MMA Offshore Ltd (ASX: MRM) has seen its share price go up nearly five times over the last three years.

Collins St Asset Management (through the flagship Collins St Value Fund) first became interested in MMA Offshore back in March 2021 at a time when MMA Offshore was trading at only 25% of the book value of its assets in the mid 30 cent range.

MRM share price

Since Collins St Asset Management’s initial investment, MMA Offshore’s management have executed well and undertaken substantial repair to the balance sheet whilst being buoyed by strong macro-economic tailwinds supportive of the broader offshore oil and gas servicing sector.

The release of MMA’s annual results to the ASX on the 29th of August confirms this and lays out an exciting platform for growth moving forward that both diversifies and strengthens its revenue base.

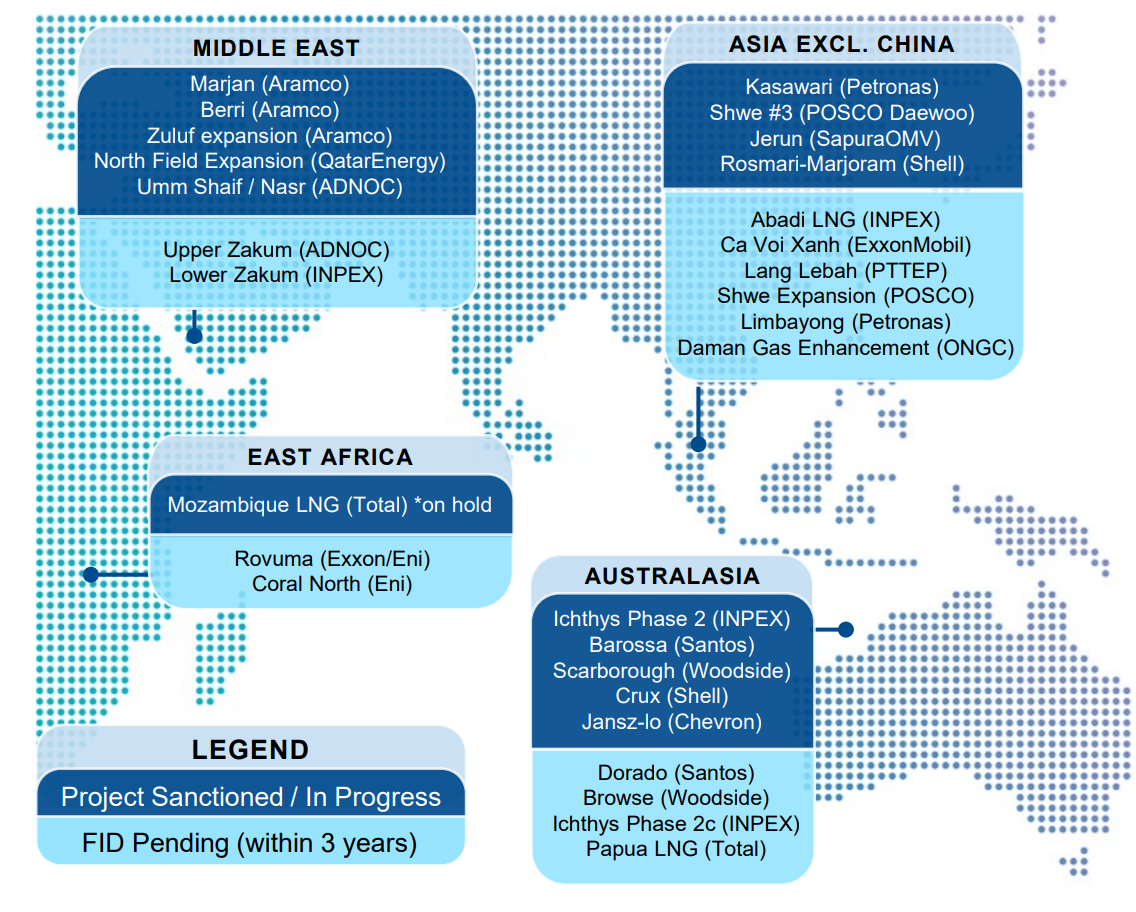

Indeed, MMA Offshore find themselves in the enviable position of being a dominant regional player in several key global markets where, over the next five years, there are expected to be over USD$400B in greenfield oil and gas projects coming on line that fall squarely within their area of expertise:

Source: MMA Offshore FY 2023 Presentation & Commsec.

