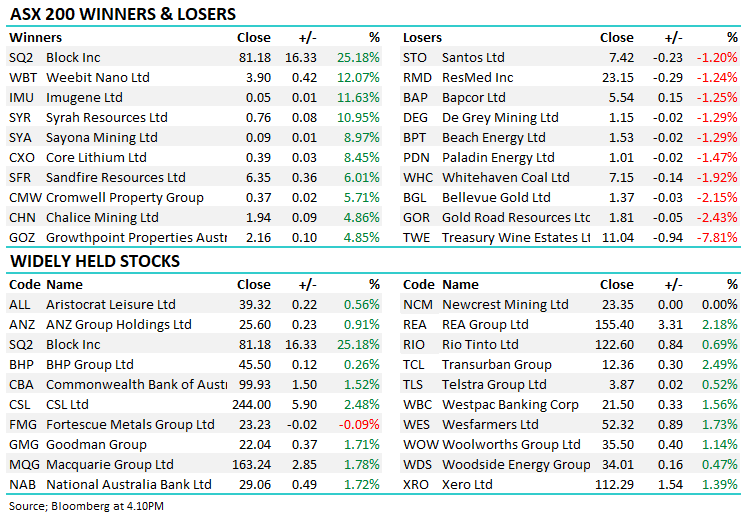

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +1.14% to 6978.20.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

Stocks were up for a 4th straight session today with the main board now ~3.5% above this week’s low, a sharp turnaround since Jerome Powell hinted that the Fed has ended the most aggressive rate hiking cycle in history, with US 10-year yields now ~40bps below recent highs.

- The ASX 200 finished up +78pts/ +1.14% to 6978

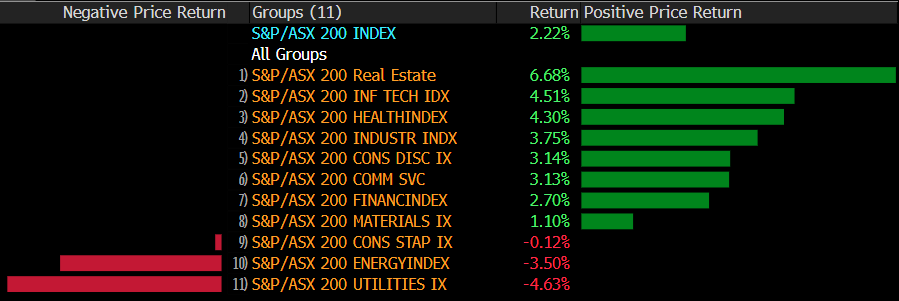

- The Industrial sector was best on ground (+2.07%) while Property (+2.02%) and Healthcare (+1.95%) also did well.

- Energy (-0.08%) was the only sector to close lower while Staples (+0.17%) and Utilities (+0.24%) underperformed.

- Australian 10-year yields fell 6bps sitting at 4.73% at our close influenced by the fall in US yields, the RBA steps up to the plate on Tuesday with the market pricing the decision as a coin toss.

- Origin Energy Ltd (ASX: ORG) –1.06% down again and we’ve had multiple questions on this over the past 24 hours… When Brookfield Corp (NYSE: BN) made the revised $9.53 offer, they called it their best and final, yet AusSuper have said they will not accept, and they have a blocking stake. When a potential acquirer calls it best and final, they cannot legally increase it. The only way this deal will happen is if AusSuper changes their mind, which seems unlikely as they have been strong in saying the stock is worth more.

- Treasury Wine Estates Ltd (ASX: TWE) -7.81% back online today after completing the instructional component of its capital raise at $10.80 with a renounceable entitlement offer now live for retail holdings. There was some shortfall in the institutional component of the deal which was placed in a bookbuild and cleared overnight at $11.50 – above today’s SP and a good result for the company. The renounceable rights are now trading under code TWER, closing today 49.5c while TWE stock finished at $11.04

- Macquarie Group Ltd (ASX: MQG) +1.78% had a volatile session, opening down but doing a good job of talking the market around post a softer-than-expected 1H24 result, offset by a buy-back and the expectation that the 2H will be better.

- Aussie Broadband Ltd (ASX: ABB)-8.67% back trading after raising $120m from institutions shareholders at $3.55 to fund the acquisition on Symbio Holdings Ltd (ASX: SYM) with up to $20m to come from retail via an SPP. We think this is a good deal.

