indicators that rely on measures such as PE bands to form a view, which we think is way too simplistic.

Ian has a good handle on AGL and Origin Energy Ltd (ASX: ORG) for that matter, very similar companies, and is well respected in these two names, perhaps more so than in his other stocks that include: APA Group (ASX: APA), Transurban Group (ASX: TCL), Aurizon Holdings Ltd (ASX: AZJ) & Atlas Arteria Group (ASX: ALX).

- The chart below outlines Ian’s history of calls on AGL.

Today’s downgrade to hold from Buy was predicated on Energy pricing, where he said that…..forward curves since December have not improved, with the anticipated summer surge not emerging.

FY25 curves are down $8/MWh and FY26 down $4/MWh across both NSW and Vic, with pricing now sitting at ~$100/MWh for NSW and $68/MWh in Vic for FY25. This is materially different to FY22, where there was a concern of shortages.

AGL Energy (AGL) – Ian Myles Calls – Source Bloomberg

Sectors This week – Source Bloomberg

Stocks This week – Source Bloomberg

Broker Moves

- AGL Energy Cut to Neutral at Macquarie Group Ltd (ASX: MQG); PT A$9.30

- Nufarm Ltd (ASX: NUF) Cut to Neutral at Macquarie; PT A$5.73

- Rea Group Ltd (ASX: REA) Cut to Sell at CLSA; PT A$160

- Qoria Ltd (ASX: QOR) Rated New Buy at Canaccord Genuity Group Inc (TSE: CF); PT 40 Australian cents

- Sayona Mining Ltd (ASX: SYA) Cut to Hold at Canaccord; PT 6 Australian cents

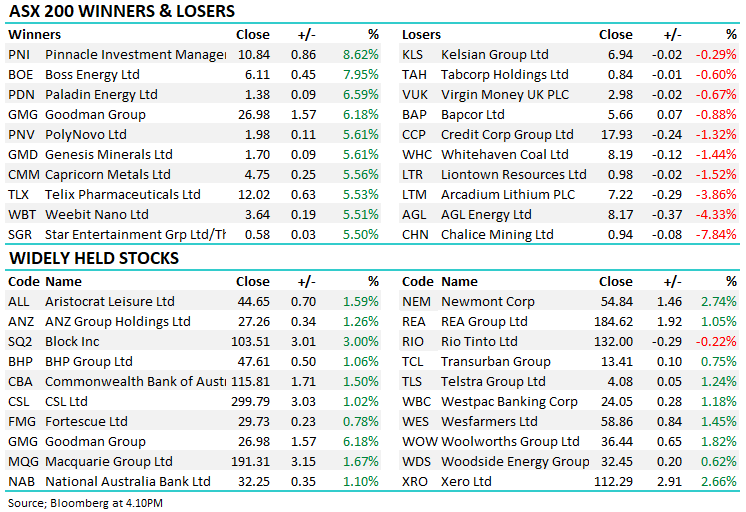

Movers & Losers