Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down +0.77% to 6890.20.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

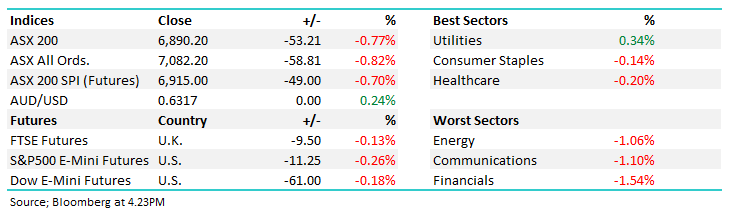

Another sell-off today with the ASX hitting the lowest close in 11-months, although the selling is fairly anaemic in nature and on very light holidays volumes, but still, the direction of least resistance has clearly been down since the ASX 200 peaked at the end of July at 7472, now down ~600pts/8% from that milestone, back at the very bottom of its 12-month trading range.

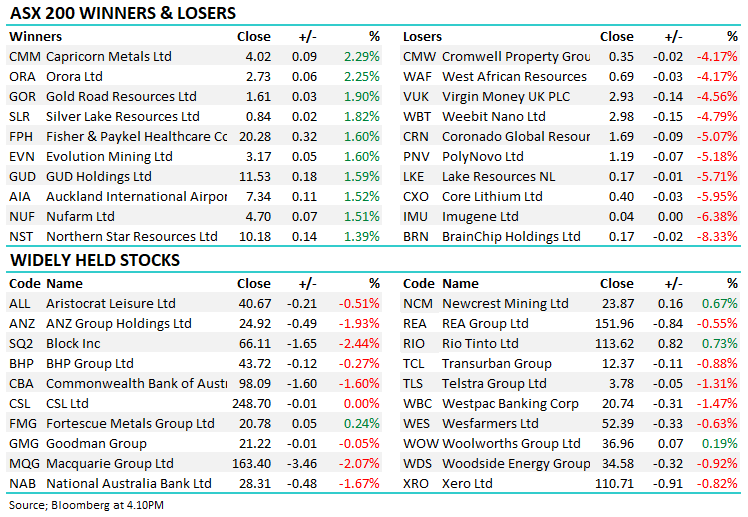

- The ASX 200 finished down -53pts/ -0.77% to 6890 with a lack of interest right across the market.

- The Utilities sector was best on ground (+0.34%) and the only sector to make gains, while Staples (-0.14%) and Healthcare (-0.20%) did better than the soft market.

- Financials (-1.54%), Communications (-1.10%) and Energy (-1.06%) the weakest links

- Bond yields continued to rise sharply overnight on stronger US data, the JOLTs Job Openings jumped to 9.61m up ~700k in the month and a reversal of the trend after 3 month’s of declines, keeping the door ajar for another rate hike, the market now pricing a 50/50 probability at the November meeting.

- We have US ISM Services PMI out tonight which is expected to contract to 53.6 from 54.5, though a higher than expected print wouldn’t surprise given the recent trend of data coming in hotter than tipped.

- Orora Ltd (ASX: ORA) +2.25% ticked another box in their acquisition of European high end bottle manufacturer Saverglass with the French works council signing off. They expect the deal to be completed this quarter – we like ORA but have remained patient while this deal plays out.

- TPG Telecom Ltd (ASX: TPG) -2.23% are still in discussions with Vocus Group Ltd (ASX: VOC) for the sale of TPG’s Enterprise, Government and Wholesale business and fixed infrastructure. The deal had expired, but both parties still appear keen to see something happen.

- Banks were hit today, ANZ Group Holdings Ltd (ASX: ANZ) the worst of them off -1.93%, Commonwealth Bank of Australia (ASX: CBA) -1.6%, National Australia Bank Ltd. (ASX: NAB) -1.67% & Westpac Banking Corp (ASX: WBC) 1.47% – we wrote a quick piece on the banks this morning (here) providing our take & current portfolio positioning in the sector.

- Qantas Airways Limited (ASX: QAN) -1.79% chalked up a new cycle low below $5 and is now down almost 30% from its recent high – not a pretty picture for QAN as Chairman Richard Goyder tracks around the country meeting investors.