- Block Inc CDI (ASX: SQ2) +25.18% knocked it out of the park with their quarterly result showing strong cash flow – that could be the result that the market needed to see!

- Iron Ore was 1% higher in Asia supporting the miners today although the Iron Ore related stocks underperformed.

- Gold was flat during our time zone $US1987

- Asian stocks were strong, Hong Kong +2%, Japan +1.41% while China added +0.70%.

- US Futures are mixed – not a lot happening ahead of employment data tonight, +180k jobs exp

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

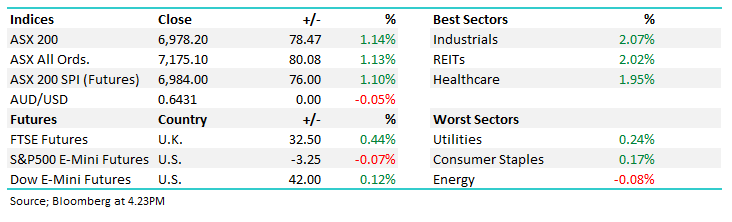

Macquarie Group (MQG) $163.24

MQG +1.78%: A softer-than-expected 1H24 result today driven mainly by weaker performance from Macquarie Asset Management (MAM) – net profit of $1.42bn was below consensus of $1.69bn and they declared an Interim dividend of $2.55, ahead of the $2.25 expected.

While their overall guidance for the year suggests some stabilisation in 2H earnings, and the approved on-market share buyback of up to $2bn is very supportive, the result was a miss and should lead to downgrades.

That said, MQG sees the market like no other, and when they conclude that allocating $2bn towards their own stock is the most compelling use of capital, we should take note, and that is what happened today.

A tough period for them clearly, however they are a quality franchise, highly leveraged to improving markets, and we remain holders of the shares in our Growth Portfolio.

Macquarie Group (MQG)

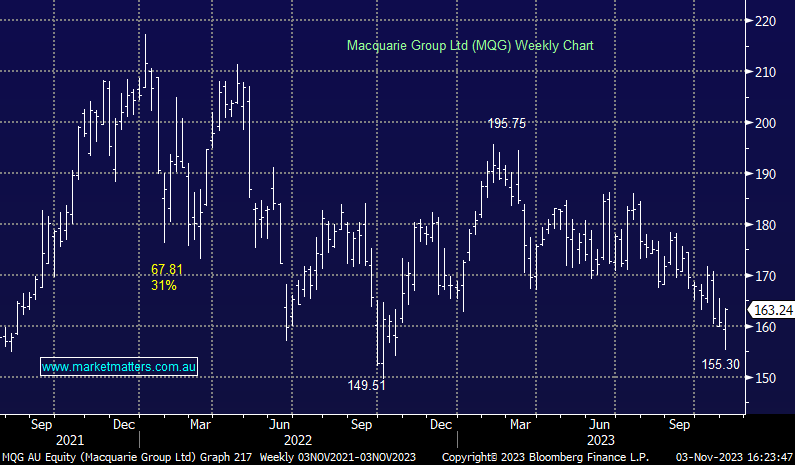

Aussie Broadband (ABB) $3.58

ABB -8.67%: shares were back trading after the company raised $120m through a placement to help fund the acquisition of Symbio.

We like the acquisition from several perspectives.

ABB is raising money at a higher multiple so the deal will be EPS accretive, while we see plenty of revenue and cost synergies to come out of the deal for telco-as-a-service business Symbio. The raise represents 14% of existing shares on issue, a pretty decent chunk, and was completed at a 9.4% discount to the last close.

Shares managed to finish above the placement price today after briefly trading underwater part way through the session. Retail holders will get an opportunity to apply for shares through a Share Purchase Plan (SPP) at $3.55/sh or a 2% discount to the 5-day CWAP up to Wednesday 29th November with the company looking for up to an additional $20m

Aussie Broadband (ABB)

Sectors this week – Source Bloomberg

Stocks this week – Source Bloomberg

Broker Moves

- Bravura Solutions Ltd (ASX: BVS) Raised to Neutral at Macquarie; PT 83 Australian cents

- CSR Limited (ASX: CSR) Raised to Neutral at Macquarie; PT A$5.50

- CSR Cut to Neutral at Jarden Securities; PT A$6

- Helia Group Ltd (ASX: HLI) Cut to Underperform at Jefferies; PT A$3.08

- Helia Group Raised to Neutral at Macquarie; PT A$3.90

Major Movers Today