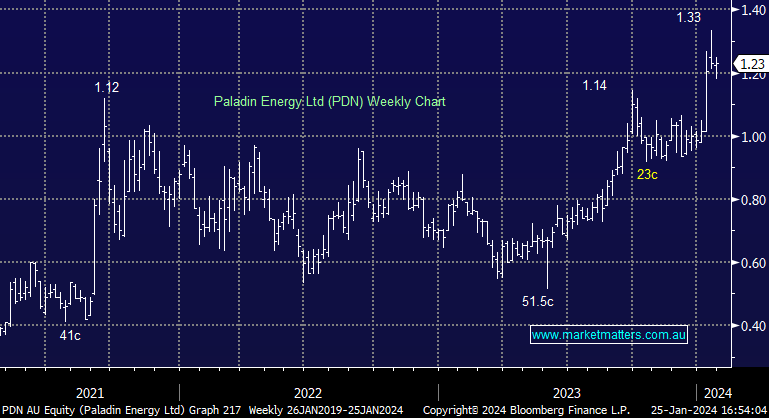

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.48% to 7,555.40.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

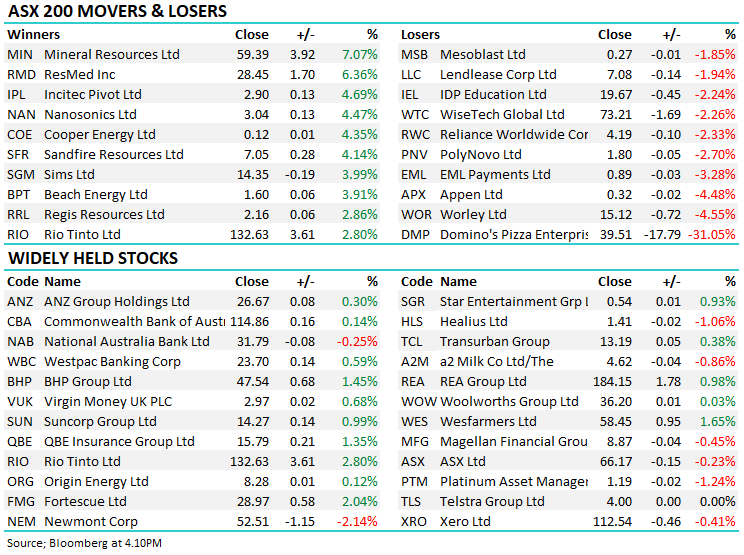

Materials & Energy stocks underpinned the fifth straight session of gains for the ASX heading into the Australia Day long weekend, while our IT sector is failing to mirror strength overseas and Real-Estate was under the pump as Barrenjoey pushed through a bunch of downgrades.

- The ASX 200 finished up +36pts/0.48% at 7555 – with decent buying come into the afternoon session.

- The Materials sector was best on ground (+1.39%) while Energy (+0.88%) and Healthcare (+0.78%) also traded higher.

- IT (-0.40%) and Property (-0.4%) the two biggest drags on the day.

- Lots of Broker Moves to get across, detailed below, as analysts numbers are refreshed ahead of results starting at the end of next week. We will send a reporting calendar out early next week, we did not get to it today!

- Resmed CDI (ASX: RMD) +6.36% rallied after reporting better-than-expected 2Q earnings after the close in the US, driven largely by better margins. Upgrades to come on this.

- Mineral Resources Ltd (ASX: MIN) +7.07% released a 2Q production update which was as much about what they have achieved as it was about alleviating market concerns around their lithium exposure and specifically, the balance sheet. They did well on both fronts.

- Domino’s Pizza Enterprises Ltd (ASX: DMP)-31.05 was walloped as they stepped away from prior guidance, the downgrade posted to the ASX at 7.17PM last night – never positive and never a good look.

- Fortescue Ltd (ASX: FMG) +2.04% maintained FY24 production guidance after shipping near-record levels of iron ore in 1H FY24.

- Paladin Energy Ltd (ASX: PDN) +0.41% released an update, confirming the restart of operations at the Langer Heinrich uranium operation in Namibia have commenced with first ore being fed to the front end of plant on Jan 20th.