- Mineral Resources Ltd (ASX: MIN) -1.28% down after finalising a $US1.1bn debt offer.

- Lithium stocks more generally were down but look like they’re finding a base, Pilbara Minerals Ltd (ASX: PLS) ~$4 is looking interesting to us, the same for IGO Ltd (ASX: IGO) ~$12.

- Takeover target Liontown Resources Ltd (ASX: LTR) +0.7% edged higher as Gina increased her stake +2% to 14.7%

- Cattle prices hit a new 9-year low as farmers continue to de-stock ahead of a likely dry spell, the Ag stocks remains a hard place to invest, Elders Ltd (ASX: ELD) -0.72% to $5.51, a new 4-year low today. We took a loss on ELD in August at $6.47, which feels better today!

- Not much happening on the Iron Ore market with China still closed for Golden Week, Fortescue Metals Group Ltd (ASX: FMG) +0.24% was a rare winner.

- Gold has been on the nose thanks to $US strength, the Dollar Index staying supported above 107 with gold now at US$1818/oz.

- A few bargain hunters around in Gold stocks following their Canadian peers higher, Evolution Mining Ltd (ASX: EVN) +1.6% & Northern Star Resources Ltd (ASX: NST) +1.39%.

- Asian stocks were lower, Hong Kong off -1.38% & Japan fell -2.24%.

- US Futures are lower, down around -0.5%.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Quarterly letter for financial advisers

We write a complimentary letter used by the growing number of Financial Advisers subscribing to our service, simply to help them better communicate with their clients.

Over the years, we’ve found that communicating directly, regularly and in an engaging way goes a long way to building trusted and enduring relationships, whatever the market conditions are dishing up. It’s this level of communication, transparency and engagement that we have built our business on, and we’re now offering that to other financial professionals.

So, get on the front foot and engage regularly, whether that’s utilising the new Market Matters White labelled Quarterly or not!

If you’re Financial Adviser and would like to register for a complimentary 12 month trial, click here.

Here is a snippet from our Q1 FY24 letter sent earlier today…

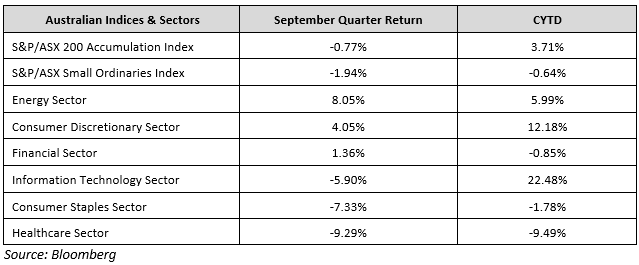

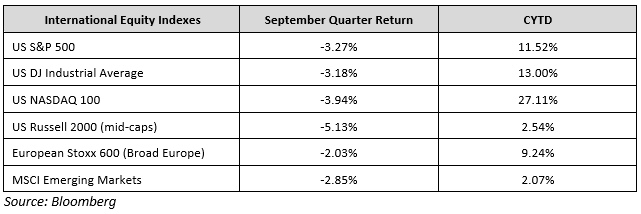

The S&P/ASX 200 rose to the highest level since March 2022 early in the first quarter but rising global bond yields, fears of a rebound in inflation and concerns about a future economic slowdown weighed on the major indices in August and September and the market finished the first quarter with a modest loss. The S&P/ASX 200 Accumulation Index was down -0.77% outperforming the US market which fell -3.27%, although it underperformed broader global markets in AUD terms as measured by the MSCI World Index (AUD) which declined -0.43%.

Rising bond yields were the main driver of the markets and this caused reversals in performance on a sector and index basis, relative to the third and fourth quarters of FY23. Starting with market capitalisation, large caps once again outperformed small caps, as they did at the end of FY23, although both posted negative returns. That relative outperformance by large caps is consistent with rising yields, as smaller companies are typically more reliant on debt financing to sustain operations and rising interest rates create stronger financial headwinds for smaller companies when compared to their larger peers.

From an investment style standpoint, however, we did see a performance reversal from the prior two quarters as value relatively outperformed growth in the first quarter, although both investment styles finished with a negative quarterly return. Rising bond yields tend to weigh more heavily on companies with higher valuations and since most growth funds overweight higher P/E tech stocks, those funds lagged. Value funds that include stocks with lower P/E ratios are less sensitive to higher yields, and as such, they outperformed.

