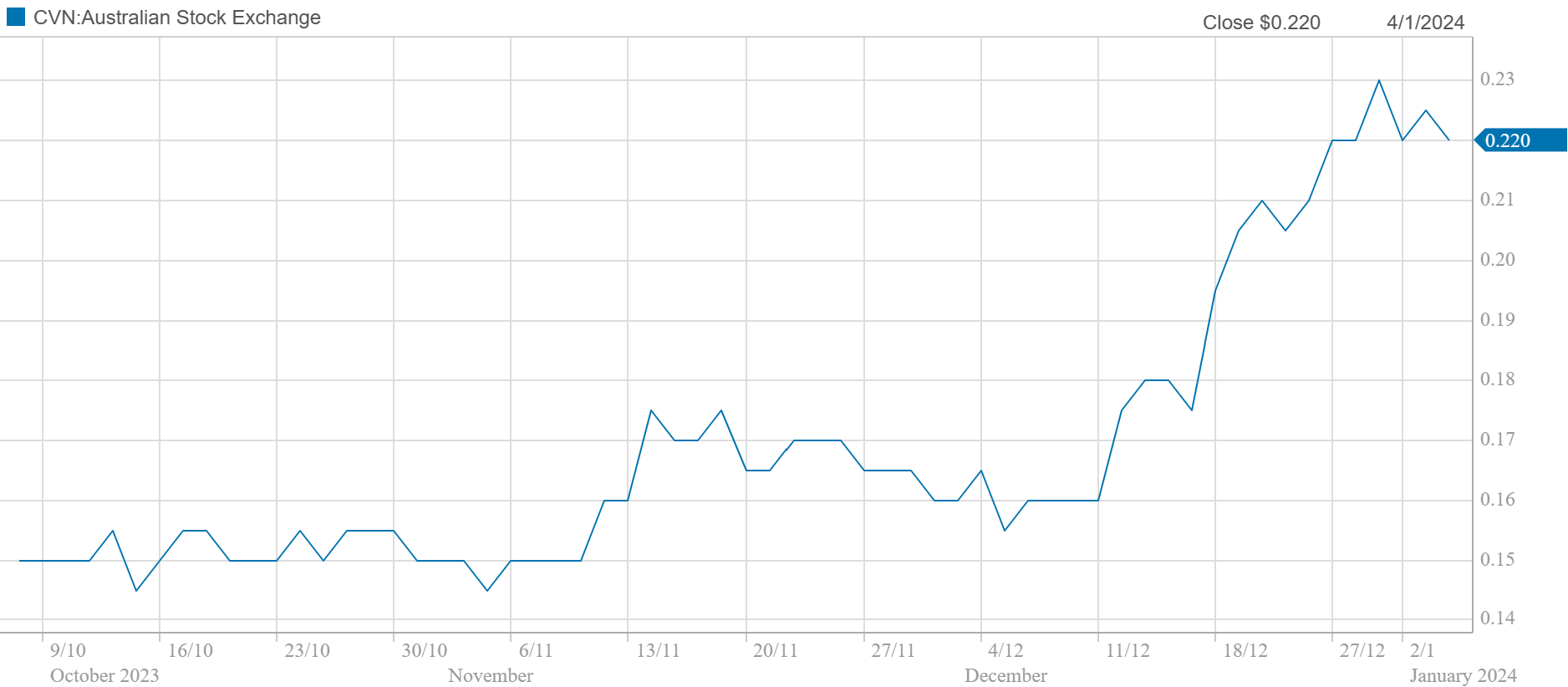

The share price of Carnarvon Energy Ltd (ASX: CVN) saw a ~50% uptick throughout the final quarter of CY2023, driven by two key announcements to the Australian Stock Exchange on the 12th and 18th of December concerning Board and Management renewal.

Notwithstanding strong recent performance, Collins St Asset Management believes that there is still the potential for substantial upside (40%+) from here as the new Board and Management team forge ahead with greater clarity, discipline and focus on having the true value of its asset base reflected in the share price.

Carnarvon Energy, in our view, is very much a typical ‘Benjamin Graham’ style investment where the tangible assets of the company are being valued at a substantial discount by the market.

The primary asset of Carnarvon Energy is a 10% interest in the Dorado project in the Bedout Basin off the coast of Western Australia.

The economics of the Dorado project are world class with over 160M barrels of oil identified with a target operating cost of under $25 per barrel once the project is brought to life.

