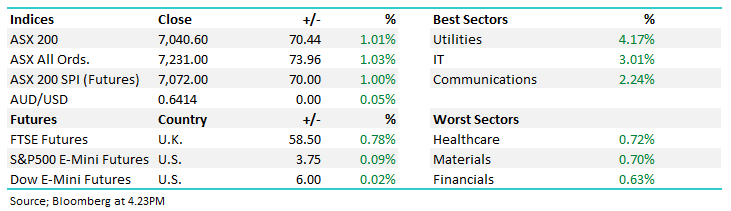

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +1.01% to 7040.60.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

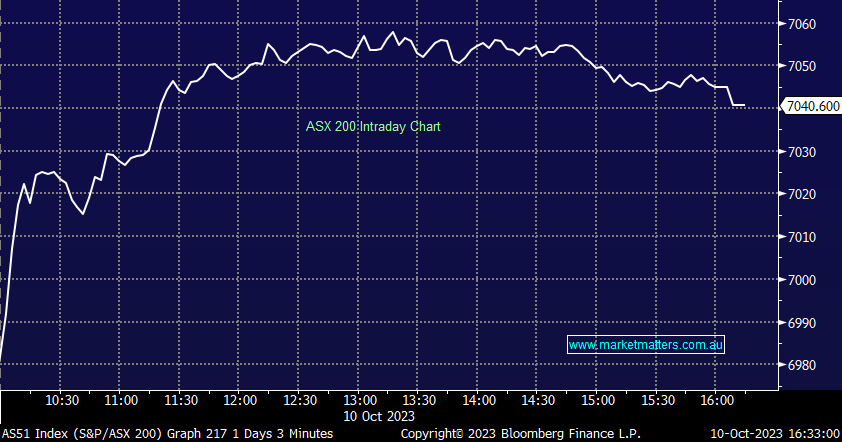

A solid session for stocks today, buoyed by a positive overseas lead along with further local data that suggests price pressures are easing taking the pressure off inflation and thus interest rates.

All sectors finished higher on the session with 85% of the main board ending in the green, pushing the ASX 200 back up through 7000, all the more impressive given our two largest sectors lagged the broader advance.

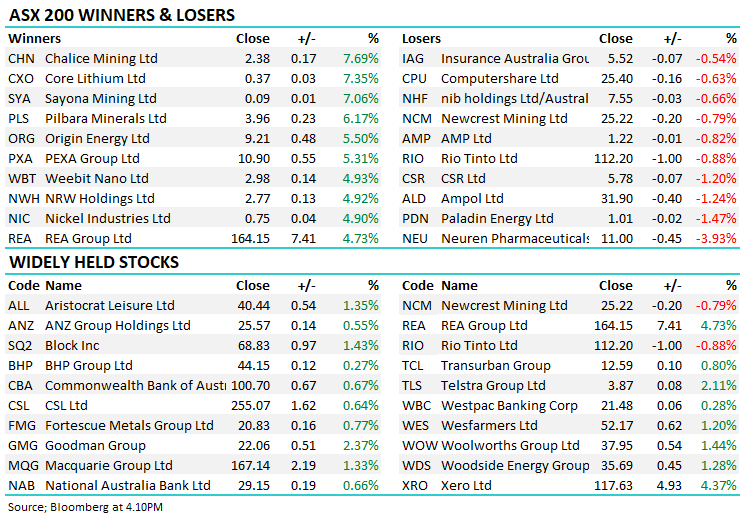

- The ASX 200 finished up +70pts/ +1.01% to 7040

- The Utilities sector was best on ground (+4.17%) while IT (+3.01%) and Communications (+2.24%) also did well.

- Financials (+0.63%), Materials (+0.70%) and Healthcare (+0.72%) underperformed the broader strength.

- Data from National Australia Bank Ltd. (ASX: NAB) today showed that cost and price pressures are easing, with their monthly business survey showing labour cost growth easing to 2% in quarterly equivalent terms, and purchase cost growth declining to 1.8% – both positive signs around inflation.

- Market Matters Invest Monthly Performance Reports out this morning – more on these below with all portfolios outperforming benchmarks. Our Investor Ap will launch shortly backing up an existing comprehensive investor portal. Portfolios are open for investment with a min initial investment of $10,000, making it a highly accessible platform to hold direct equities.

- Citigroup Inc (NYSE: C) upgraded a number of Lithium stocks today as they tweaked their long-term Lithium price assumptions, saying that while they expect prices to track sideways for the next 12-18 months, they remain bullish on the long-term outlook as a surplus over the next few years driven by volatile pricing creates a setup for deficits later this decade. Both IGO Ltd (ASX: IGO) +3.53% and Pilbara Minerals Ltd (ASX: PLS) +6.17% upgraded to buy ratings.

- Xero Limited (ASX: XRO) +4.37% rallied strongly and is the large-cap tech stock we see with a near-term catalyst coming up with their 9th November results. The new CEO has re-calibrated their focus to more profitable growth, with an audit of their US business likely to show further incremental improvements to that end. Interesting also to see a portion of management incentives now linked to some profitability metrics rather than solely skewed toward top-line growth. We won XRO.

- NRW Holdings Limited (ASX: NWH) +4.92% announced $200m of new contract wins, the bulk in their civil division, stock rallied.

- Magellan Financial Group Ltd (ASX: MFG) +4.2% up as Macquarie Group Ltd (ASX: MQG) moved from sell to neutral.