On a sector level, 8 of the 11 ASX sectors finished the first quarter with a negative return, which is a stark reversal from the broad gains of the fourth quarter of FY23. Energy was, by far, the best performing sector thanks to a surge in oil prices. Consumer Discretionary also finished Q1 with a positive quarterly return following better than feared FY23 results, while Financial stocks also eked out a small advance.

Looking at sector laggards, the impact of rising bond yields was again clearly visible as consumer staples, utilities and real estate were among the worst performers,, although healthcare, which is a relatively small sector from a constituent perspective was hit hardest by multiple company specific influences.

Those sectors are some of the most defensive in the market, but with bond yields quickly rising investors rotated out of defensive sectors and into less-volatile bond funds given the higher yields on offer for less capital risk.

Internationally, overseas markets fell, with the US, Europe and China all ending the period lower, however interestingly, emerging markets did relatively better than developed markets thanks to the announcement of larger-scale Chinese economic stimulus late in the period.

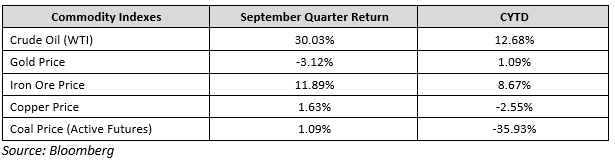

Commodities saw gains and were the best performing major asset class thanks to a significant rally in the energy complex. Oil rose throughout the quarter on continued supply concerns as Saudi Arabia and Russia extended voluntary supply cuts to the end of the year. Meanwhile, demand estimates rose late in the first quarter following the aforementioned large-scale Chinese stimulus plans, causing prices to rise sharply late in the quarter. Gold, meanwhile, declined moderately thanks primarily to the stronger U.S. dollar, which rallied steadily, hitting a fresh 2023 high in September.

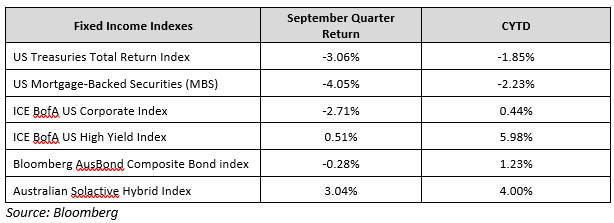

Switching to fixed income markets, the leading benchmark for global bonds (Bloomberg Barclays US Aggregate Bond Index) declined moderately for a second consecutive quarter as hawkish Fed rhetoric and hints of a rebound in inflation weighed broadly on fixed income markets.

Looking deeper into bond markets, shorter-duration debt securities posted a positive quarterly return and outperformed those with longer durations, as the Fed did not signal it intended to raise interest rates any higher than previously expected. Longer-duration bonds, however, were pressured by the combination of a rebound in some inflation indicators and as investors digested that the Fed may well delay any rate cuts in 2024, keeping rates “higher for longer.”

Turning to the corporate bond market, lower-quality but higher-yielding “junk” bonds rose slightly while higher-rated, investment-grade debt declined moderately in Q1. The large performance gap reflected continued optimism from investors regarding future economic growth, as investors “reached” for higher yields offered by riskier companies amidst broadly rising bond yields.

Markets begin the second quarter decidedly more anxious than they started, but it’s important to realise that while the ASX 200 did hit multi-month lows in September and there are legitimate risks to the outlook, underlying fundamentals remain generally robust.

This is an excerpt only from the Market Matters Quarterly – If you are a Financial Advisor and would like to sign up for a free trial – Click Here

Broker Moves

- AMA Group Ltd (ASX: AMA) Raised to Buy at Canaccord Genuity Group Inc (TSE: CF); PT 14 Australian cents

- Bank of Queensland Ltd (ASX: BOQ) Cut to Underweight at JPMorgan Chase & Co (NYSE: JPM); PT A$5.30

- IPH Ltd (ASX: IPH) Raised to Buy at Goldman Sachs Group Inc (NYSE: GS); PT A$8.75

Major Movers Today