Eliza Clarke of Firetrail Investments highlights 3 things that has impacted the global stock market and the Australian share market this week. How will this update affect the Australian share market?

1. Pizza party…

The most predicted thing of 2023, a recession, never happened…for now…

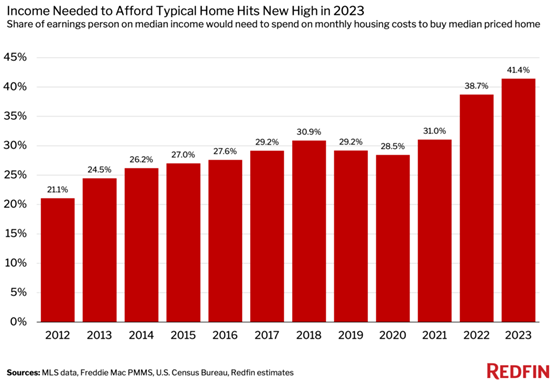

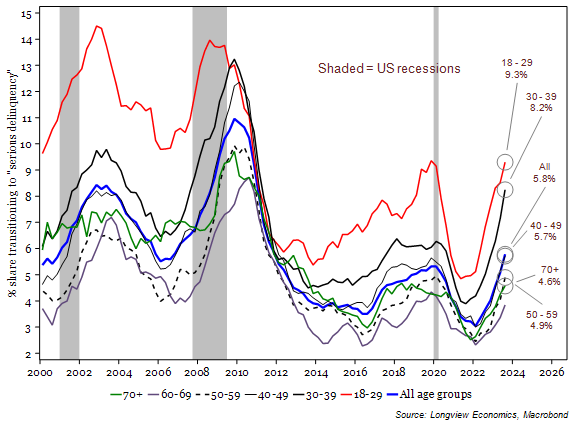

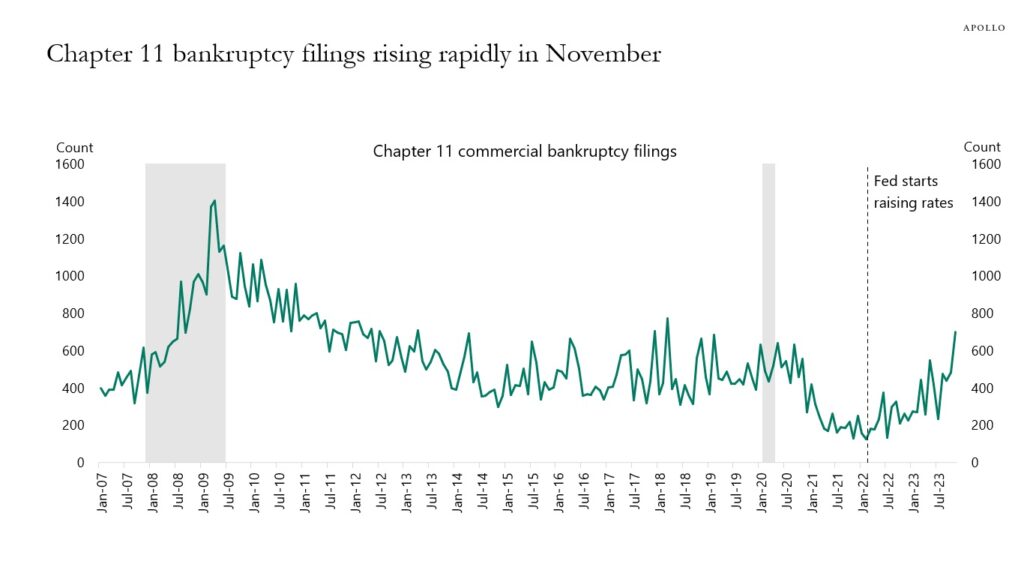

You can find all types of supporting data that suggests a recession is on the way (see charts below), but we have dodged it all year.

As we head into 2024, recessionary forecasts remain elevated. The Bloomberg economist survey places the probability of a contraction at 50%. Deutsche Bank surveyed their customers, and 37% of respondents think a hard landing is the biggest risk for the US in 2024. What do you think?

