Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.12% to 6780.70.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The local index saw the best of the day early on, starting off with a respectable ~0.60% rally thanks mostly to a bounce across the Big 4 banks. The strength slipped throughout the afternoon though with cracks in China’s economy leading Materials lower.

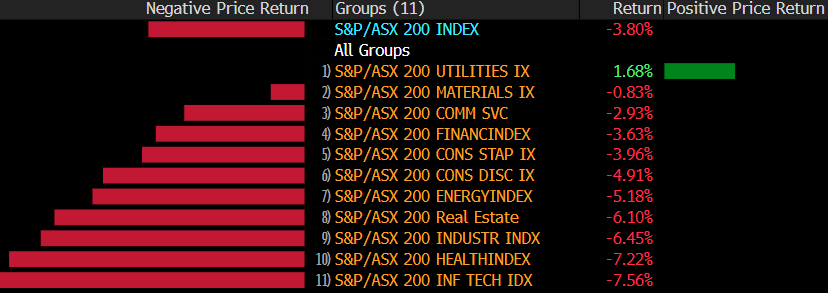

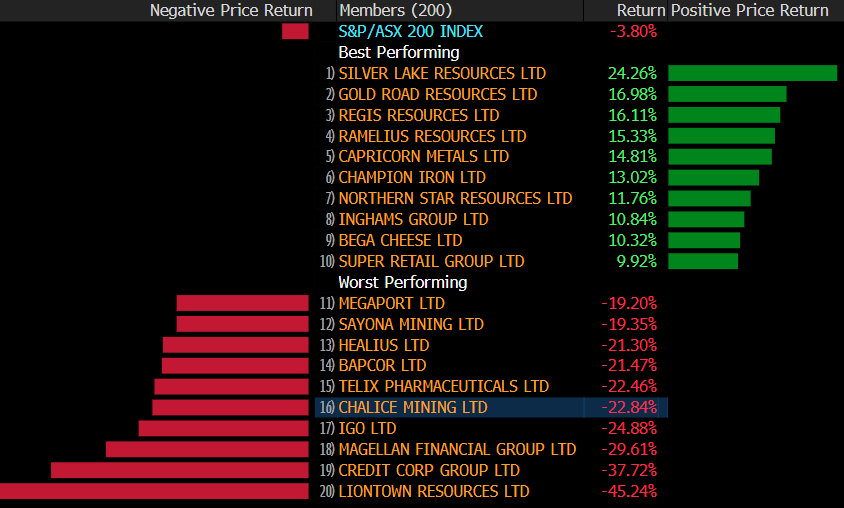

The index traded down on the session late in the day but managed to close marginally higher. Despite that, the fall in October exceeded the drop in September, down -267pts/-3.8% in the month, the biggest decline in the S&P/ASX200 since January 2022.

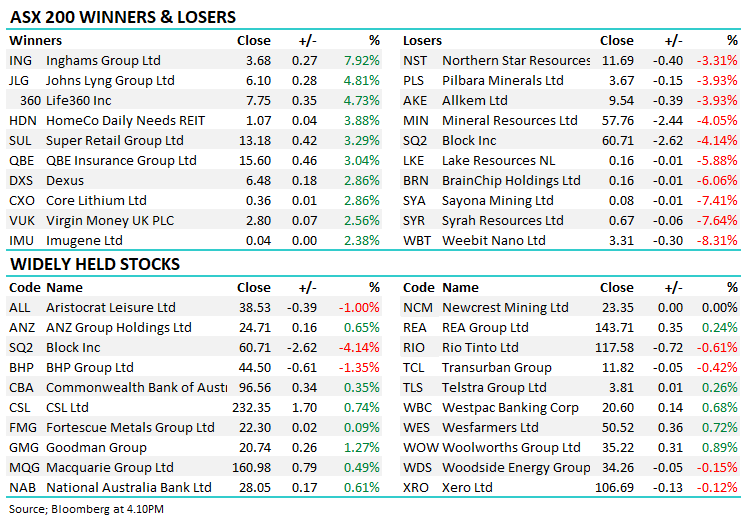

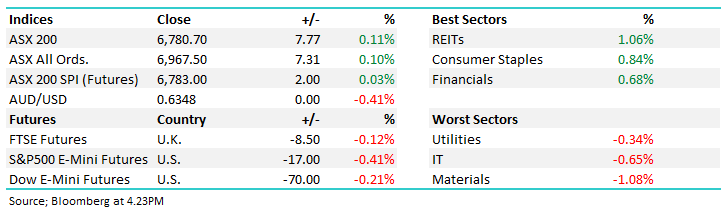

- The ASX 200 finished up +7pts/ +0.12% to 6780

- Real Estate (+1.06%) was best on ground today. Staples (+0.84%) and Financials (+0.68%) provided reasonable support to the cause as well.

