The Origin Energy Ltd (ASX: ORG) share price is largely unmoved today despite the business providing its first-half update for FY22.

Keep up to date with the February 2022 reporting season calendar.

APLNG underwrites Origin profit

Currently, the Origin Energy share price is up 0.16% to $6.11.

Key financial highlights for the half ending 31 December include:

- Underlying EBITDA of $1.09 billion, down 4.8% year-on-year (YoY)

- Underlying profit of $268 million, up 18% YoY

- Statutory loss of $131 million, down from a loss of $183 million YoY

- Interim dividend of 12.5 cents per share unfranked

The loss for the half was driven by a one-off impairment and tax expense relating to the $2 billion sale of a 10% stake in Australia Pacific LNG (APLNG)

.

Origin will still retain a 27.5% shareholding in the largest Australian natural gas producer.

A better representation of the business is underlying profit.

Strong oil prices resulted in a big jump in profit from APLNG, which supported the Origin Energy share price in 2021.

“The performance of Australia Pacific LNG was outstanding, achieving record-high revenue off the back of a strong rebound in commodity prices”

This was offset by weaker energy market earnings as lower energy tariffs and higher costs of energy both hit the bottom line.

Household demand lifted over the half, while gas volumes fell due to the impact of COVID-19.

Origin has currently transferred 850,000 of its customers onto the technology platform Kraken, which enhances the way it interacts with customers. The remaining customers will be transferred by 2022.

Eraring to potentially close in 2025

Origin also signalled its intention to bring forward the closure of Australia’s largest coal power generator in 2025.

Lower-cost renewables entering the electricity grid has made running the plant unfeasible.

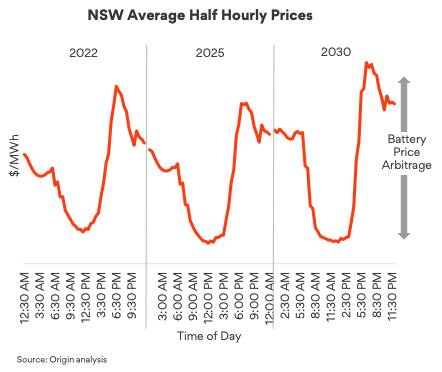

Origin will instead build a 700MW battery at the Eraring coal plant to capitalise on swings in the energy prices during peak periods.

Source: ORG HY22 Presentation

Moving away from coal power will improve the company’s ESG credentials and potentially lead to a rerating of the Origin Energy share price.

What’s next for the Origin Energy share price?

The Origin Energy share price will be supported by its growing 18.9% stake in energy disruptor Octopus. Since investing, Octopus’s valuation has more than tripled to $5.65 billion.

Furthermore, as a result of strong oil prices, Origin upgraded its FY22 EBITDA guidance range to between $1.95 billion and $2.25 billion.

“While the energy transition brings change, it also presents opportunities for Origin to continue to invest in cleaner, reliable and affordable energy”