- Gold was flat during our time zone, trading at US$2015 at our close.

- Asian stocks were mostly higher, Hong Kong +1.5%, Japan flat while Chinese stocks put on +2.2%.

- US Futures are flat to marginally higher around 0.35%.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

ResMed (RMD) $28.45

RMD +6.36%: Rallied today after reporting better-than-expected 2Q earnings after the close in the US, driven largely by better margins.

Adjusted EPS of $1.88 was up from $1.66 this time last year and was ~5% ahead of consensus. This was driven by a slight beat at the revenue line which increased 12% YoY to $1.16bn, a tad ahead of the $1.15bn expected along with a gross margin of 56.9%, which was actually up on the prior period, a positive surprise to the market, with analysts expecting further contraction.

As Laura Sutcliffe as UBS wrote this morning, “The irrational fear of the improbable last year around GLP-1 receptor agonists is abating.

In terms of commentary from RMD, they said…“Our second-quarter fiscal year 2024 results reflect strong double-digit growth across our combined device, masks and accessories, and residential care software businesses, as well as cost discipline to support an acceleration in profitability”.

- A good result and an appropriate reaction by the shares today

ResMed (RMD)

Mineral Resources (MIN) $59.39

MIN +7.07%%: Released a 2Q production update which was as much about what they have achieved as it was about alleviating market concerns around their lithium exposure and specifically, the balance sheet.

Both iron ore & lithium production beat expectations in the quarter while mining services was also strong. The numbers for lithium from here look better than feared as well with costs well contained last quarter and expected to continue to trend lower as production rates improve. As a result, the company’s assets all remain economical despite the price weakness in Lithium.

Their new iron ore project, Onslow, is expected to come on line as planned late in FY24, and the company is looking at options regarding the haul road which may alleviate pressure on the balance sheet.

- All in all, a comforting update today from MIN which has caused us some pain in recent months.

Mineral Resources (MIN)

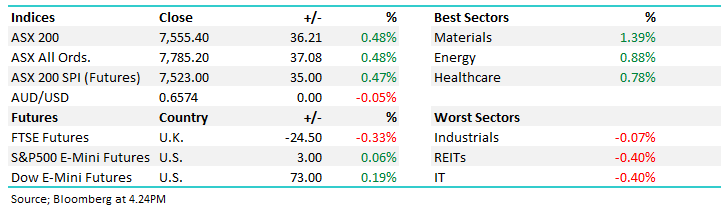

Domino’s Pizza (DMP) $39.51

DMP -31.05%: Walloped today and fell to 4 year low following an announcement posted to the ASX at 7.17PM last night – trying to sneak one past a closed market – never positive and never a good look – surely they know better!

While Same Store Sales growth (SSSg) has remained strong in the local market, weakness in Europe and Asia has led to the company walking away from previously issued guidance for the time being. ANZ Group Holdings Ltd (ASX: ANZ) SSSg was up +8.2% for the first half, however Asia was -8.9% and Europe only +0.6% for the half with latest update implying just 0.9% growth in the 2Q. Domino’s now expect first half Profit Before Tax of $87-90m, ~15% below consensus and ~5% below 1HFY23 – not a great trajectory for a company on an estimated PE of around 26x.

- We have not had any interest in DMP for the past 18-months and that view remains.

Domino’s Pizza (DMP)

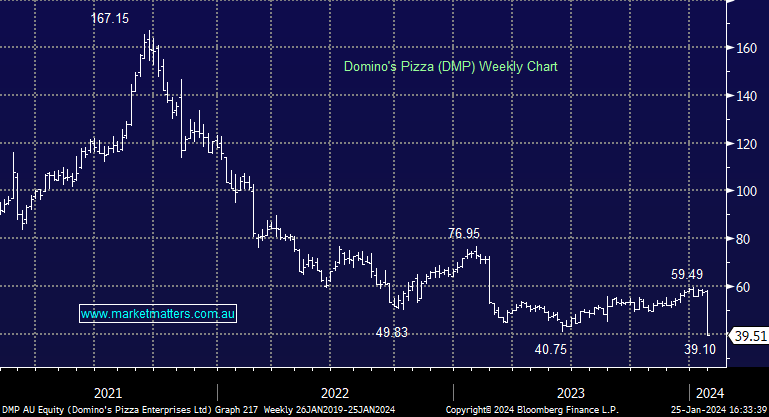

Paladin (PDN) $1.23

PDN +0.41%: Paladin released its December quarter activities report and details of a US$150m debt facility. The restart of operations at the Langer Heinrich uranium operation in Namibia has commenced with first ore being fed to the front end of plant on Jan 20th. The project is now 93% complete and is largely on-time and on-budget.

