The Pro Medicus Limited (ASX: PME) share price has drifted 28% lower in 2022 while the S&P/ASX 200 (INDEXASX: XJO) and All Ordinaries (ASX: XAO) are around 7% below their starting point. It surprises me because the PME share price has been on a tear in recent years and shares are still not cheap.

PME share price over time

Founded in 1983, Pro Medicus is a provider of radiology IT software for hospitals, imaging centres and health care groups worldwide. It’s most well-known for its Visage software which is sold to hospitals and sometimes to clinics.

Pro Medicus’ business is software, not hardware, and it is divided across two segments: Visage Imaging, and the Radiology Information System (RIS).

Visage Imaging is now the company’s core product and allows hospitals to stream, store and analyse medical images in the cloud, with its primary focus being in the USA. Most people think Pro Medicus built the Visage 7 software from the ground up. It didn’t. Co-founders Sam Hupert (a doctor) and Anthony Hall (a programmer) discovered the Visage imaging team, which is based out of Germany and still work for the company today, while at an event.

You can watch my in-depth interview with CEO Sam Hupert below.

Radiology Information Systems (RIS) or RIS is the company’s original software product offered to radiology clinics to help them manage the workflow of the clinic. Its primary focus is the Australian market and just like Visage, it is sticky, deeply embedded, high-margin software.

PME share price – the secret sauce

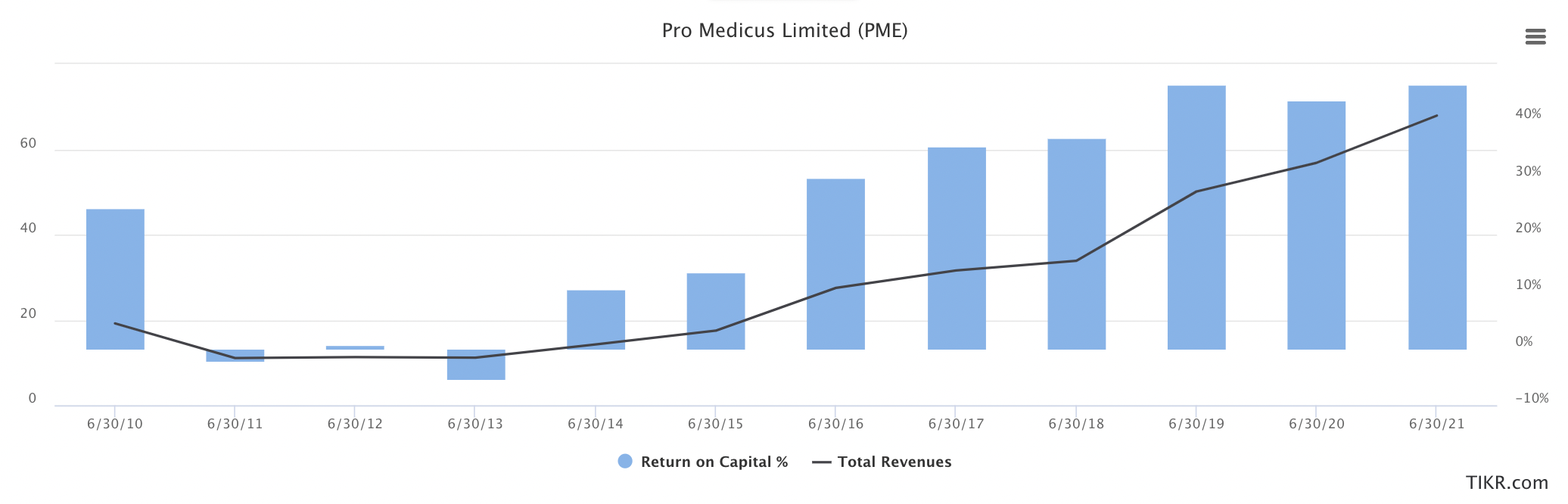

You can see why Pro Medicus has been one of Australia’s best-performing companies. As its revenue has grown it’s been able to maintain its super high return on invested capital (ROIC). ROIC measures the company’s ability to earn a return on every dollar inside the company, such as debt, cash or equity. This is why PME features alongside other steller performers like data software company Objective Corporation Ltd (ASX: OCL) and wealth platform Netwealth Ltd (ASX: NWL). You can see the full list of the ASX’s best shares by business quality in our “moat quality” list.

PME share price outlook

PME’s value proposition lies within its flagship Visage software, which allows radiologists to view large image files generated by X-rays remotely on mobile devices, and how the team can innovate to capitalise on compelling themes like Artificial Intelligence and real-time machine learning. Visage already allows diagnostic decisions to be made on the go and even during a hospital’s emergency surgery.

At the end of the day, the PME share price is trading at the equivalent price-earnings ratio of 124x. That’s a very steep valuation, even if you believe it’s the ASX’s best software stock. For a better valuation and lower quality, why not take a look at Data#3 Ltd (ASX: DTL). I wrote about Data#3 yesterday

.