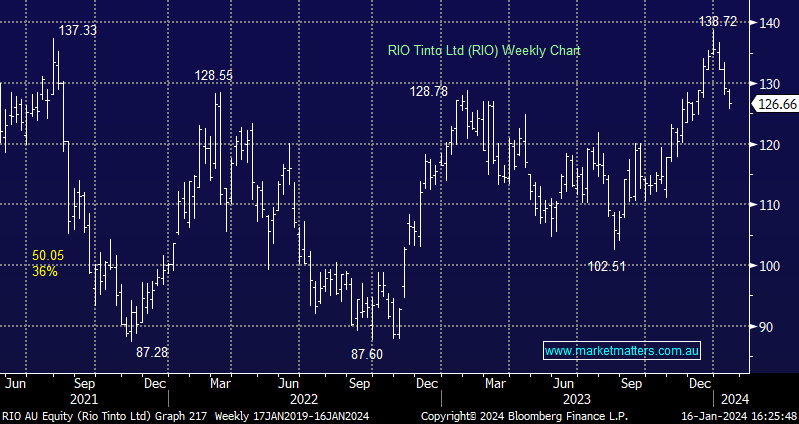

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -1.09% to 7,414.80.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

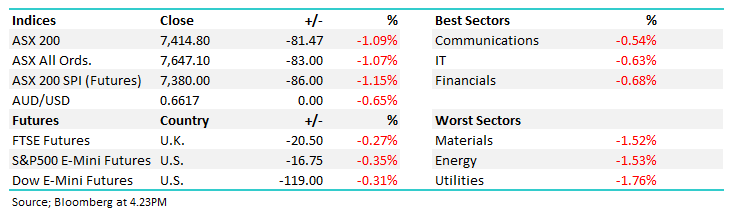

Markets looked tired with the ASX getting knocked on broadly lower European markets overnight (US markets closed) however US futures were also a bit soggy during our time zone.

Lots of broker moves as analysts get their feet back under the desk with cuts aplenty today which hurt different pockets of the market, but overall, it looks like the market needs a breather here after a great run.

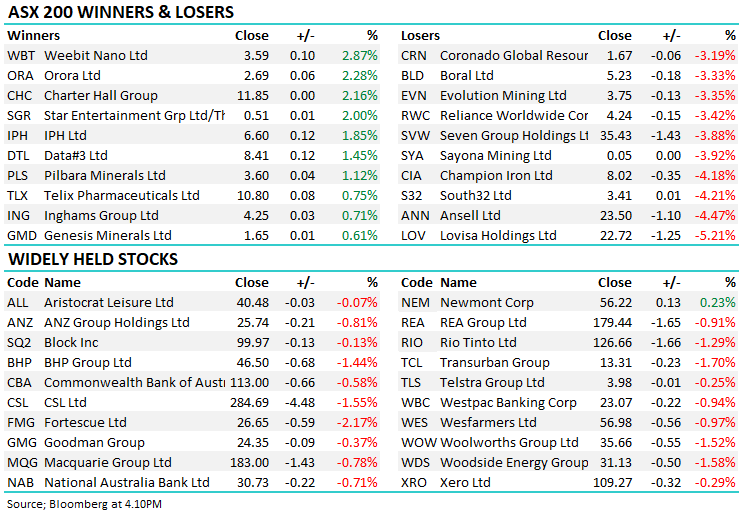

- The ASX 200 finished down -81pts/-1.09% at 7414 – a bit of a reality check

- All sectors finished lower, Utilities (-1.76%), Energy (-1.53%) and Materials (-1.52%) hit the hardest.

- Communications (-0.54%), IT (-0.663%) and Financials (-0.68%) the relative performers but all lower none-the-less.

- Lots of Broker moves to get across, detailed below with some divergent views, particularly in the retail space, upgrades yesterday from Citi, downgrades today elsewhere.

- Evans & Partners broadly downgraded Healthcare which put the sector under pressure, Ramsay Health Care Ltd Fully Paid Ord. Shrs (ASX: RHC) -2.64%, Ansell Limited (ASX: ANN) -4.47% & Healius Ltd (ASX: HLS) -1.44% the main targets.

- Worley Ltd (ASX: WOR) -2.12% continued lower after a negative update last week, we’ll dig into this one tomorrow morning in the Portfolio Positioning Report as we hold in the Active Growth Portfolio.

- Hub24 Ltd (ASX: HUB) -2.10% fell despite seeing $4.45bn inflow in the 2Q which was a record – it has been strong leading into the update, more on this one below.

- Netwealth Group Ltd (ASX: NWL) -0.06% did better on a broker upgrade.

- Rio Tinto Ltd (ASX: RIO) -1.29% out with production numbers that were broadly inline with expectations

- Lovisa Holdings Ltd (ASX: LOV) -5.21% was hit after UBS cut to neutral – these retailers have had a great run of late, hard to see it continuing.