Clearly based on these numbers, the oil and gas sector is in no danger of being fully phased out any time soon – an important point to bear in mind because in our view the market is pricing in a full transition to renewable sources of energy within a timeframe that is simply not possible given the way transport, manufacturing and retail energy consumption operates.

This misinterpretation by the market was one of the triggers that led our deep value, contrarian research process to uncover MMA Offshore and a number of other solid operators within traditional energy markets in the first place.

However, this is not to say that MMA Offshore should be categorised solely as a traditional energy servicing company.

Far from it.

Indeed, a lot like many other companies operating in the traditional energy sector, MMA Offshore has the assets, technical know-how and balance sheet to actually be part of the energy transition as well.

It is noteworthy that over the last four years, revenue from the offshore wind power generation sector has grown from 0% of group revenue to approximately 24% today.

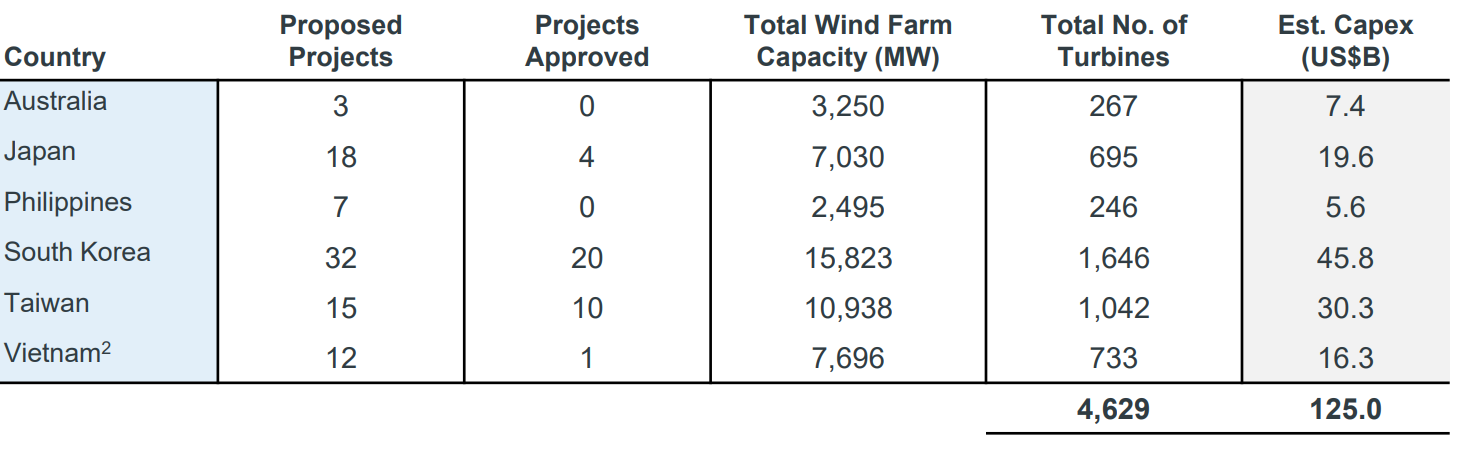

From a future growth perspective, the outlook for the offshore wind sector is compelling, with an estimated USD$125B of capital expenditure forecast in the Asia Pacific region over the next eight years.

Source: MMA Offshore 2023 FY Presentation & Commsec.

Of course, as the saying goes,

the opportunity of a life time must be seized within the life time of the opportunity

To that end, it is pleasing to see that MMA Offshore have a robust balance sheet with net cash of $14M, flexible funding arrangements via an AUD$120M revolving loan facility and net tangible assets roughly equal to its current share price, thus providing a stable platform from which to pursue future growth opportunities over the years ahead.

To learn more about the deep value, contrarian and high conviction investment process that has led Collins St Asset Management to ideas such as MMA Offshore (back when it was in the mid 30 cent range!), visit Investment Solutions – Collins St (csvf.com.au).