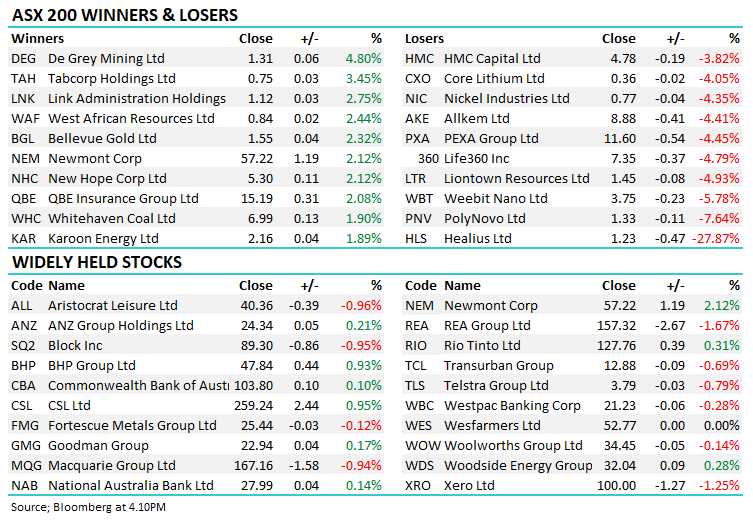

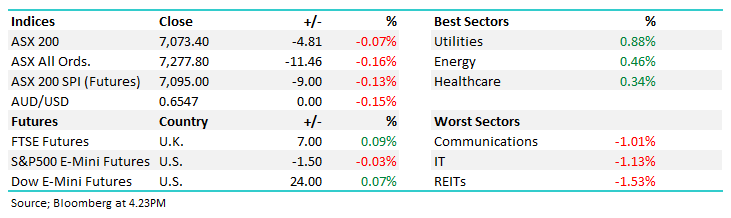

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.068% to 7,073.40.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The best of it was seen early today with the index pushing up on open, only to lose steam from midday onwards and trickle lower into the close – still, there is not a lot of new impetus to sell the market, and as one fund manager we had lunch with today who looks after $10bn+ said, volumes are becoming tough when moving around the market at size, in other words, it’s paying to be smaller and nimble in this environment.

- The ASX 200 finished down -4pts/ -0.07% to 7073

- The Utilities (+0.88%), Energy (+0.46%) and Healthcare (+0.354%) were best on ground.

- Property (-1.53%), Tech (-1.13%) and Communications (-1.01%) were weak.

- Origin Energy Ltd (ASX: ORG) +1.69% moved higher, although still sits at a ~8% discount a day out from the Scheme meeting on its future, which seems unlikely to get up.

- Praemium Ltd (ASX: PPS) -35% had a shocker, downgrading earnings guidance by ~30% at their AGM today, the stock fell more.

- ANZ Group Holdings Ltd (ASX: ANZ) +0.21% told staff that bonuses would be linked to attendance in the office.

- Healius Ltd (ASX: HLS) -27% was whacked after completing a $154 million share offer priced at $1.20, shares closed today at $1.22.Probably not a bad bet now the balance sheet is in order.

- Bubs Australia Ltd (ASX: BUB) Halted pending a capital raise to fund US expansion.

- Bowen Coking Coal Ltd (ASX: BCB) +18.18% edges higher – now up 44% from the raise price of 9c.

- Medibank Private Ltd (ASX: MPL) -1.42% fell despite re-affirming guidance.

- EBOS Group Ltd’s (ASX: EBO) $3.75bn deal to acquire TPG Capital-backed pets and vets business Greencross Limited (ASX: GXL) has fallen through.

- Gold was flat trading US$1998/oz at our close.

- Iron Ore remained comfortable above US$130/mt

- Asian stocks were mixed, Hong Kong flat, Japan +0.36% and China -0.34%.

- US Futures are flat

- Thanksgiving on Thursday in the US and a half-day trade on Friday.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Praemium (PPS) 37.5c

PPS -35.34%: a tough day for the investment platform business, tumbling on comments made at their AGM.

Praemium has been working hard to right size their cost base but it is facing headwinds on both costs and revenues and today’s update sent the stock to 3-year lows.

On the revenue front, lower trading volumes have weighed on income given Praemium clips the ticket on activity.

They also take their keep from cash balances which have been running lower than FY23.

On the cost front, the company will take a one-off $1m hit on restructuring charges and capex continues to climb in line with inflation. As a result, the company expects 1H EBITDA to be down 20% on last year where consensus was expecting ~10% growth.

A pretty frustrating update from Praemium today, our outlook turns more cautious as a result

Praemium (PPS)

Broker Moves

- Hub24 Ltd (ASX: HUB) Raised to Overweight at Wilsons; PT A$37.23

- IPH Ltd (ASX: IPH) Raised to Add at Morgans Financial Limited; PT A$8.15

- Adbri Ltd (ASX: ABC) Raised to Neutral at Citigroup Inc (NYSE: C); PT A$2.25

- Karoon Energy Ltd (ASX: KAR) Raised to Buy at Goldman Sachs Group Inc (NYSE: GS); PT A$2.68

- New Hope Corporation Ltd (ASX: NHC) Raised to Neutral at Citi; PT A$5.20

- TechnologyOne Ltd (ASX: TNE) Cut to Hold at Bell Potter; PT A$17.25

Major Movers Today