- Uranium stocks broadly lower, Paladin Energy Ltd (ASX: PDN) -1.54% and Boss Energy Ltd (ASX: BOE) -0.72%

- Gold was down -0.44% during our time zone, trading at US$2049 at our close.

- Asian stocks were down, Hong Kong -1.9%, Japan off -0.94% while Chinese stocks fell -0.47%..

- US Futures are down around 0.35%.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

HUB24 (HUB) $35.95

HUB -2.2%%: the independent investment platform announced some impressive Funds Under Administration (FUA) growth numbers today, however the stock dopped, weighed by a soggy market.

FUA inflows of $4.5b for the quarter were a record, now up to $91.2b, +25% on pcp. Around a third of the flows came from one key client transition though a 16.4% increase in advisor numbers supports a positive outlook. Additionally, a further ~$3b is expected to come in over the 2H from their deal with Equity Trustees (EQT).

HUB24 flagged additional headcount had been added in the first half though, likely to weigh on profit at the first half result due out on February 20.

HUB24 (HUB)

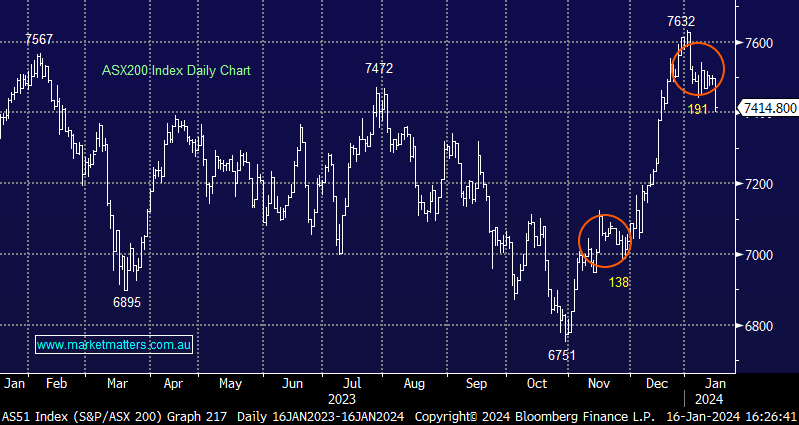

Rio Tinto (RIO) $126.65

RIO -1.29%: the iron ore miner released their 4Q23 production update today with numbers largely as expected and 2024 guidance left unchanged.

Iron Ore production in the year was up marginally to 331.8mt while mined copper at 620kt was slightly above the midpoint of 590-640kt guidance. The miner noted an improvement in the injury rate which has supported strong production rates into the end of the year.

Guidance is aiming for flat production of iron ore, bauxite, alumina and aluminium, while mined copper is expected to increase 5-10%.

Rio’s shares were soft today, though largely in line with peers BHP Group Ltd (ASX: BHP) and Fortescue Ltd (ASX: FMG).

Rio Tinto (RIO)

Broker Moves

- Seven Group Holdings Ltd (ASX: SVW) Cut to Hold at Bell Potter; PT A$38

- Boral Ltd (ASX: BLD) Rated New Hold at Bell Potter; PT A$5.15

- Netwealth Raised to Neutral at Citigroup Inc (NYSE: C); PT A$16.10

- Ansell Reinstated Negative at Evans & Partners Pty Ltd; PT A$23

- Charter Hall Group (ASX: CHC) Raised to Overweight at Morgan Stanley (NYSE: MS)

- Super Retail Group Ltd (ASX: SUL) Cut to Underweight at Jarden Securities; PT A$14.50

- Champion Iron Ltd (ASX: CIA) Cut to Sector Perform at Bank of Nova Scotia (TSE: BNS); PT A$8.39

- Strike Energy Ltd (ASX: STX) Cut to Neutral at Barrenjoey

- Karoon Energy Ltd (ASX: KAR) Cut to Neutral at Barrenjoey; PT A$2.08

- Super Retail Cut to Underweight at JPMorgan Chase & Co (NYSE: JPM); PT A$15.50

- Super Retail Cut to Hold at Morgans Financial Limited

- BHP Cut to Hold at Morgans Financial Limited; PT A$49

- Rio Tinto Cut to Hold at Morgans Financial Limited; PT A$127

- Super Retail Cut to Reduce at CLSA; PT A$16.50

- Healius Cut to Negative at Evans & Partners Pty Ltd; PT A$1.30

- Ramsay Health Cut to Negative at Evans & Partners Pty Ltd

- Integral Diagnostics Ltd (ASX: IDX) Cut to Neutral at Evans & Partners Pty Ltd

- Sonic Healthcare Ltd (ASX: SHL) Cut to Neutral at Evans & Partners Pty Ltd

- Australian Clinical Labs Ltd (ASX: ACL) Rated New Positive at Evans & Partners Pty Ltd; PT A$3.70

Major Movers Today