Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down 0.74% to 7153.90.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The market was on edge today ahead of the US inflation read tonight which is expected to show headline CPI of 3.6% for August, up from 3.2% in July due to higher energy prices, testing the narrative that inflation has peaked and so too have interest rates.

So, some risk off today throughout Asia while US Futures offered little in the way of support.

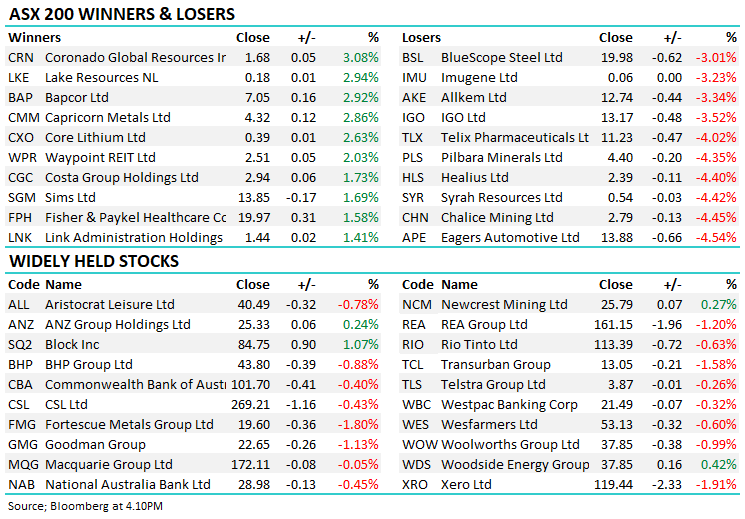

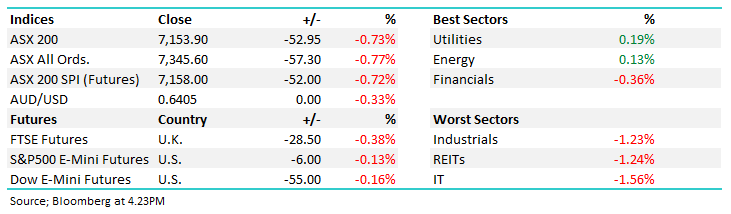

- The ASX 200 fell -52pts/ -0.73% to 7153 – no recovery today from the lows = not bullish!

- The Utilities sector was best on ground (+0.19%) while Energy (+0.13%) also ended higher.

- IT (-1.56%), Property (-1.24%) & Industrials (-1.23%) fought it out for the wooden spoon.

- Oil prices held 10-month highs on tightening supply while Iron Ore has remained resilient ~US$120/tonne

- Pact Group Holdings Ltd (ASX: PGH) +7.41% rallied on the prospect of privatisation from its 50% shareholder Raffy Germinder. The stock is down ~60% this year to close today at 72.5c, it was originally IPO’d in 2013 at $3.80!

- Kin Group is offering 68cps to take out the minority holders and come off the boards – the pitch is framed as a way to end the suffering for shareholders.

- Qantas Airways Limited (ASX: QAN) -0.18% down slightly after losing its high court appeal over worker outsourcing, compensation & penalties could now be applied.

- IGO Ltd (ASX: IGO) -7.6% was the biggest drag on the ASX200, although it did trade ex-dividend (but fell more).

- Lithium stocks collectively are still on the nose, Allkem Ltd (ASX: AKE) -3.4% and Pilbara Minerals Ltd (ASX: PLS) -4.35% to $4.40 – we think it’s tickling the BUY zone.

- Viva Energy Group Ltd (ASX: VEA) -2.4% fell after 16% of the stock worth $714m changed hands at $2.87, major shareholder Vitol was the seller. The stock closed at $2.86.

- Centuria Industrial Reit (ASX: CIP) was flat after they offloaded $70m in Melbourne property assets – a strategic review the rationale.

- Telstra Group Ltd (ASX: TLS) -0.26% traded to a low of $3.83 this morning before ticking higher into the close – we covered our views on the stock this morning here

- We also mused about our poor position in Resmed CDI (ASX: RMD) – we hate sitting on the fence but it’s hard to have high conviction one way or another on this post it’s aggressive decline.

- Coal prices are up again, the active contract out of Newcastle trading at $US166/tonne, Whitehaven Coal Ltd (ASX: WHC) 0.49% remained muted while Stanmore Resources Ltd (ASX: SMR) -2.22% fell as they look to raise debt to fund the purchase of BHP Group Ltd’s (ASX: BHP) Coal assets.

- S32 was flat before trading Ex-divi tomorrow for ~5c. The stock has pulled right back and still looks interesting.

- Bapcor Ltd (ASX: BAP) +2.92% was strong today, they reported well in August, consolidated the rally and look like popping again.

- Audinate Group Ltd (ASX: AD8) +2.02% raised $50m at $13 (SPP still underway) and has since bounced from the raise level – the stock had a great FY23 result and momentum remains strong.

- Gold was down $US3 trading at US$1910 at our close.

- Asian stocks were down, Hong Kong off -0.22%, Japan -0.52% while China was off -0.70%

- US Futures are lower, only marginally though.

S&P/ASX 200 (INDEXASX:XJO)

S&P/ASX 200 (INDEXASX:XJO)

Broker Moves

- Australian Clinical Labs Ltd (ASX: ACL): Australian Clinical Labs Rated New Neutral at Macquarie

- BHP Group Ltd’s (ASX: BHP): BHP Raised to Add at AlphaValue/Baader

- Eroad Ltd (NZE: ERD): Eroad Raised to Buy at Bell Potter; PT NZ$0.98

- Incitec Pivot Ltd (ASX: IPL): Incitec Cut to Sell at Citi; PT A$2.90

- Swoop Holdings Ltd (ASX: SWP): Swoop Holdings Ltd Reinstated Hold at Morgans Financial Limited

Major Movers Today

online pharmacy buy augmentin no prescription online pharmacy