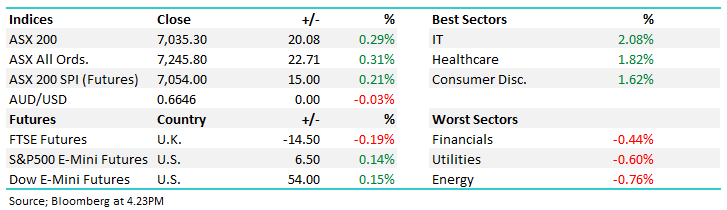

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.29% to 7,035.30.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

Rinse & repeat, the trend for the week thus far as the market opens in an optimistic tone only to see selling pick up throughout the session – not even an improving inflation picture was enough to sustain early optimism, the best of the gains seen before midday.

- The ASX 200 finished up +20pts/ +0.29% to 7035.

- The IT sector (+2.08%) was the standout, while Healthcare (+1.82%) and Consumer Discretionary (+1.62%) finished higher.

- Energy (-0.76%), Utilities (-0.60%) and Financials (-0.44%) struggled.

- October inflation data was another positive surprise on the economic front, while only a monthly read with some natural shortcomings in this data set, 4.9% YoY compared to 5.2% expected and 5.6% the prior month i.e. the trend here is still favourable.

- Aussie Bond Yields pulled back as the threat of further rate hikes came off the table, 2-year yield -13bps to 4.09%.

- The AUD was down, but not much trading 66.43c – it is a cork in a bigger ocean and while further rate hikes still seem unlikely, rate cuts will play out in the US sooner than here.

- As suggested this morning, we cannot see the RBA hiking again in the current cycle, but we believe it won’t be until 2H of 2024 that cuts are even entertained.

- Gold stocks had a day in the sun with bullion prices strong overnight + edged higher in Asia today, now $US2046/oz. – the weakness in the $US the catalyst.

- Northern Star Resources Ltd (ASX: NST) +4.37%, Evolution Mining Ltd (ASX: EVN) +5.44% Barrick Gold Corp (NYSE: GOLD) +5.25% & Silver Lake Resources Ltd (ASX: SLR) +3.29% held across MM Portfolios.

- Temple & Webster Group Ltd (ASX: TPW) +14.4% rallied hard on a strong sales update at their AGM today, July to November showed sales (+23%) tracking well ahead of consensus.

- Fisher & Paykel Healthcare Corporatn Ltd (ASX: FPH) +7.87% was strong on a 1H result that beat consensus on the back of strong Homecare product sales.

- Harvey Norman Holdings Limited (ASX: HVN) +4.16% higher despite sales FY24 to date being under pressure, -7.8% at the group level, but -11.6% for the Australian arm.

- It seems Temple & Webster have managed to pick up some of Gerry’s business over the last few months!

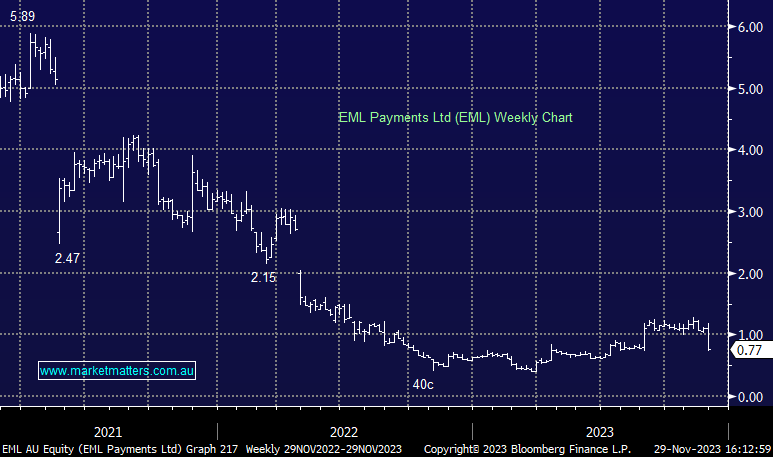

- EML Payments Ltd (ASX: EML) -29.68% hit 3-month lows on softer-than-expected comments at their AGM.

- Iron ore a touch lower, not major, the miners down ~0.5% as a consequence.

- Asian stocks were down, Hong Kong -2%, Japan -0.09% while China lost -0.48%.

- US Futures are all up around 0.12%.

- RIP Charlie Munger – a true legend. Everyone has a favourite quote, mine is this:

It’s remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

EML Payments (EML)

EML -29.68%: shares in the payments technology business slumped to 3-month lows today on some softer-than-expected comments at their AGM.

EML has been working to refocus the business on their profitable Australian and UK operations, but the ghosts of its past continue to plague its outlook.

The PCSIL business in Ireland has been under growth restrictions for the last few years due to money laundering breaches with remediation works still ongoing and weighing on cash flow.

EML is also trying to offload Sentinel, an open banking brand they acquired in 2021.

A number of preliminary bids have been received, it is likely to see cents on the dollar compared to the €70m acquisition price, though a deal here would likely be a positive.

On a more positive front, EML maintained FY23 guidance of EBITDA between $52-58m, up 40-56% on FY23, a range which is ~25% above current consensus expectations. Year-to-date (YTD) revenue is up 39% and EBITDA is up 129%, tracking well vs guidance.

Unfortunately, this was overshadowed by continuing uncertainty regarding the PCSIL business and the continuing cash drag as a result of the regulatory burden.

EML Payments (EML) share price

Broker Moves

Zip Co Ltd (ASX: ZIP) Rated New Buy at Unified Capital; PT A$1.05

WiseTech Global Ltd (ASX: WTC) Reinstated Sector Perform at RBC; PT A$75

PeopleIn Ltd (ASX: PPE) Cut to Accumulate at CLSA; PT A$1.65

Idp Education Ltd (ASX: IEL) Raised to Buy at Bell Potter; PT A$27

Collins Foods Ltd (ASX: CKF) Cut to Accumulate at CLSA; PT A$12.50

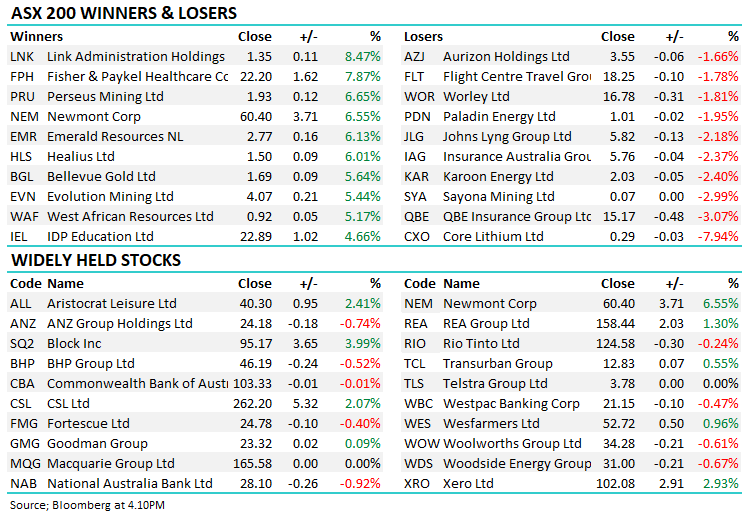

Major Movers Today