Wow! How on earth have we already made it to the end of another financial year?!

The end of the financial year (EOFY aka June 30th) is a fantastic time to reflect on your financial goals and the progress you’ve made so far. Plus, it’s a good opportunity to adjust course if you need to — just in time for a tax refund, if you’re lucky.

In this article, we’re going to look at the ‘why’ behind your financial goals, making sure you’re setting goals in line with your values and breaking them down into short, medium and long-term goals.

What’s your why?

We all have different reasons for the choices we make in life. And some of the most personal decisions we make will involve money. Early retirement. Buying a house. European holidays.

What are your goals? And do they involve money?

This might not be something you can put your finger on right now, but take some time to reflect on why you started your personal finance or investment journey. So many of us just jump straight into things without getting to know our reasons why.

Maybe a friend made you get into financial shape. Maybe you’re ready to get out of debt. Maybe you’re curious about how other people manage their money. Maybe you want to be a millionaire. Or maybe you just want to save enough for a trip to Tassie or Europe.

Start with your values

Learning about money can be hard, but not learning will be harder.

Something that will be helpful at any stage along your journey is identifying your values, or the things that you want to spend your money on because they bring you joy. Some people are okay with spending lots of money on a new car. I’m not. I’d rather spend it on a trip to London, so I can go to the theatre. You might prefer the free air and humidity of a beach in Spain.

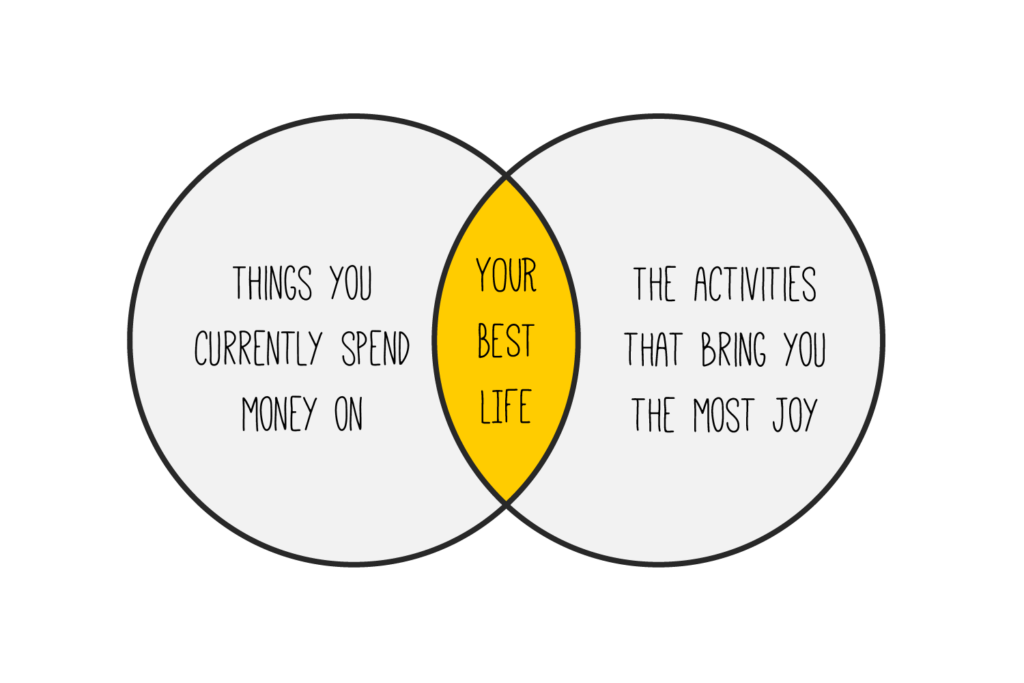

At Rask, we’ve created a reflection activity to help you identify the things you currently spend the most money on, and match them against the activities that bring you the most joy.

Your challenge is to then find out how much those lists overlap and whether there are changes you want to make in the way you spend your money. Once you’ve filled in the list (it only takes a minute or two) draw a line between the activities which match.

Now let’s set some goals

Okay, now that you’ve got your ‘why’. Let’s set some goals that you plan to achieve…

One of the most important parts of setting goals is working backwards to make sure the goals are realistic (so you feel better once you reach them) and creating a plan to get there.