First production is expected in early 2Q24 and the final capital cost is expected to be US$125, up slightly from the US$118m budget. With cash of US$61m and the new US$150m debt facility, Langer Heinrich is fully funded through to first positive cashflow which is expected mid CY24.

Paladin (PDN)

Broker Moves

- Liontown Resources Ltd (ASX: LTR) Raised to Buy at UBS; PT A$1.25

- DMP AU Cut to Hold at Morgans Financial Limited; PT A$50

- Genesis Minerals Ltd (ASX: GMD) Cut to Hold at Moelis & Co (NYSE: MC); PT A$1.70

- Steadfast Group Ltd (ASX: SDF) Cut to Neutral at JPMorgan Chase & Co (NYSE: JPM); PT A$6.45

- Domino’s Pizza Enterprises Cut to Neutral at Jarden Securities

- ANZ Group Cut to Neutral at Jarden Securities; PT A$26.30

- Domino’s Pizza Enterprises Cut to Neutral at Citigroup Inc (NYSE: C); PT A$61.57

- Credit Corp Group Limited (ASX: CCP) Raised to Buy at Canaccord Genuity Group Inc (TSE: CF); PT A$20

- National Australia Bank Ltd (ASX: NAB) Cut to Negative at Evans & Partners Pty Ltd; PT A$26

- Magellan Financial Group Ltd (ASX: MFG) Cut to Underperform at Macquarie Group Ltd (ASX: MQG); PT A$7.60

- Genesis Minerals Raised to Outperform at Macquarie; PT A$2

- Wesfarmers Ltd (ASX: WES) Raised to Buy at Goldman Sachs Group Inc (NYSE: GS); PT A$62.90

- Corporate Travel Management Ltd (ASX: CTD) Cut to Neutral at Goldman; PT A$20.70

- Domino’s Pizza Enterprises Cut to Underperform at Jefferies

- Endeavour Group Ltd (ASX: EDV) Raised to Equal-Weight at Morgan Stanley (NYSE: MS)

- Centuria Capital Group (ASX: CNI) Cut to Underweight at Barrenjoey; PT A$1.65

- HomeCo Daily Needs REIT (ASX: HDN) Cut to Neutral at Barrenjoey; PT A$1.35

- Charter Hall Social Infrastructure REIT (ASX: CQE) Cut to Underweight at Barrenjoey

- Lendlease Group (ASX: LLC) Cut to Underweight at Barrenjoey; PT A$7.30

- Dexus (ASX: DXS) Cut to Underweight at Barrenjoey; PT A$7.65

- Charter Hall Long WALE REIT (ASX: CLW) Cut to Underweight at Barrenjoey

- National Storage REIT (ASX: NSR) Cut to Underweight at Barrenjoey; PT A$2.35

- Charter Hall Group (ASX: CHC) Cut to Neutral at Barrenjoey; PT A$11.85

- Waypoint REIT Ltd (ASX: WPR) Raised to Overweight at Barrenjoey; PT A$2.55

- Arena REIT No 1 (ASX: ARF) Raised to Neutral at Barrenjoey; PT A$3.60

- Charter Hall Retail Raised to Neutral at Barrenjoey; PT A$3.70

- Centuria Industrial Reit (ASX: CIP) Raised to Neutral at Barrenjoey; PT A$3.20

- Idp Education Ltd (ASX: IEL) Cut to Hold at Morgans Financial Limited

- Boral Ltd (ASX: BLD) Cut to Sell at Goldman; PT A$4.90

- BHP Group Ltd (ASX: BHP) Cut to Hold at SBG Securities; PT A$51.49

Major Movers Today