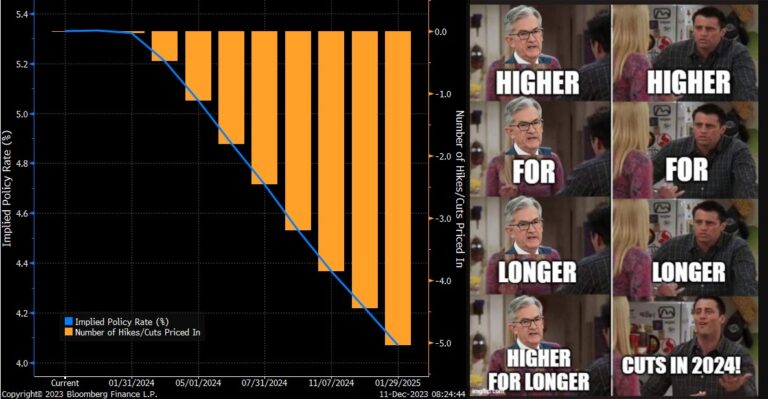

US implied policy rate over the next year

2. ESG is maturing…

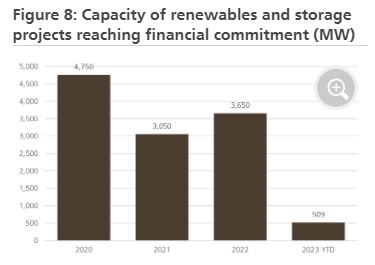

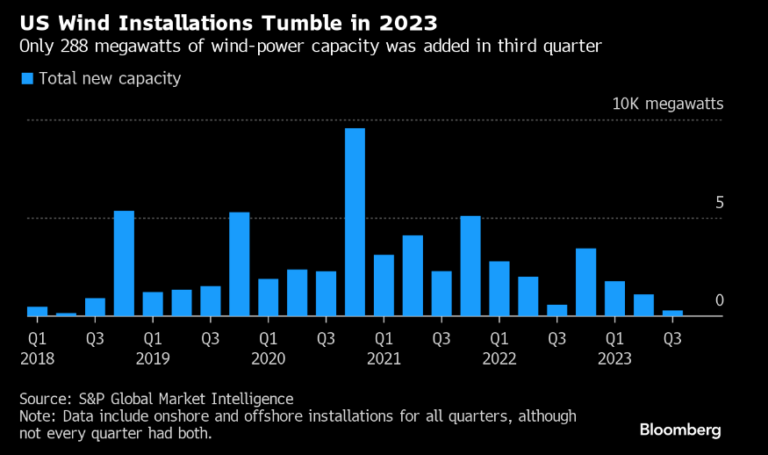

Whilst it’s been a strong year for the Magnificent 7, it hasn’t been so good for solar / renewable energy or electric vehicle companies. It is tough across the resources sector to get projects done, which is impacting the pace of the transition. Clean Energy Council data shows just 509 MW of renewable and storage projects reached financial close in Australia in 2023. And in the US, they had just 288 MW of wind-power capacity added in 3Q.

We recently wrote about why the S3 Global Opportunities Fund has been cautious about investing in renewable energy stocks and where we see better opportunities in the energy sector here. Spoiler alert – one of these companies is Schneider Electric SE (EPA: SU).

Schneider Electric helps its customers reduce their electricity consumption and carbon footprint by offering solutions such as smart meters, sensors, software, automation, lighting, heating, cooling, and electric vehicle charging.

Schneider Electric benefits from growing demand for energy efficiency solutions from various sectors such as buildings, industries, data centres, and infrastructure. Schneider Electric also has a diversified geographic exposure and a solid financial performance.

3. Just keep travelling…

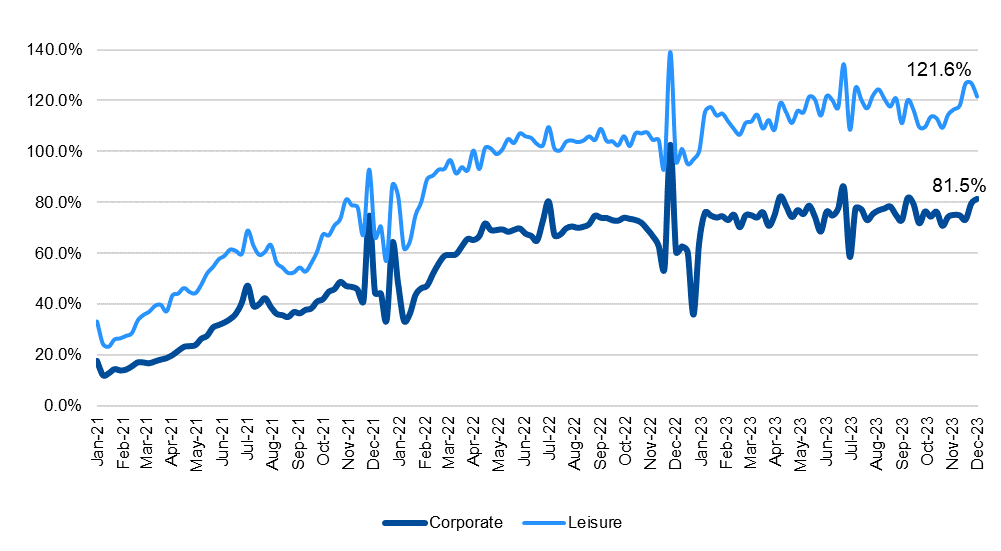

Another theme that surprised the team through the year was just how much demand for travel there was.

We’ve shown a lot of travel charts this year, but we have one more as we head into the Christmas/Holiday period.

The US corporate is back to 82% of pre-Covid levels, whilst leisure travellers are at 122% of pre-Covid levels. If that recession continues to evade us, how long will this theme continue?

Chart/meme combo of the year:

Will rates go down (nearly) as fast as they went up?…

US implied policy rate over the next year