Is Lynas Rare Earths Ltd (ASX: LYC) a still buy today after its licence extension in Malaysia? Daniel Ortisi from Stock Doctor tells us what changes this will bring to the ASX share market.

Rare earth miner Lynas Rare Earths announced an important extension to its cracking and leaching (C&L) licence in Malaysia from Jan 2024, to March 2026. This appears to be the driving factor behind the stocks ~12% gain on Tuesday.

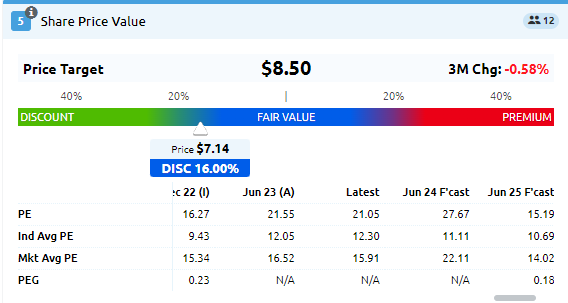

Lynas Rare Earths share price

In return, LYC has agreed to increase R&D spend in Malaysia from 0.5% of gross sales to 1%, with a focus on reducing the impact of radioactive waste materials.

For now, we retain the company as a Borderline Star Growth stock.

Source: StockDoctor.com.au

The extension of the licence is an important outcome for multiple reasons:

- LYC has been in construction of a C&L plant in Kalgoorlie, Western Australia with capacity of only ~9ktpa Neodymium Praseodymium (NdPr), which would have been a bottleneck to Group production growth in future years. The ~7ktpa capacity in Malaysia will now come back online, meaning LYC will not face a bottleneck in C&L capacity.

- The license to conduct C&L in Malaysia will take operating pressure off the newly developed Kalgoorlie facility, and likely mean more consistent production outcomes over the next 12 months whilst the new facility ramps up.

- It will allow LYC to make further investments across its business for total NdPr production capacity to reach ~16ktpa. The previous target was ~12ktpa, a material long term increase (forecast to reach 12ktpa by FY28, consensus does not appear to account for this due to short tenure of license renewal).

Outlook and active risks – Stock Doctor’s Golden Rule 3

The update was an important step for de-risking operations, however there will likely be little change to LYC’s FY24 guidance as the December quarter will still be impacted by maintenance and construction ongoing in Malaysia. If anything, the June quarter (4Q24) may experience upgrades to consensus.

Analysts are increasing production forecasts in FY25 by ~10-15% due to higher confidence in operating reliability, and the added capacity.

Rare earth prices, and sentiment for demand driven by electric vehicle sales still remain an overhang for the stock in the short term, which has been driving downward earnings revisions in recent months.

Bottom Line

We remain confident in LYC’s long term value proposition.

The vast majority of economic value within rare earths is derived in the process of separation and product finishing – not mining. Hence, we believe the company will maintain its highly strategic importance in global rare earth supply chains, as the only material producer of separated oxides outside of China.

The company is fairly priced if you assume rare earth prices do not appreciate from current levels, however, we are more positive on the commodity longer term – and continue to rate it within our Star Stock universe.