- Origin Energy Ltd (ASX: ORG) +5.5% rallied as the ACCC gave the green light on the Brookfield bid, now they just need FIRB approval + probably a better price!

- Telstra Group Ltd (ASX: TLS) +2.11% finally moved, we continue to see value in TLS at current levels, a nice combination of defence, yield and some growth, now at the right price.

- AGL Energy Limited (ASX: AGL) +3.91% was up on the news and looks good here after a period of consolidation – we continue to hold AGL in our Income Portfolio, now more a buy sub $11.

- Copper stocks had a good session, Sandfire Resources Ltd (ASX: SFR) +4.17% caught our eye with the stock garnering strong support whenever it ticks below $6, closing today at $6.25

- Gold stocks up a bit but are showing some signs of fatigue after a very strong few days – Evolution Mining Ltd (ASX: EVN) +0.28% and Northern Star Resources Ltd (ASX: NST) +1.51%, while Newcrest Mining Ltd (ASX: NCM) -0.79% lost ground.

- Iron Ore was down -1.74% in Asia, keeping a lid on Fortescue Metals Group Ltd (ASX: FMG) +0.77% and Rio Tinto Ltd (ASX: RIO) -0.88%.

- Gold was flat in our time zone at $US1861.

- Asian stocks were mostly higher, Hong Kong up +1.07% and Japan put on +2.39%, while China fell -0.57%

- US Futures are up mildly.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Market Matters Invest Performance

Monthly Performance Reports and commentary for the suite of Market Matters Invest Portfolios out this morning covering the month of September.

To receive these Monthly Updates directly to your inbox, sign up here.

While September was another tough month for equities with the ASX down by -2.84%, our portfolios outperformed across the board:

- The Active Growth Portfolio: -1.48% (1 year +22.17%): Download Monthly Report Here

- The Active Income Portfolio: +0.09% (1 year +17.33%): Download Monthly Report Here

- The Emerging Companies Portfolio: +1.08% (1 year +8.67%): Download Monthly Report Here

The International Equities Portfolio is not yet open for direct investment, however, we are on track for launch before Christmas. The portfolio declined -1.62% in September versus its benchmark of -3.98%, and is up 18.35% for 1 year.

The portfolio has been running since 2019 and has returned 16.16% pa.

For Sophisticated Investors, James Gerrish and his team offer bespoke portfolio management via Shaw & Partners – more information is available here.

Portfolios are aligned with our Market Matters approach and can include Australian and international Equities, Fixed Interest and alternative assets, with an asset allocation structure designed for targeted objectives. Email: [email protected] for more information.

Market Matters Invest Portal

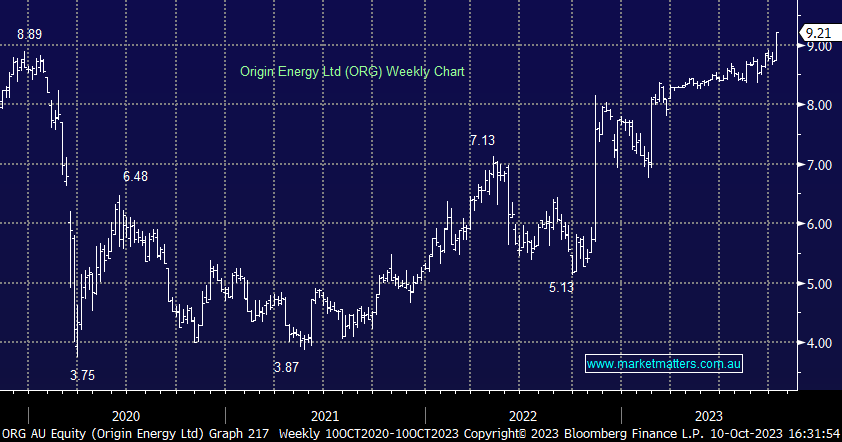

Origin Energy Ltd (ASX: ORG) $9.21

ORG +5.5%: the ACCC showed their softer side today, approving the Brookfield deal to acquire Origin Energy despite some vertical integration concerns. Brookfield already manages gas and electricity distributor Ausnet Services Ltd (ASX: AST), which raised the ACCC eyebrows given the similarities in Origin’s services.

The competition regulator, though, gave this a green light, noting the capital Brookfield plans to put into Origin to transition the company, and the country, away from fossil fuels.

The issue is now shares are trading above the bid price despite FIRB not yet giving it the tick of approval. Key shareholders are looking to earn an improved bid price now given the improvements in the business and sector since the original takeover bid.

Origin Energy Ltd (ASX: ORG)

Broker Moves

- IGO Raised to Buy at Citi; PT A$13

- Core Lithium Ltd (ASX: CXO) Raised to Neutral at Citi; PT 38 Australian cents

- Pilbara Minerals Raised to Buy at Citi; PT A$4.50

- ResMed GDRs Raised to Overweight at JPMorgan Chase & Co (NYSE: JPM); PT A$26.50

- 29Metals Ltd (ASX: 29M) Raised to Outperform at Macquarie

- Magellan Financial Raised to Neutral at Macquarie; PT A$7

- Beach Energy Ltd (ASX: BPT) Cut to Sell at Goldman Sachs Group Inc (NYSE: GS)

- Woodside Energy Group Ltd (ASX: WDS) Raised to Buy at Goldman

Major Movers Today