Daniel Ortisi of Stock Doctor shares a glimpse into the operations, drivers and potential risks of XRF Scientific Limited (ASX: XRF). Is XRF share price a buy today?

Recently, our analyst team visited the executives of XRF Scientific Limited at their Melbourne precious metals labware manufacturing facility.

This visit offered an insightful glimpse into the operations, drivers and potential risks of the business.

Members should note that XRF does not classify as a Star Stock, primarily due to its current liquidity status and a market capitalisation that falls short of our benchmarks.

Nonetheless, we recognise XRF as an emerging opportunity worth mentioning.

XRF Scientific share price

Business overview

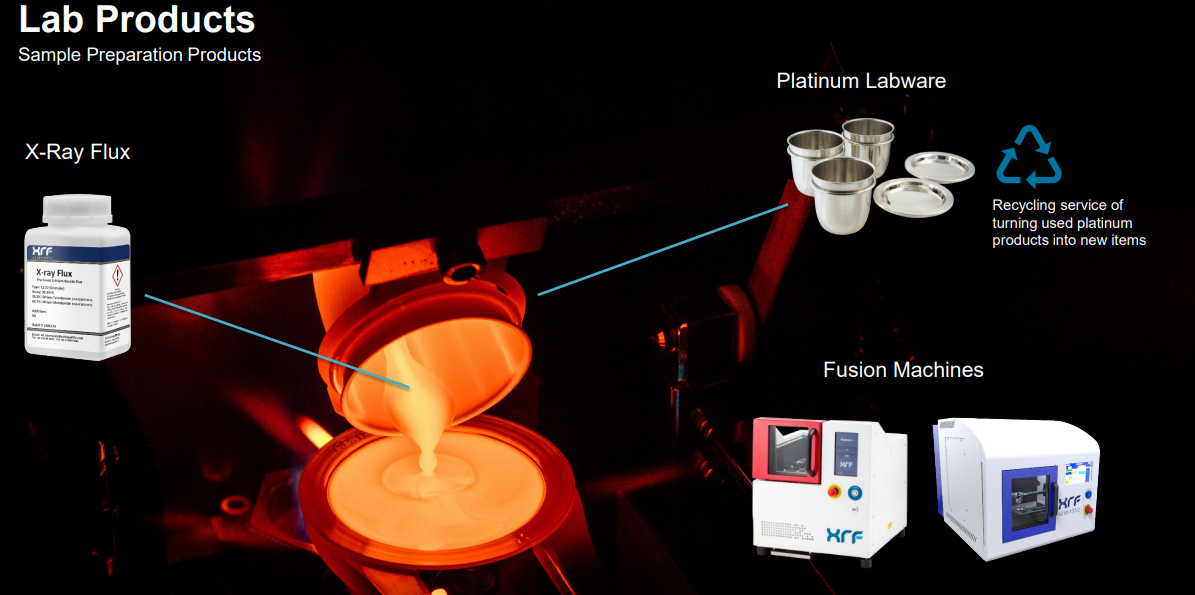

XRF, a Perth-based company, plays a significant role in the mineral sampling industry, offering a range of equipment, labware and chemicals for X-Ray Fluorescence (i.e. XRF) analysis.

XRF’s business is structured into three main segments:

Consumables Manufacturing (42% FY23 profits) – This segment, the cornerstone of XRF’s operations, specialises in producing “fusion flux” – a critical component used in the x-ray fluorescence process, for generating homogenous testing samples. With an impressive ~65% of global market share for fusion flux, XRF’s competitive advantage lies in rapid order fulfillment (24/48 hour dispatch) and superior product quality.

Precious Metals (30% FY23 profits) – This segment focuses on manufacturing platinum based labware, such as crucibles and moulds, essential for withstanding high temperatures and for being inert during the x-ray fluorescence process. XRF’s ability to manage the high costs of purchasing and holding platinum inventory (due to its strong balance sheet) coupled with their high production volumes, allows the Group to maintain strong margins whilst maintain high precision in manufacturing. Management explained to us that they are the only manufacturer in the world to make platinum moulds which are perfectly flat – which aids in ensuring homogeneity in the testing process.

This characteristic also allows the Group to compete with low cost and imprecise manufacturers from China and India.

Capital Equipment (28% FY23 profits) – XRF designs, manufactures, and sells specialised furnaces and laboratory equipment for the x-ray fluorescence process. There is a sense of interoperability between the three operating segments as XRF’s ability to offer machinery, consumables and even servicing in a ‘one stop shop’ helps to simplify the purchasing decision of its customers. For example, XRF can often bundle machinery, labware and flux to customers, as well as provide servicing and advice to lab technicians across the entire sampling process.

The acquisition of ORBIS Mining, a business that manufactures crushers for sample testing in the gold industry, has notably enhanced the Capital Equipment segment, showcasing a growth in profits from ~$250,000 to $1.5m.

Cyclicality, and reliance on the mineral sector

Contrary to common perception, XRF’s operations exhibit more stability than typical mining services providers like Perenti Ltd (ASX: PRN) and Imdex Limited (ASX: IMD). This stability stems from:

- Diverse revenue streams, with ~30% coming from non-resource industries like industrial testing (i.e cement); and

- The essential nature of XRF’s products for their customer, especially in the resource definition and quality testing process. For example, XRF sells product directly to large Australian iron ore miners for their own internal laboratories to test mineral samples and help the resource definition process – and for product qualification testing upon the sale of ore into China (ore is tested for deleterious elements such as phosphorus which will result in penalty pricing adjustments etc).

Ultimately, XRF’s demand drivers are exacerbated by the cyclicality of the mining industry. However they have grown and diversified their business and customer base over time to cushion earnings during the downturns.

An overview of the golden rules

XRF generated solid cash flows in FY23 which grew to ~$8m from $3m the year prior. It has a net cash balance sheet and owns tangible assets (Melbourne property, platinum used for inventory) which gives us comfort over its Strong Financial Health rating. (GR1)

Return on equity (ROE) and net profit margins (NPM) continue to expand as the business experiences record levels of demand due to strength in underlying commodity prices. Furthermore, material investments made in the capital equipment and precious metals divisions will add incrementally to margins and returns (new product lines, customer acquisition in Europe). Both metrics pass our current filters for Star Stock inclusion. (GR2)

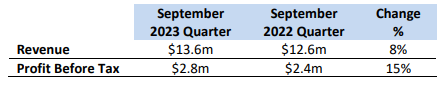

The 1Q24 update showed 15% growth in profits before tax, driven by demand for capital equipment. We anticipate profit growth to be high single digit, to low double digit for FY24 after accounting for an increase in the tax rate from 25% to 30% and perhaps some added expenditure to retain staff in Australia. Investors should be aware that there is very little analyst coverage for the stock, and therefore a lack of reliability within consensus expectations. (GR3)

Conclusion

Management has been with the business for a long time and have performance incentives tied to total shareholder return relative to a peer group and index, which we think is one of the stronger LTI systems offered.

Whilst the CEO may not directly hold a significant amount of stock, we see strong alignment to shareholders as ~7% of the company is held by Board and Key Management (GR7).

In summary, while XRF Scientific Limited is not currently part of our ‘Star Stock’ portfolio due to market liquidity and size constraints, its unique market position and solid competitive advantages cannot be overlooked.

We believe XRF could represent a decent, yet often misunderstood, opportunity within its niche.

Members who may be interested in the company should keep it on their watchlists. XRF’s evolving market position could signal a timely investment opportunity in the near future.

For more information, please get in touch with the team via our Lincoln Live sessions on Monday or call directly.