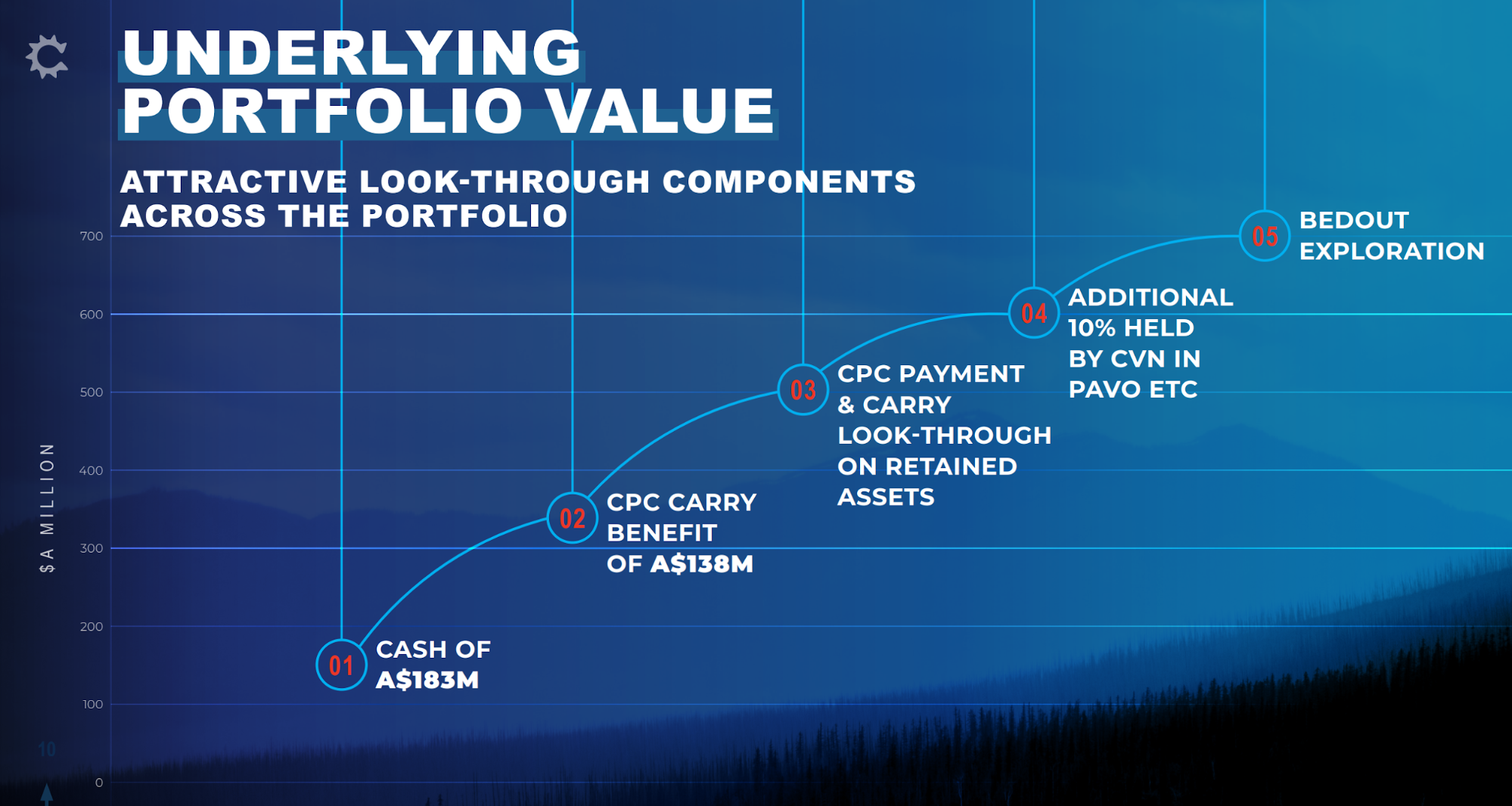

CVN also have over $180M in cash on their balance sheet (no debt) and a contribution entitlement of approximately $140M towards their share of funding the development of Dorado.

On our analysis, even if one were to assign zero value to all other projects CVN have an interest in (including the >40M barrel Pavo Field of which CVN has a 10% stake) there is a very conservative pathway to $0.30 per share for the company based on the $321M in cash and carry already accounted for and the size and quality of the Dorado project.

From a stock pricing perspective, however, the listed valuation of Carnarvon Energy had been depressed for quite some time due to concerns around the lack of prioritisation of the Dorado project by Santos (the major owner) and the potential for inflationary pressures to adversely alter the cost profile of the project. Lingering concerns have also existed with respect to the administrative cost base of CVN and the potential for Management to allocate net cash holdings towards new projects that may be longer dated, more speculative and less shareholder friendly in the medium term.

This is where ‘active’ funds management can turn into something more than simply buying and selling shares – ‘active’ share ownership can also involve engaging with other shareholders, Management and the Board in order to agitate for positive change.

Having been on the register of Canarvon Energy for over 12 months the Collins St Value Fund in concert with another fund manager engaged in some shareholder activism in December 2023. This activism saw the CEO and a number of Board members removed from their positions and replaced with the new Board and Management team committing to more shareholder friendly initiatives moving forward such as:

- Reducing corporate costs;

- Focussing on the development of the Dorado project; and

- Avoiding any new acquisitions.

Whilst shareholder activism is not a key part of the Collins St Value Fund’s strategy we are prepared to actively engage with Boards and Management teams where required and, on occasion, collaborate with other shareholders where common interests and perspectives can be found.

The Collins St Value Fund remains invested in Carnarvon Energy and looks forward to seeing further shareholder value being realised throughout in 2024.

To learn more about the deep value, contrarian and high conviction investment process that has led Collins St Asset Management to ideas such as Carnarvon Energy visit: Investment Solutions – Collins St (csvf.com.au)