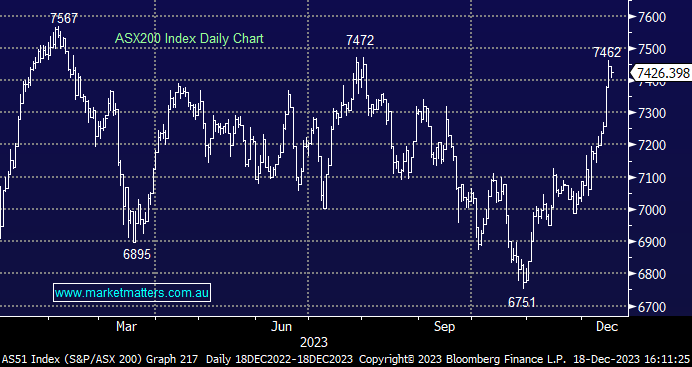

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.22% to 7,426.40.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

Shares finally snapped a 6 session-winning streak today as the ASX took a breather from the impressive December run. Real Estate was the key laggard as exuberance over expectations of rate cuts settled. There remains some strong support for local equities, shares finished well ahead of the -1% drop implied by futures ahead of the market open this morning.

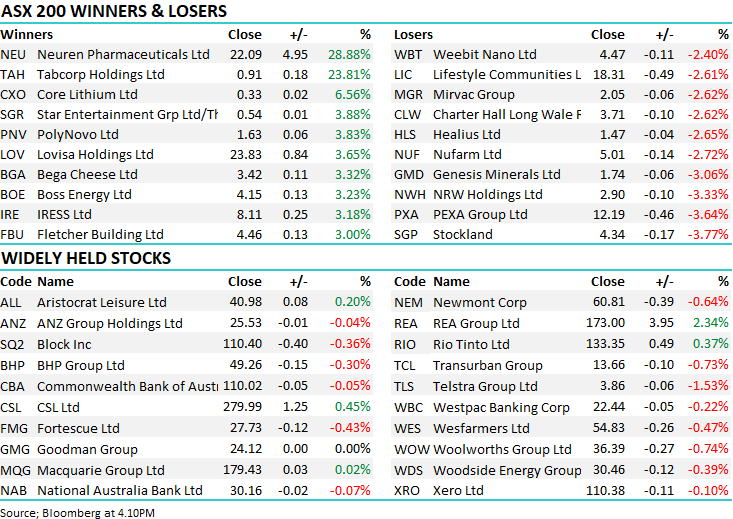

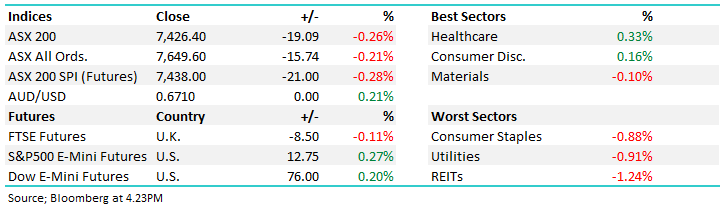

- The ASX 200 finished down -16pts/-0.22% at 7426.

- The Healthcare sector (+0.33%) was best on ground, followed by Consumer Discretionary (+0.16%) as the only other gainer.

- The worst sector was Real Estate (-1.24%) followed by Utilities (-0.91%) and Staples (-0.88%)

- Link Administration Holdings Ltd (ASX: LNK) +27.06% copped a takeover bid from Japan’s Mitsubishi UFJ Financial Group Inc (TYO: 8306) for $2.10/sh cash + 16c dividend. The deal was a 32.9% premium to Friday’s close, a day where LNK also rallied ~8%. The Link board have unanimously recommended the deal which is a whisker shy of 52-week highs for the stock

- Adbri Ltd (ASX: ABC) +31.8% also copped a bid, major shareholder Barro teaming up with UK’s CRH PLC (NYSE: CRH) to launch a $3.20/sh offer for the remaining shares. The building products company is still evaluating the offer, though we would expect strong support given Barro’s 43% ownership and the price just shy of 2-year highs for the stock.

- Tabcorp Holdings Ltd (ASX: TAH) +23.13% surged on new terms for Victoria’s betting licence. Tabcorp will pay $600m upfront + $30m a year for the 20-year deal, funded through existing facilities. Tabcorp said the new terms would have added $140m to EBITDA in 2023.

- Neuren Pharmaceuticals Ltd (ASX: NEU) +29.52% hit new all-time highs on positive trial results for their drug to treat the Phelan-McDermid syndrome, a congenital disease impacting development and behaviour.

- Lendlease Group (ASX: LLC) -1.20% sold 12 of their Australian Communities projects for $1.3b to Stockland Corporation Ltd (ASX: SGP) and Thai company Supalai PCL (BKK: SPALI). The deal will add up to $160m to the FY24 Core Operating Profit while the company reaffirmed guidance.

- Iron Ore was marginally lower in Asia.

- Gold was slightly higher in Asia, though gold shares were mixed today

- Asian stocks were soft as well, Nikkei -0.7% and Hang Seng -0.88%

- US Futures are all up around +0.15%

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Broker Moves

- Wildcat Resources Ltd (ASX: WC8) Rated New Speculative Buy at Canaccord Genuity Group Inc (TSE: CF)

- Select Harvests Ltd (ASX: SHV) Raised to Reduce at CLSA; PT A$3.25

- Boss Energy Ltd (ASX: BOE) Raised to Outperform at Macquarie Group Ltd (ASX: MQG); PT A$5

- Imdex Limited (ASX: IMD) Raised to Buy at Citigroup Inc (NYSE: C); PT A$2.20

- Sigma Healthcare Ltd (ASX: SIG) Cut to Hold at Shaw and Partners Ltd

- BlueScope Steel Limited (ASX: BSL) Cut to Neutral at Citi; PT A$22.50

- Pepper Money Ltd (ASX: PPM) Raised to Buy at Citi; PT A$1.40

- Wesfarmers Ltd (ASX: WES) Cut to Neutral at Evans & Partners Pty Ltd

- Hub24 Ltd (ASX: HUB) Rated New Buy at William O’Neil

Major Movers Today