Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.88% to 7,442.70.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The strong momentum continued today, though this time led by the resources sectors as commodity prices found their feet.

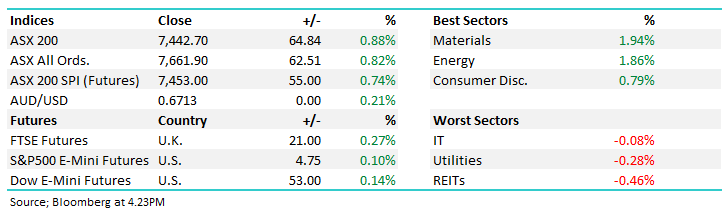

Shares finished ~0.3% off their highs with some profit taking through the afternoon but today’s rally makes it the 6th consecutive positive day for the ASX200 which is now up ~10% since the late November low of 6751.

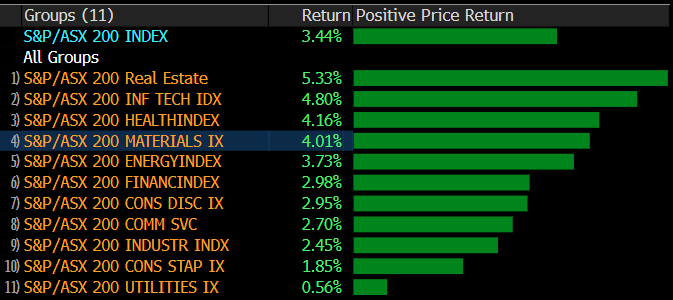

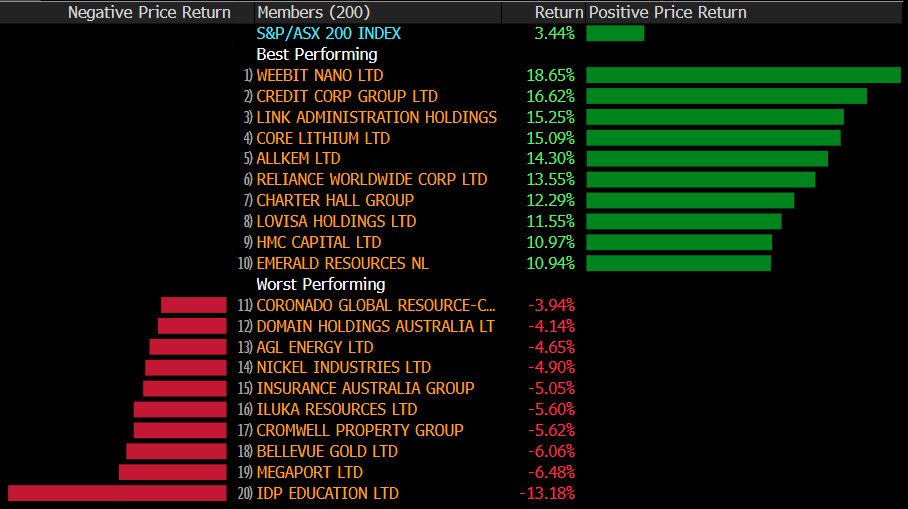

This week alone the index was up +247pts/+3.44%, higher for the third consecutive week

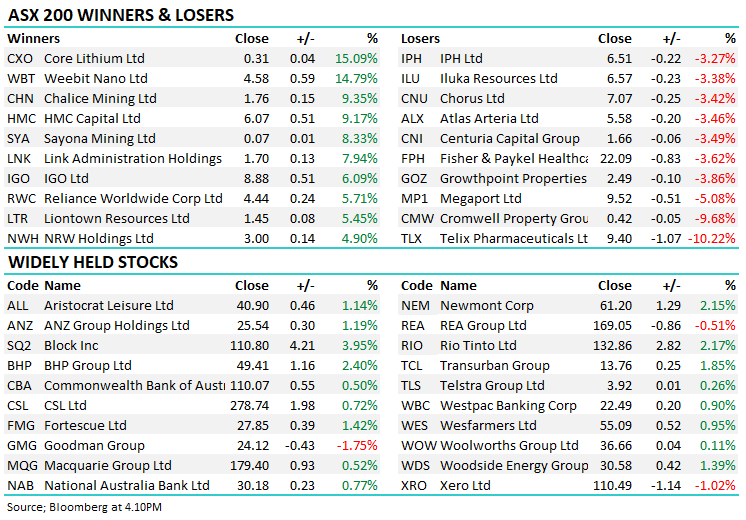

- The ASX 200 finished up +64pts/+0.88% at 7442.

- The Materials sector (+1.94%) was best on ground, followed by Energy (+1.86%)

- The worst sector was Real Estate (-0.46%) followed by Utilities (-0.28%) and Tech (-0.08%)

- Link Administration Holdings Ltd (ASX: LNK) +7.94% announced an MOU with Australia’s largest Superfund, AusSuper with $300b in assets and 3.3m members. The deal will extend their agreement to 2028, a win for Link where concerns were raised after Hesta pulled their agreement earlier this year.

- Adbri Ltd (ASX: ABC) +8.61% expects their Kwinana cement plant to come online in 2Q 2024 in line with earlier forecasts. Strong demand for building products int eh 2H helped the company lift EBITDA guidance to $310-320m, up from at least $300m and 5% above consensus.

- Dexus (ASX: DXS) -3.02% cut their office portfolio valuations by 6% and industrial by 2.1% ahead of the end of the year. The landlord will pay a 26.7c dividend for the half.

- Iluka Resources Limited (ASX: ILU) -3.38% said their new rare earths refinery may cost up to 20% more than market expectations with the project facing a number of challenges.

- AMP Ltd (ASX: AMP) -1.57% continues to withhold $350m of capital which was earmarked for shareholders as the wealth management company works with regulators.

- Iron Ore was marginally higher in Asia, adding +0.3%, Fortescue Ltd (ASX: FMG) once again hitting all-time highs.

- Gold was flat in Asia, taking a breather from the recent rally to trade at $US2035/oz

- Asian stocks were strong – Nikkei +0.86%, Hang Seng +3.00% & China +0.32%.

- US Futures are all up around +0.15%

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Sectors this week – Source Bloomberg

Stocks this week – Source Bloomberg

Broker Moves

- Allkem Ltd (ASX: AKE) Raised to Overweight at Jarden Securities; PT A$11.40

- Pro Medicus Limited (ASX: PME) Rated New Overweight at JPMorgan Chase & Co (NYSE: JPM); PT A$100

- Mach7 Technologies Ltd (ASX: M7T) Rated New Overweight at JPMorgan; PT A$1.05

- Alumina Limited (ASX: AWC) Raised to Overweight at Barrenjoey; PT A$1.10

- Orora Ltd (ASX: ORA) Raised to Positive at Evans & Partners Pty Ltd; PT A$3

- Volpara Health Technologies Ltd (ASX: VHT) Cut to Hold at Bell Potter; PT A$1.15

Major Movers Today