The Pilbara Minerals Ltd (ASX: PLS) share price will be on watch today after announcing its inaugural profit result.

Keep up to date with the February 2022 reporting season calendar.

PLS share price buoyed by rising lithium demand

Key financial results for the half ending 31 December include:

- Revenue of $$291.7 million, soaring 493% year-on-year (YoY)

- Net profit after tax of $114 million, up from a loss of $21.2 million

- No interim dividend

Pilbara Minerals benefitted from two tailwinds during the half.

Firstly, it increased its mine output by 49% to 170,228 dry metric tonnes (dmt) of spodumene concentrate.

Spodumene contains lithium, which is used in a variety of applications such as electric vehicles.

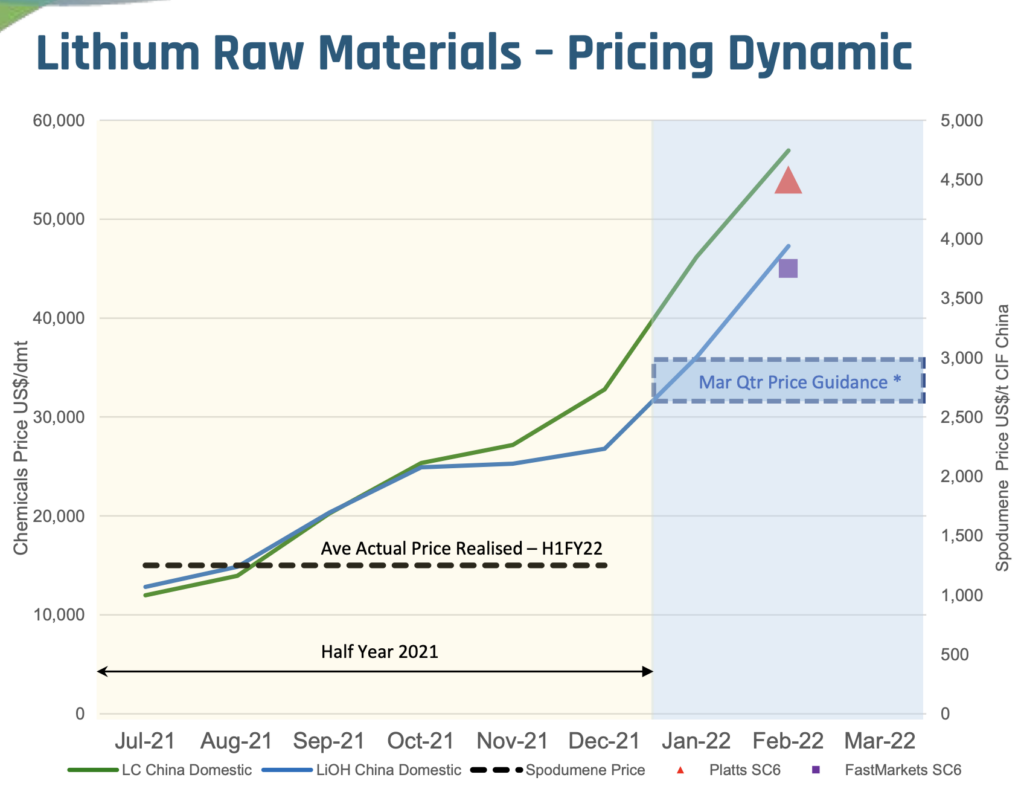

Secondly, a rising lithium price provided a huge boost to its top-top line growth.

Pilbara’s average selling price was $1,700 per tonne, compared to a production cost of $666 per tonne.

“Our financial performance for the period is a direct reflection of the incredible turnaround which has been experienced in the lithium raw materials supply chain over the past year or so”

Fortunately, further upside remains, with the realised price Pilbara received well below the current lithium market price.

Source: PLS FY22 Half Year Results Presentation

As for costs, management highlighted elevated shipping and labour expenses due to inflationary pressures.

Other mining companies such as Fortescue Metals Group Limited (ASX: FMG) and BHP Group Ltd (ASX: BHP) also cited similar cost pressures.

Pilbara also said its production was below expected levels, due to unplanned downtimes and a lower than expected ore blend.

CEO transition

The Pilbara Minerals share price will be weighed on by the departure of CEO Ken Brinsden.

After leading the business for the past seven years, he will step down at the end of 2022.

“It has been an absolute privilege to lead Pilbara Minerals from its days as a start-up lithium explorer… to become what it is today – an ASX-100 company with a wonderful culture, an incredible team of hard-working people and a clear vision to become a leader in the clean energy materials space”

A replacement is expected to be announced by the third quarter of 2022.

What next for the Pilbara Minerals share price?

The Pilbara Minerals share price will benefit from increased production over the second half of FY22.

But it did not specify how much would be shipped, citing the availability of sea vessels and actual production results.

The business expects total production of 340,000-380,000 dmt for the FY22, implying at least the same if not more production in the second half.

Moreover, production costs are expected to fall to $450-$490/dmt excluding royalties.