- Materials (-1.08%) was the weakest sector today, Tech (-0.65%) and Utilities (-0.34%) were the only other sectors lower today.

- China data put further pressure on our market, particularly on Materials which struggled after a weaker print. October’s Manufacturing PMI swung into contractionary territory at 49.5 vs 50.2 expected. Non-manufacturing PMI was still marginally expansionary (above 50), though short of expectations, printing 50.6 vs 52 expected.

- Bank Of Japan (TYO: 8301) left policy rates on hold, the global anchor of low rates holding firm at -0.1%. The commentary was also markedly more dovish than expectations despite increasing 2024 inflation forecasts, though the central bank has lifted the 1% cap on 10-year bonds, now using that level as a “reference rate” to increase flexibility.

- Inghams Group Ltd (ASX: ING) +7.92% hit 2-year highs following a decent trading update. The company said underlying metrics had improved while wholesale poultry prices were trending higher, forecasting around $71m in underlying NPAT for the 1st half vs consensus of $90m for FY24. They did note a 1st half skew is to be expected.

- Origin Energy Ltd (ASX: ORG) -0.44% largest shareholder AusSuper (~13.5% of shares) flagged they would vote against the Brookfield bid at $8.91/sh saying assumptions used in the Independent Expert report undervalued the business. Shares are trading above the bid price suggesting AusSuper isn’t alone in that view.

- Treasury Wine Estates Ltd (ASX: TWE) halt, raising funds to buy US premium wine brand Daou for $US900m. More on the deal in tomorrow’s Morning Report, we own TWE in the Active Growth Portfolio.

- Data#3 Limited (ASX: DTL) -5.18% CEO/MD Laurence Baynham will depart the company early next year after being with Data#3 for 29 years, 10 of those in the corner office.

- Iron Ore was up 0.25% in China today. That gain was not reflected in the related equities.

- Gold fell -0.1% today, holding back below $US2,000/oz at $US1,995/oz. Gold stocks were markedly weaker than the precious metal’s move, Northern Star Resources Ltd (ASX: NST) -3.31%.

- Indices in the region were also weaker today. Nikkei -1.06%, Hang Seng -0.5% and China flat at the time of writing

- US Futures point to a soft end to the month overnight. S&P 500 (INDEXSP: .INX) futures -0.4% and Nasdaq Composite (INDEXNASDAQ: .IXIC) futures -0.6%.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Sectors in October – Source Bloomberg

Stocks in October – Source Bloomberg

Broker Moves

- Reece Ltd (ASX: REH) Rated New Sell at UBS; PT A$15.80

- Transurban Group (ASX: TCL) Raised to Neutral at Goldman Sachs Group Inc (NYSE: GS); PT A$13.10

- Paladin Energy Ltd (ASX: PDN) Raised to Neutral at Citigroup Inc (NYSE: C); PT 95 Australian cents

- Pantoro Ltd (ASX: PNR) Cut to Sell at Bell Potter; PT 3 Australian cents

- Sandfire Resources Ltd (ASX: SFR) Rated New Overweight at Wilsons; PT A$8.45

- IGO Ltd (ASX: IGO) Cut to Reduce at CLSA; PT A$10

- Ramelius Resources Ltd (ASX: RMS) Cut to Neutral at Macquarie Group Ltd (ASX: MQG); PT A$1.70

- GWA Group Ltd (ASX: GWA) Raised to Buy at CLSA; PT A$2.15

- Ventia Services Group Ltd (ASX: VNT) Cut to Accumulate at CLSA; PT A$2.90

- IGO Raised to Equal-Weight at Morgan Stanley (NYSE: MS); PT A$9.25

- CSR Limited (ASX: CSR) Raised to Hold at Jefferies; PT A$5.20

- IGO Raised to Neutral at JPMorgan Chase & Co (NYSE: JPM); PT A$10

- Endeavour Group Ltd (ASX: EDV) Raised to Overweight at JPMorgan; PT A$5.90

- Endeavour Group Raised to Buy at Jefferies; PT A$6.50

- Endeavour Group Raised to Accumulate at CLSA; PT A$5.25

- IGO Cut to Neutral at Citi; PT A$13

Major Movers Today