Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.13% to 7,058.40.

A quiet Monday to kick off the new trading week with the index failing to live up to the levels implied by SPI Futures on Saturday morning.

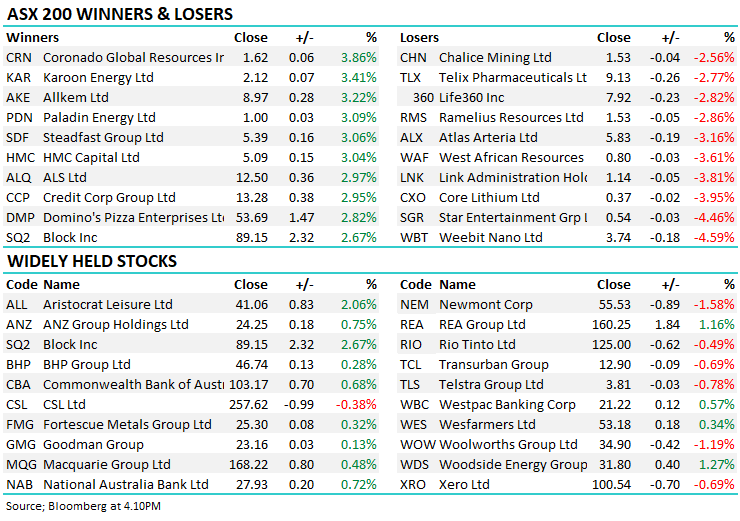

A tick over 50% of the main board traded higher, however it was a session void of any real impetus in either direction – Banks up a touch, resources mixed and a bit chop-chop elsewhere!

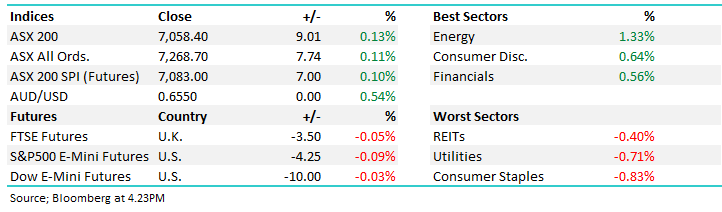

- The ASX 200 finished up +9pts/ 0.13% to 7058

- The Energy sector bounced back (+1.33%) while Consumer Discretionary (+0.64%) and Financials (0.56%) outperformed.

- Staples (-0.83%), Utilities (-0.71%) and Property (-0.40%) the weakest links.

- Healius Ltd (ASX: HLS) Halted, is preparing to launch an equity raise to help its brittle balance sheet, apparently Barrenjoey has the gig with shares expected to be issued at a 30% discount to last, raising ~$200m

- Uranium stocks were back on the up today after a recent pullback, Paladin Energy Ltd (ASX: PDN) +3.09% back at $1.00.

- Gold struggled, Northern Star Resources Ltd (ASX: NST) -2.55% while Evolution Mining Ltd (ASX: EVN) showed its resilience down just ~0.8%.

- Star Entertainment Group Ltd (ASX: SGR) -4.46% continues to burn those who try and pick a bottom, 53.5c today, well down on the recent raise price of 60c.

- PEXA Group Ltd (ASX: PXA) +2.32% has been under a lot of pressure in recent months, however, we think it represents solid value at current levels.

- Orora Ltd (ASX: ORA) -0.39% also looks interesting at ~$2.55, a very recent addition to the Active Income Portfolio

- Portfolio Manager Harrison Watt on Ausbiz last week calling out a High Conviction (smaller) Stock Idea – Click here to watch

- Iron ore up smalls in Asia, hanging around US$130/mt.

- Gold was flat trading US$1981/oz at our close.

- Asian stocks were mixed, Hong Kong +1.74%, Japan -0.42% and China +0.42%.

- US Futures are flat

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index – Weekly Chart for wider context

Broker Moves

- Accent Group Ltd (ASX: AX1) Cut to Market-Weight at Wilsons; PT A$1.90

- Accent Group Cut to Neutral at Citigroup Inc (NYSE: C); PT A$1.93

Major Movers Today