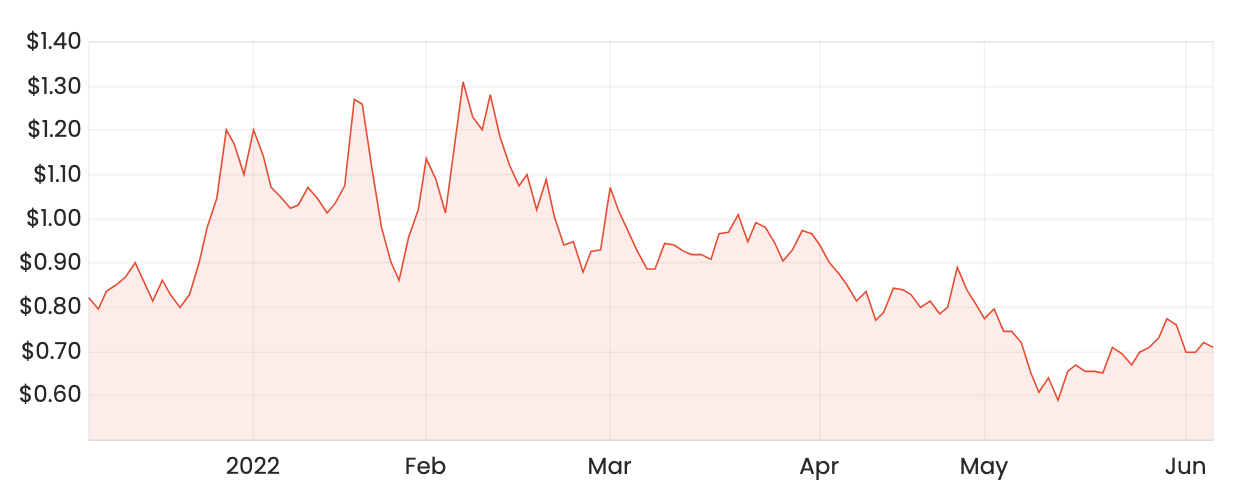

The Playside Studios Ltd (ASX: PLY) share price is down 40% in 2022 despite ratching up revenue and securing an extended work-for-hire deal with Meta Platforms Inc (NASDAQ: FB), otherwise known as Facebook. What’s next for the Playside share price?

PLY share price down, but not out?

Playside Studios is a games development company from Melbourne, Australia. It also has a studio/office on the Gold Coast. The company is known for its mobile games, but increasingly its titles for cross-platform play (PC and console) and Web3.

Playside’s acquisition of the intellectual property rights of the BEANS Dumb Ways to Die franchise drew lots of attention to the company after it launched its own version of Non-Fungible Tokens (NFTs) to passionate gamers and followers.

Playside’s launch of the BEANS NFTs effectively enabled the company to crowd-fund its games development. It sold ownership rights to digital images of BEANS characters on the Ethereum (ETH) blockchain.

More Work-For-Hire with Facebook

This week, Playside announced an extended agreement with Meta Platforms / Facebook, which will see Playside continue to work on projects for the social media giant’s Horizon Worlds platform. Horizon worlds is a free virtual reality (VR) game that ties in with Meta’s VR goggles and hardware, known as Oculus.

In addition to the 16-month extension, Playside will work with Meta on a VR initiative for six months.

No financial details were disclosed but Playside founder and CEO Gerry Sakkas said the deals highlight the possibilities for the company in this emerging space.

“This announcement reinforces PlaySide’s belief in VR and the role it is likely to play in the metaverse as it is further imagined in time.” – Gerry Sakkas

Globally, Playside has worked, or is working, with big publishers such as 2K Games, Activision Blizzard, Shiba Inu and Wax. These agreements allow Playside to earn a somewhat consistent income stream from games publishers for its creative and development efforts. However, the key growth driver over the long run will be its in-house games development and ownership.

What next for the PLY share price?

With multiple titles set to launch, joint ventures, work-for-hire deals and the launch of BEAN Land in the next few years, Playside has been and will be busy.

The key question for investors, and what is needed from here, is how much revenue can the company capture from its investments in its own titles? With a market capitalisation of over $250 million and $15 million of revenue in the last 12 months, PlaySide investors are paying a price for the shares that is equivalent to ~16x the company’s annual sales. That’s pretty high, especially in an environment when technology shares are under the microscope.

That said, it’s a very early stage company with a decent level of cash in the bank. CEO Gerry Sakkas will be balancing the cost of launching new titles alongside an increasing employee count. Currently, PLY is expected by analysts to continue to drive revenue higher over the next few years. While extremely volatile, I think Playside could be one to watch.