Are graphite companies like Syrah Resources Ltd (ASX: SYR) and Talga Group Ltd (ASX: TLG) a buy? Luke Laretive from Seneca Financial Solutions tells us why he has his eye on the ASX’s graphite players.

A recent UBS report has revitalised the graphite sector after a punishing 12 months for investors, as natural graphite prices declined 0.30%.

Syrah Resources struggles

UBS Group AG (SWX: UBSG) highlighted Syrah Resources and Talga Group as key picks in the sector.

Syrah Resources is perhaps the most well-known ASX-listed graphite miner. It’s meteoric share price rise from a penny stock to over $1 billion in market capitalisation as it discovered, grew, and developed its Balama natural graphite project in Mozambique.

SYR share price

The heady days of 2022 saw the share price rally to over $2.50, however investor sentiment has soured in 2023, as after spending billions of dollars to get into production, the company has had trouble producing a graphite product that meets customer specification. This resulted in excess product stockpiles and subsequently, Syrah having to pause production back in May.

Combine these stock-specific issues with falling graphite prices and you can see why the SYR share price has fallen over 70%.

Long-time readers of my weekly note will know that I was a very early investor in Syrah Resources, and while I’m grateful to have made a few dollars from the early exploration success, I’ve always had concerns about product marketing.

Graphite is not a ‘standardised’ commodity (yet), it’s not sold on the floor of the London Metals Exchange but instead via individually negotiated, opaque, long-term contracts with battery anode manufacturers. This makes forecasting revenue inherently difficult.

With that said, UBS has resumed coverage on SYR with a buy rating and $1.10 share price target, over twice its current share price of 44c.

EV demand drives the graphite price

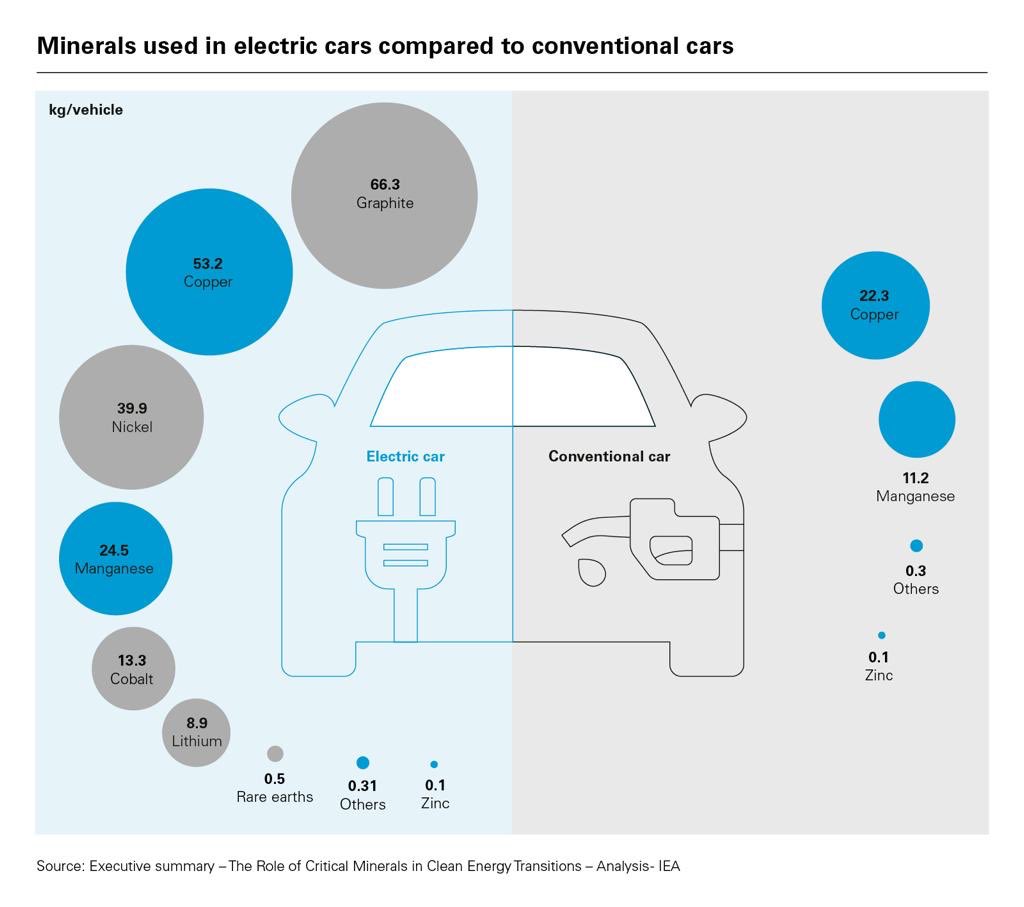

Longer-term, forecasts by Benchmark Minerals Intelligence (BMI) has the graphite market in a supply deficit as EV demand explodes 5x between now and 2030.

