Our flagship, blue-chip share portfolio (the Seneca Australian Shares SMA) has delivered 13.90% pa returns since inception, outperforming the S&P/ASX 200 (INDEXASX: XJO) and ranking it among the top performers in its peer group.

After conducting our usual extensive and thorough research process, we’ve just increased our position in ‘The Big Australian’, BHP Group Ltd (ASX: BHP), moving it to overweight in our portfolio – something we only do when after building high conviction and confidence in a company’s ability to generate extraordinary returns in the near future.

BHP Group Ltd (ASX: BHP)

3 reasons why BHP is a buy…

- High iron ore prices likely to persist against analyst opinion

(go look at iron ore price broker forecasts vs current price, support with steel production, China stimulus – attached, search “industrial production”)

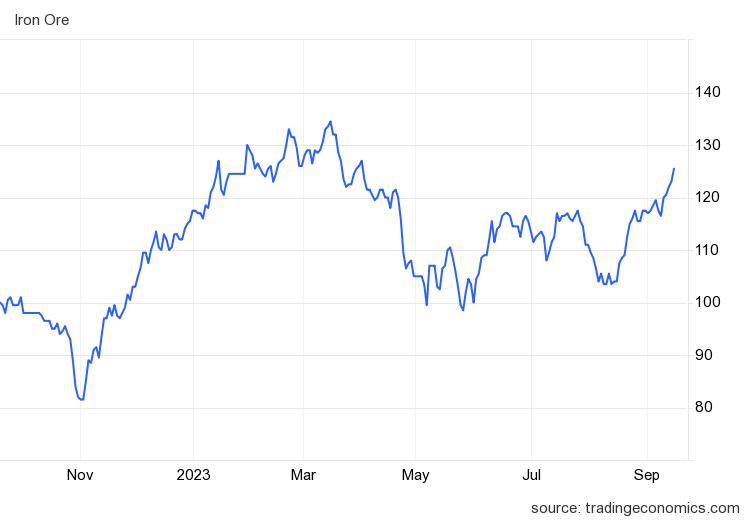

Brokers are forecasting iron ore prices to fall this year, with consensus estimates ranging from US$80-105/t in FY24, averaging ~US$95/t. The iron ore price is the largest single swing factor affecting BHP shares, with ~70% of the company’s value underpinned by iron ore earnings. Current prices, recently breaching US$120/t, see upside risk to BHP earnings.

Persistent higher prices could trigger earnings upgrades among the analyst community.

Despite the negative sentiment in the media regarding Chinese growth, industrial production growth rebounded to 4.5% year-on-year in August, exceeding expectations of 3.8% growth.

Although real estate developments are down -11% and new starts are down over 20%, infrastructure and manufacturing (particularly automobiles) remains resilient supporting growth.

We think property activity may be near the bottom, with property starts now 65% below the H2 2020 average and the potential for stimulus from the Chinese government.

We think for these reasons, iron ore prices have scope to surprise to the upside leading to short/medium-term upgrades to consensus BHP earnings.

- Met coal prices rising

BHP owns a number of coking coal (as distinct from thermal coal used for energy generation) mines in the Bowen Basin, Queensland. The Australia Hard Coking Coal

price is back to $280/t, up 20% from end-June. Pricing for coking coal is dependent on steel mill margins (high blast furnace demand = high demand for coking coal).

An accident at a large coal mine Shaanxi, China has caused operations to be suspended, hitting supply and supporting prices. Meanwhile demand for high-quality Australian premium mid-volatility coking coal remains strong as it needs to be blended with lower quality PCI and semi-soft coal coming out of Russia to supply India.

India is a key driver of coking coal demand growth, accounting for 22% of seaborne demand.

BHP is currently running an auction process to sell the Daunia and Blackwater mines, with the sale price for both mines combined rumoured to be ~A$5 billion. We understand that there are still a number of interested bidders in the process run by Macquarie Capital.

Should a sale eventuate, BHP would be selling in an elevated coal price environment in a competitive bidding process, which would maximise proceeds for BHP.

- Copper and future facing commodities exposure

BHP has emphasised a focus on future facing commodities that tap into structural growth trends such as copper (renewable energy), nickel (electric vehicles) and potash (sustainable farming).

BHP is one of the best ways to get exposure on the ASX after its takeover of copper miner/developer Oz Minerals Limited (ASX: OZL) which helps the BHP share price benefit from institutional fund flows. BHP’s stable of copper assets also includes the Olympic Dam mine in South Australia and a stake in the mammoth Escondida copper mine in Chile.

Oz Minerals Limited (ASX: OZL)

Copper, colloquially known as “doctor copper”, is a leading indicator of economic growth. Many analysts and fund managers jumped the gun earlier in 2023 and went too early on the copper trade, with the copper price flat year-to-date at ~US$3.80/lb. However, we think the risk/return proposition is better 9 months down the line, with Chinese demand bottoming and limited supply coming online from a dearth of major discoveries.

Although there are risks associated with BHP expanding outside of its core money making business being iron ore, BHP management has a history of sensible capital allocation has helped BHP generate a total shareholder return of 13.2% per annum (includes dividends) over the last 20 years.

Return profile

BHP is trading on a FY24 free cash flow yield of 7%-8% on consensus estimates. A payout ratio of >50% (64% in FY23) means shareholders will likely enjoy a mid-single digit dividend yield, fully franked. At spot prices, BHP’s free cashflow yield rises to 10%-11%, presenting meaningful capital upside to shares.

Should commodity prices fall, we think BHP is best placed to capitalise, due to its position at the bottom of the iron ore cost curve, and strong balance sheet (net cash and low cost of capital) enabling the company to make value accretive acquisitions at reasonable prices.