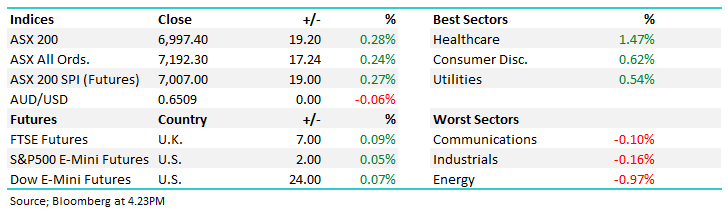

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.28% to 6997.40.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

Stocks started the week higher ahead of the RBA decision on interest rates tomorrow, a hike the more probable scenario according to both economists and interest rate futures, however on balance, we believe they shouldn’t and won’t hike as weakness creeps into the local economy, the 1H of 2024 could be a testing time for many people in Australia and we see no reason for the RBA to come off the sidelines after sitting pat for 4 straight meetings, especially given the changing bias in the US last week.

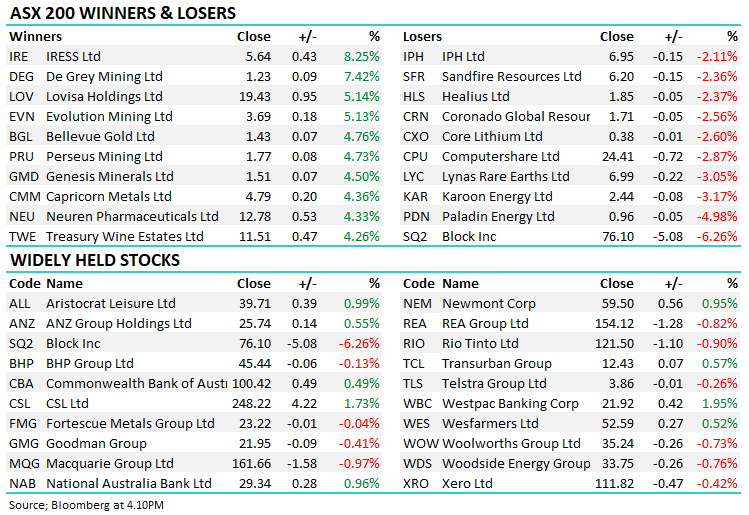

- The ASX 200 finished up +19pts/ +0.28% to 6997

- The Healthcare sector was best on ground (+1.47%) while Consumer Discretionary (+0.62%) and Utilities (+0.54%) also did well.

- Energy (-0.97%), Industrials (-0.16%) and Communications (-0.10%) underperformed.

- MM is looking for Michele Bullock to leave the RBA Cash Rate at 4.1% on Cup Day, but it’s a close call, and we are against ‘consensus’ on this view– equities are likely to struggle for a few days if they hike.

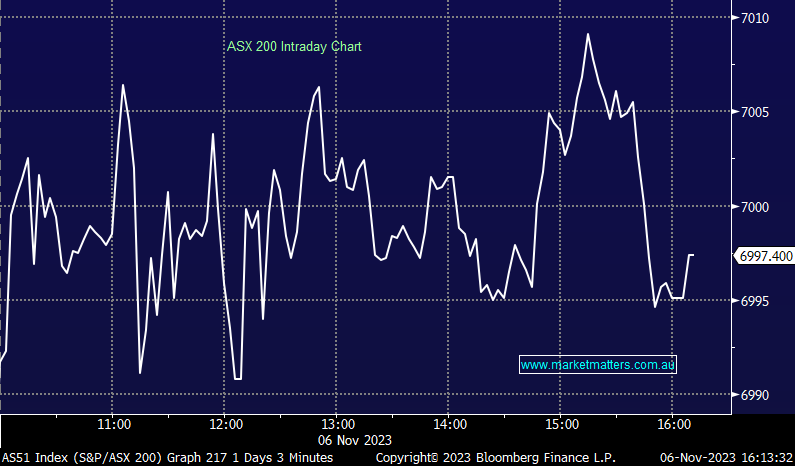

- Westpac Banking Corp (ASX: WBC) +1.95% rallied on a broadly inline result v bearish positioning but a $1.5bn on-market buyback helped.