UBS forecast accompanying growth for global battery demand, expected to increase 7x to 2030 with larger battery sizes and increasing electric vehicle numbers in turn driving anode material demand – for with natural graphite is the critical feedstock.

That’s a lot of graphite that’s going to have to be produced…

Synthetic graphite supply is the current headwind for natural graphite prices. As a perfect substitute for natural graphite, synthetic graphite manufacturers have been able to fill supply shortfalls and prevent prices from rising.

We see this as a temporary solution.

Synthetic graphite is significantly more expensive to produce relative to natural graphite and the process products high amounts of carbon dioxide. Car manufacturers are increasingly focused on the emissions profile of their entire supply chain, and we see the substitution effect of synthetic graphite fading over time.

Particularly as ex-China EV demand accelerates and the global market for battery minerals more broadly matures. BMI forecasts natural graphite’s market share to grow from the current 35% to 49% by 2030, which aligns with our views.

While natural graphite has been losing share to synthetic graphite (China dominant) in the EV market in recent times, natural graphite is better suited to low-cost lithium ion phosphate (LFP) batteries with its lower emissions profile.

What about the other graphite stocks?

As with all commodities, there are a host of ASX juniors looking to become “the next Syrah”.

UBS initiated on emerging natural graphite anode producer Talga with a Buy rating and a $2.20 Price Target – almost 2x the current share price. Talga is aiming to produce a fully integrated battery anode (resource and refining) from its Vittangi project in Sweden.

A couple of larger international shares which are more established in the graphite supply chain including Shanghai Putailai New Energy Tech Co Ltd (SHA: 603659) and Posco Future M Co Ltd (KRX: 003670).

Our top pick in the sector: Sarytogan Graphite

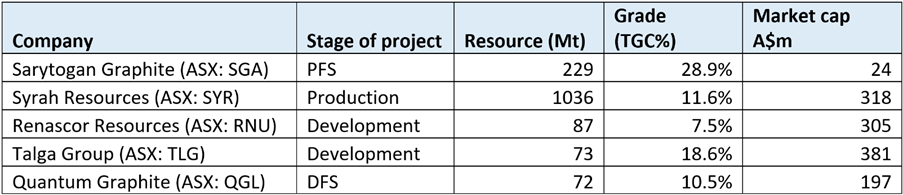

Sarytogan Graphite Ltd (ASX: SGA) has the highest-grade graphite resource on the ASX at its namesake project in Kazakhstan.

The resource currently sits at 229Mt @28.9% total graphite content. This stacks up favourably against more advanced peers.

Graphite needs to be purified to at least 99.95% to be “battery grade”.

On 28 August 2023, Sarytogan announced a breakthrough, successfully producing a sample of graphite with purity levels of 99.99% via the inclusion of a thermal process. This opens the door for SGA to sell this high purity product for up to US$3,000 per tonne into the battery anode market (compared to ~US $600 per tonne for lesser purity graphite sold in traditional graphite markets, like Syrah).

Another graphite developer Quantum Graphite Ltd (ASX: QGL) re-rated after achieving battery grade specifications, and currently sits at ~$200 million market cap, compared to SGA at just ~$30 million market cap. QGL is further advanced, having completed a Definitive Feasibility Study, and therefore been able to announced project economics to the ASX, giving investors a valuation anchor point.

QGL share price

We expect Sarytogan’s project in Kazakhstan to offer investors robust economics in its upcoming feasibility study, expected to be released to the ASX in 2024. The high grades, soft host material and low infrastructure requirements point to potentially low strip ratios, mining costs and upfront capital expenditure. Affordable containerized rail to Europe and China would give SGA a range of marketing options once in production. Management is incentivised to deliver this PFS by mid-2024 and the company has enough cash to avoid raising capital between now and then.

Some unfairly baulk at the project location in Kazakhstan. In practice, Kazakhstan is 12th in global mining value, accounting for 40% of global uranium supply and is a significant oil producer. Environmental conditions are conducive for mining with semi-arid land similar to that found in Western Australia and a supportive mining code. We think the stigma attached to Kazakhstan is unfounded.

While SGA is early stage and somewhat speculative, we like the project from the current valuation for the potential re-rate on the release of compelling project economics and potential for off-take and strategic partner news flow. Further test work that can add rigour and scale to the metallurgical process which should also add value for shareholders after SGA have initially “cracked” the battery-grade 99.95% threshold.