The Suncorp Group Ltd (ASX: SUN) share price was trading 1.7% lower on Wednesday afternoon despite posting an excellent profit result. So what’s up with the Suncorp share price? Stock Doctor’s Daniel Ortisi explains…

General insurance and banking company Suncorp Group Ltd released its full-year FY23 results. Cash profits were in line with expectations at $1,254m, a year-on-year increase of 86%. The excellent profit result was overshadowed by the Suncorp dividend, which missed consensus expectations by 18% (60 cents per share, vs estimates of 72 cents).

Suncorp share price

Why were Suncorp’s dividends below expectations?

Suncorp has been undergoing a sale process for its Banking division (~37% of FY23 cash profits) to Big 4 constituent ANZ Group Holdings Ltd (ASX: ANZ). The ACCC recently rejected the ANZ takeover citing concerns over competition in Queensland for its business and agri-business lending.

The rejection has caused a ~12-month delay in the sale process as the companies will now appeal the decision in federal court. As a result of this delay, Suncorp expects the separation costs to increase by ~$100 million over the following three years, which ultimately led the board to lower its 2H23 payout ratio in order to retain a stronger capital position (60% payout, against a target range of 60-80%).

Additionally, reinsurance costs (when an insurance company transfer the risk of a policy to another party or group) have risen significantly, which contributed to the board’s conservative payout.

Suncorp’s insurance division is thriving

Whilst most of the market commentary will likely focus on dividends, we would point out the incredible rebound in profitability for Suncorp. The rebound was driven by higher earnings from the company’s investment portfolio.

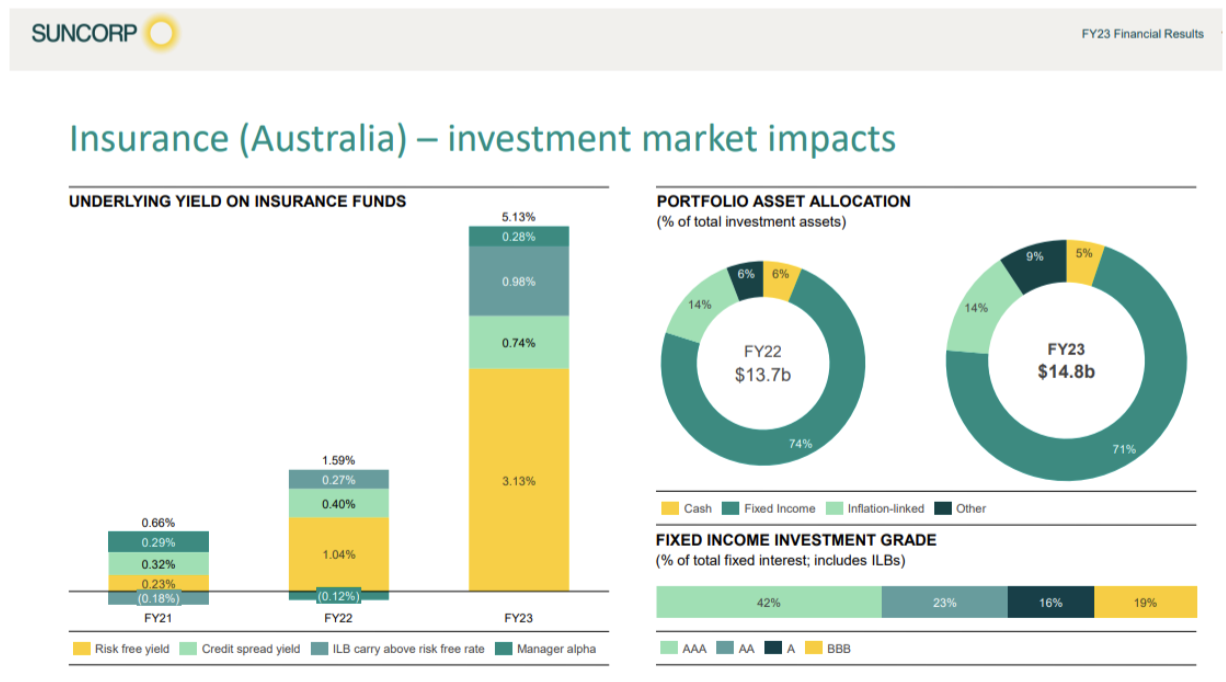

Many investors would be familiar with the concept of “float” from Warren Buffett’s Berkshire Hathaway, which includes the upfront proceeds/premiums held by insurance companies from issuing policies. Suncorp has a near $15b investment portfolio, with a running yield of ~5.13%.

The underlying investment income, taking into account market movements of the assets, resulted in a net gain of $724m, contrasted against a loss of $190m the year prior.

Source: Company presentation

Suncorp shares: A “star income stock”?

The team at Stock Doctor believe the insurance industry is well placed to manage the current inflationary environment due to the benefit they enjoy from rising interest rates. Additionally, many insurance companies are believed to have “pricing power”, as they can increase the price of policies in line with or above inflation.

Our team has a positive view of Suncorp, which we currently rate as a “Star Income Stock”. We also view private health insurance (PHI) provider NIB Holdings Limited (ASX: NHF) as an attractive way to play the PHI space.