Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.45% to 7,504.10.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

A few in the market scratching their heads this morning about the 1.5% decline in the last few hours of trade overnight, multiple reasons at play, with a big put options position as one of them, along with strong US economic data, however, the market has run hot and some profit taking met low volumes and selling fed on itself.

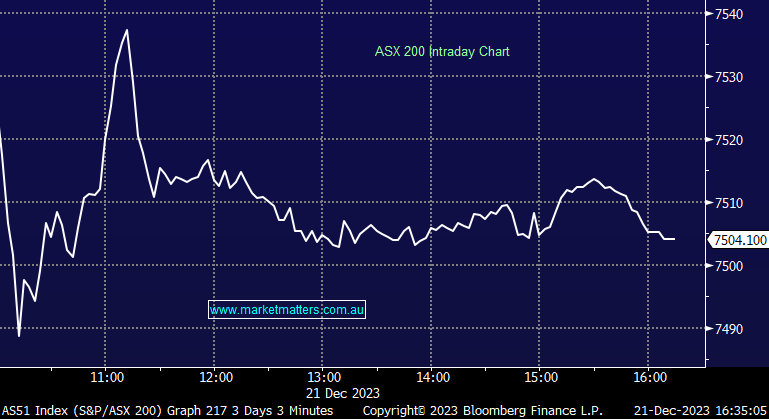

The ASX though did better than the 1% decline futures were implying, the low for the day set early on before fighting back to end mildly lower, still ~750 points/ 11% above the 6751 low set on the 30th October. With one trading session to go before Christmas, the ASX200 is up 6.6% before dividends.

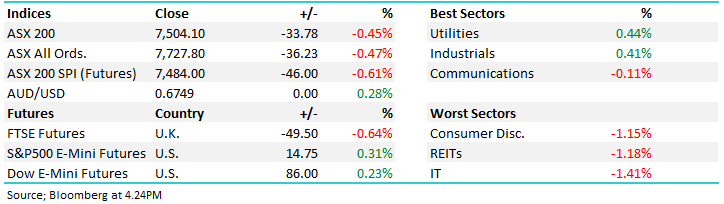

- The ASX 200 finished down -33pts/-0.45% at 7504.

- The Utilities sector was best on ground (+0.44%) while Industrials (+0.41%) also traded higher.

- IT (-1.41%) the biggest drag while Property (-1.18%) and Consumer Discretionary (-1.15%) were also weak.

- 3-year Aussie Bonds dropped to 3.64%, the lowest since June, they’re now down 84 basis points since November 1.

- Aussie 10-years are down a full 1% over the same period, back testing 4%.

- UK inflation was softer than expected in November, coming in at 3.9% YoY, well below the 4.3% expected and the prior month of 4.6%.

- UBS were active amongst the property stocks today, Mirvac Group (ASX: MGR) -3.74% cut to neutral while Vicinity Centres (ASX: VCX) –1.72% was cut to sell.

- A big block in Altium Limited (ASX: ALU) -0.36% was traded today, 515,329 shares done at $46.90.

- Sandfire Resources Ltd (ASX: SFR) +0.87% said that their Motheo Copper Mine expansion remains on budget – shares were down ~2% early before recovering to close higher.

- ANZ Group Holdings Ltd (ASX: ANZ) +0.08% was flat despite their CEO talking up market share growth at their AGM today.

- FINEOS Corporation Holdings PLC (ASX: FCL) +9.58% rallied after the CEO/Founder bought 2.4m shares, the stock closed at $1.945.

- Rio Tinto Ltd (ASX: RIO) +0.02% hit an intraday record high of $135.40, Iron Ore prices trading around the same levels.

- Pacific Smiles Group Ltd (ASX: PSQ) +4.93% rallied after rejecting a bid from Genesis Capital at $1.40, they have agreed to open the books though with the stock closing at $1.455 implying there is more to play out.

- Liontown Resources Ltd (ASX: LTR) -8.33% fell on a legal dispute over royalties, they said it’s not material but it looked a bit ‘material’ today.

- Whitehaven Coal Ltd (ASX: WHC) +0.55% up after they announced they have refinanced the $1.1bn acquisition bridge facility they used to buy BMA with a 5-year facility through a syndicate of banks.

- Iron Ore was 1.3% higher in Asia.

- Gold was flat during our time zone, trading at US$2037 at our close.

- Asian stocks were mixed, Hong Kong flat, Japan up a touch as were Chinese stocks.

- Warner Bros Discovery Inc (NASDAQ: WBD) and Paramount Global Class B (NASDAQ: PARA) after talking about merging in a deal worth about $55bn, bringing together two of Hollywood’s “Big Five” studios – it would help them compete more aggressively against streaming platforms Netflix Inc (NASDAQ: NFLX) and Walt Disney Co (NYSE: DIS).

- US Futures are up around 0.30%.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Broker Moves

- CSR Limited (ASX: CSR) Reinstated Neutral at Evans & Partners Pty Ltd; PT A$6.47

- Evolution Mining Ltd (ASX: EVN) Raised to Outperform at Macquarie Group Ltd (ASX: MQG); PT A$4.20

- Macquarie Technology Group Ltd (ASX: MAQ) Raised to Sector Perform at RBC

- PEXA Group Ltd (ASX: PXA) Cut to Hold at Morgans Financial Limited; PT A$11.65

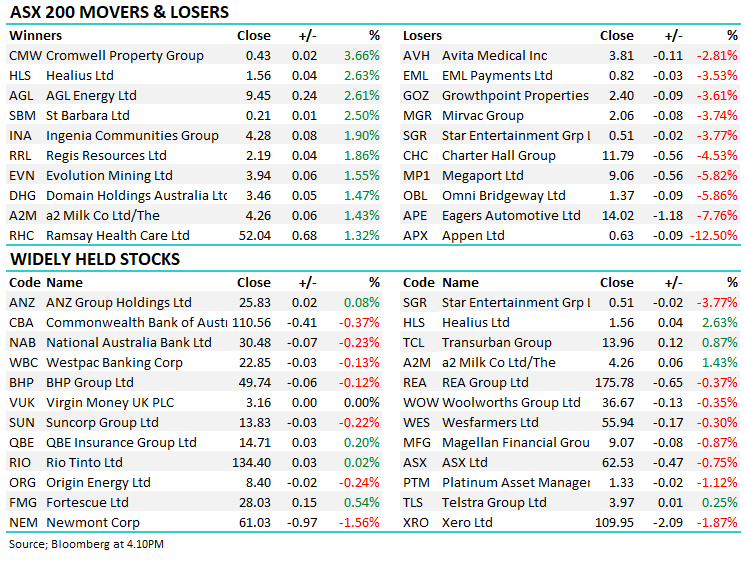

Major Movers Today