Eliza Clarke of Firetrail Investments highlights 3 things that has impacted the global stock market and the Australian share market featuring Domino’s Pizza Inc (NYSE: DPZ) and Domino’s Pizza Enterprises Ltd’s (ASX: DMP) current performance.. How will this update affect the Australian share market?

1. Pizza party…

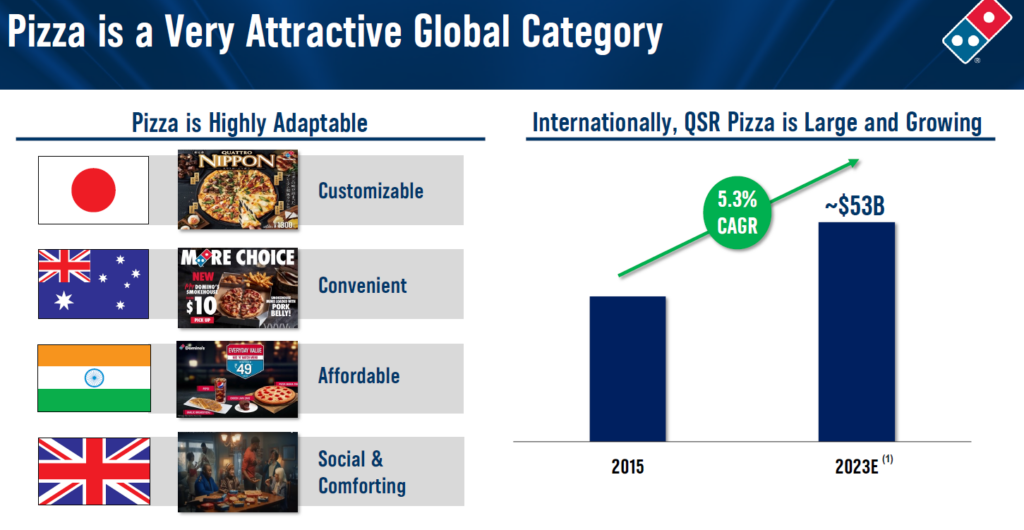

The Domino’s Pizza Inc held their investor day overnight, and pizzas are proving popular in these uncertain economic times.

Domino’s Pizza is forecasting more sales (+7% annual global retail sales growth), more stores (annual global net unit growth of 1,100+) and more profit (8%+ annual operating income growth).

US Domino’s Pizza share price

The strength of the US business bodes well for Domino’s Pizza Enterprises Ltd’s, which we hold in the Australian High Conviction Fund.

Australian Domino’s Pizza share price

The Australian Domino’s business continues to innovate and have got some interesting new menu items online – check out their snack boxes if you need a mid-day feed!

2. Some things change, some stay the same…

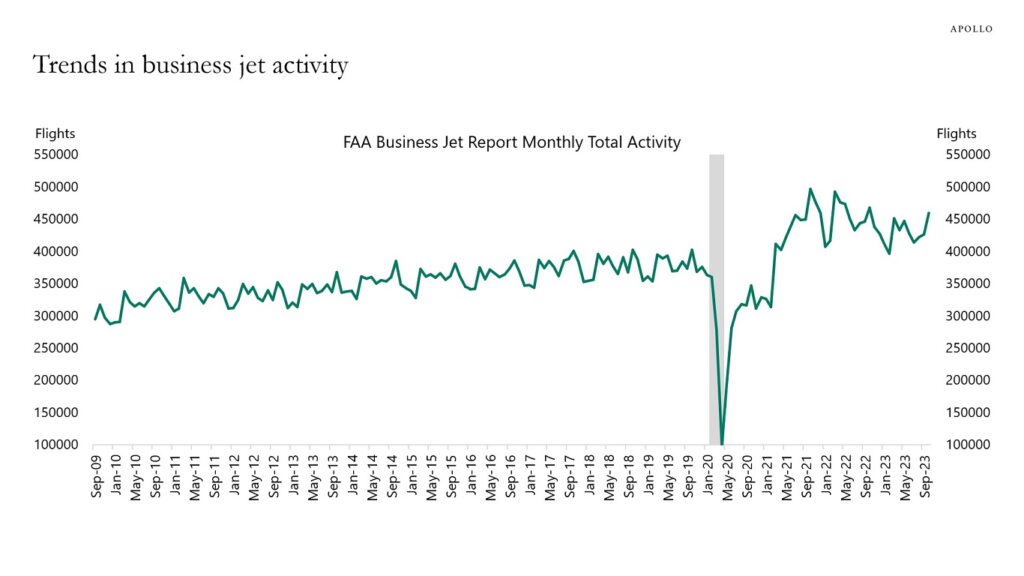

As we approach the 4-year mark since the onset of Covid we reflected on what has seemed to change permanently, and what has returned to ‘normal’.

Besides the adjustment to a work from home business culture, private jet travel seems to have enjoyed a structural shift post Covid.

The US Federal Aviation Administration (FAA) monthly Business Jet Report provides a snapshot of trends in business jet activity, and the report from November 2023 shows continued strong demand for private jets.

3. Can Trump triumph?…

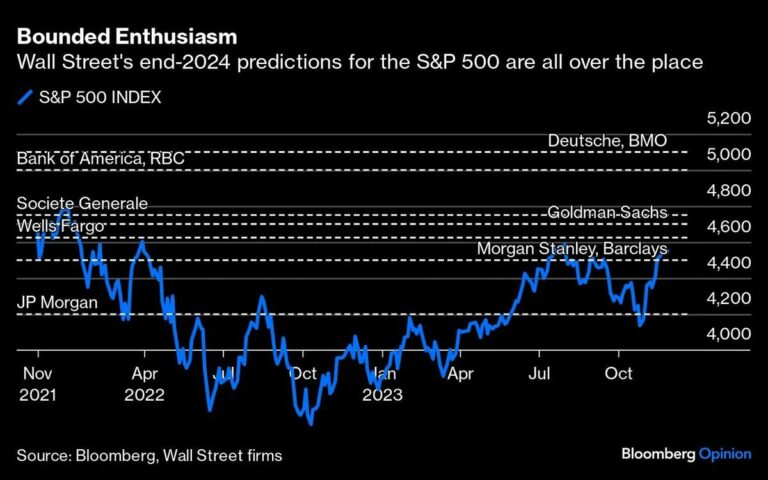

As we close out 2023 the predictions for where 2024 will end have begun. None of Wall Streets largest banks are predicting the S&P 500 (INDEXSP: .INX) to fall under its 2022 low, and the majority think it wont top the high from the beginning of 2022. What do you think?…

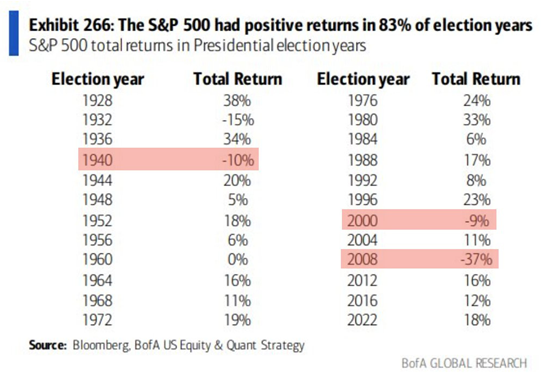

2024 is also a US election year. And election years tend to be strong years for the S&P 500.

S&P 500 returns historically were positive 83% of the time during presidential election years (only 4 out of the past 24 election years were negative, i.e. 17%).