- Goodman Group (ASX: GMG) -0.41% reconfirmed FY24 guidance at their Q1 update this morning.

- Iress Ltd (ASX: IRE) +8.25% rallied on a positive note from JPMorgan Chase & Co (NYSE: JPM) – they see deep value in this turnaround play.

- Gold stocks enjoyed the session, Evolution Mining Ltd (ASX: EVN) +5.13% a standout while Northern Star Resources Ltd (ASX: NST) +3.18% was also solid – we own both.

- Consumer Discretionary caught our eye, interesting to think the RBA is odds on to hike tomorrow yet the retailers are rallying, Lovisa Holdings Ltd (ASX: LOV) +5.14%.

- Growing concern around the risks associated with Ozempic has helped Resmed CDI (ASX: RMD) +3.11% today – sentiment is slowing turning back in their favour. We remain patient.

- Whispir Ltd (ASX: WSP) +61.67% ripped on a takeover from Soprano Digital pitched at 48c, closing today at 48.5c – the ex-Appen Ltd (ASX: APX) CEO behind the deal.

- Weebit Nano Ltd (ASX: WBT) +2.05% was higher, although finished a long way off highs after the $750m company recorded its first-ever revenue of $US100,000.

- Treasury Wine Estates Ltd (ASX: TWE) +4.26% was up as the PM touched down in China.

- Magellan Financial Group Ltd (ASX: MFG) -0.43% saw another $800m leave in October, although it seems like performance was okay for the period.

- Iron Ore was 0.5% higher in Asia, and miners were largely flat.

- Gold was higher over the weekend but gave back gains during Asian trade, -$US9 higher at $US1983

- Asian stocks were up to varying degrees, Hong Kong +1.5%, Japan +2.6% while China edged up +0.74%.

- US Futures are flat.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Westpac (WBC) $21.92

WBC +1.95%: Rallied today after delivering a largely inline FY23 result, although the $1.5bn on market share buy-back announced was a positive surprise while they also made better progress on costs.

Net Income of $7.2bn was up +26% YoY, a shade below consensus of $7.33bn while the 2H dividend of 72cps was ahead of expectations. Margins improved to 1.95% while a lot of focus was on the cost side, thexpense-to-income ratio of 49.4% vs. 55.1% last year was better than many of the pessimistic assumptions and shows they are now heading in the right direction.

Capital is very strong with the Tier 1 ratio at 12.4% vs. 11.3% last year and above estimates of 12.1%, this has underpinned a solid share buy-back.

While earnings headwinds persist, a strong capital position and diligence on costs are supportive

Westpac (WBC) share price

Goodman Group (GMG) $21.95

GMG -0.41%: the global industrial property company was out with a 1Q update which was largely as expected, though shares were slightly lower up against a small gain for the broader Real Estate sector.

They completed $1b of work in the quarter, Net Property Income was up 4.9% on a like-for-like basis and occupancy remained strong at 99%. Goodman maintained FY24 guidance of operating EPS growth of 9% and total distributions of 30cps.

The update included more commentary on their plans for a push into data centres, seeing unprecedented demand in the space.

Their industrial portfolio has been performing well and Goodman’s low gearing could see them well placed to pick up over-leveraged, distressed assets on the cheap to further support growth.

Goodman Group (GMG) share price

Broker Moves

- APM Human Services International Ltd (ASX: APM) Rated New Buy at Canaccord Genuity Group Inc (TSE: CF); PT A$2.65

- Integral Diagnostics Ltd (ASX: IDX) Raised to Equal-Weight at Morgan Stanley (NYSE: MS)

- Integral Diagnostics Cut to Neutral at Jarden Securities

- Integral Diagnostics Raised to Buy at CLSA; PT A$2.50

- Iress Raised to Overweight at JPMorgan; PT A$7

- CSR Limited (ASX: CSR) Raised to Add at Morgans Financial Limited; PT A$6.75

Major Movers Today