You can try setting goals with different timeframes, for example:

- Short term goals: 0-6 months (e.g. pay off the Afterpay bill and close the account)

- Medium term goals: 6 months – 3 years (e.g. save a home deposit, see below)

- Long term goals: 5-10+ years (e.g. $250,000 in Super)

Goal example: buying your first property

Long term goal (5+ years): Imagine I want to buy a house. I realise I’ll need to save $50,000 for a house deposit in 5 years. This means I’ll need to save $10,000/year — or $192.31/week.

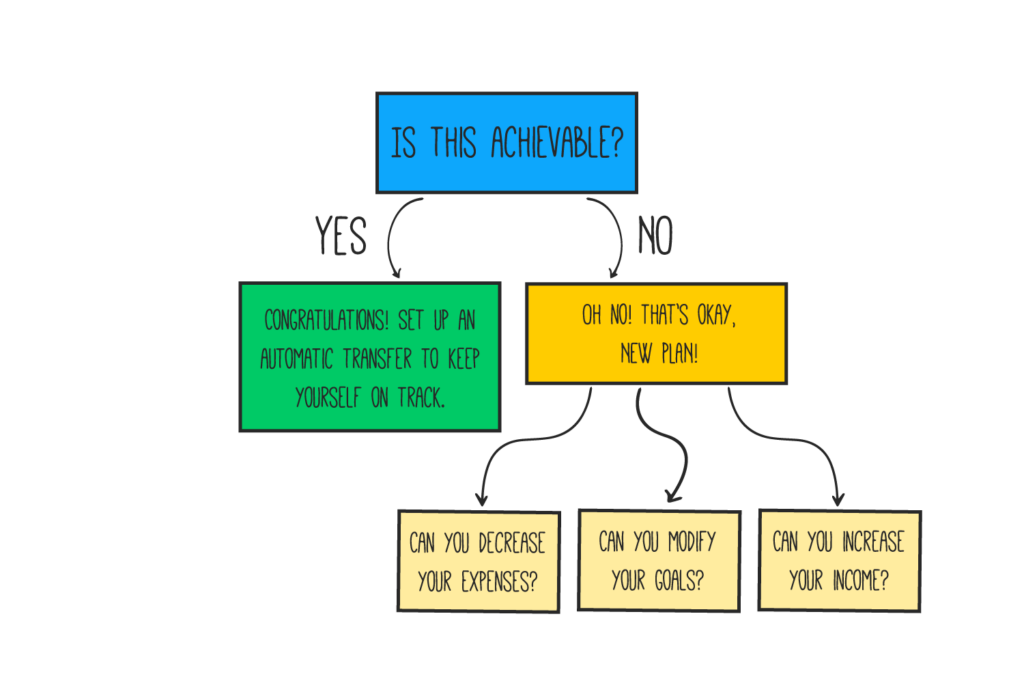

Is this achievable for me? Maybe. But maybe not. Do I currently have $192.31/week in disposable income to save?

Now let’s create some shorter term goals to help reach the house deposit goal.

Some short term goals could be:

- I’ll complete one Rask Roadtrip course a week to increase my financial literacy.

- I will set up a budget by the end of the month with my income and expenses.

- I will set up an automatic transfer of $192.31/week. (Automated savings = huge win!)

And some medium term goals:

- I will contact a mortgage broker to work out my borrowing power.

- I will negotiate a pay rise at work by using examples to show how well I’ve done.

- I will decide what I am looking for in a property and identify what is important to me.

We can also set some investing goals. If you do this, I think it’s really important to measure progress on the factors within your control, like the amount you invest, rather than factors outside of your immediate control, like investment returns from one month to the next.

For example, deciding to invest $200 each week, rather than focusing on your portfolio balance ($35,544.69).

Action Step: Using your phone (or grab a pen and paper), write out at least one long term goal, with short and medium term goals to help you get there.

That’s your North Star ⭐ Start trekking towards it.

***

Still stuck? Don’t worry if you’re not sure how to reach some of your goals just yet. That’s what the Rask Roadtrip is for! You can enrol for free today by heading to Rask Education.